Coca-Cola Amatil (CCL) – Neutral

CCL’s 1H18 result highlighted improving conditions in the core Australian Beverage segment, ongoing strength in the NZ / Fiji business, whilst Indonesia continues to disappoint due to overall macro conditions (according to management).

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 27/08/18 | CCL | A$9.54 | A$8.90 | NEUTRAL |

| Date of Report 27/08/18 | ASX CCL |

| Price A$9.54 | Price Target A$8.90 |

| Analyst Recommendation NEUTRAL | |

| Sector : Consumer Staples | 52-Week Range: A$7.52 – 10.08 |

| Industry: Beverages | Market Cap: A$6,907m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate CCL as a Neutral for the following reasons:

- CCL is now trading on undemanding valuation, with a pricing to earnings-multiple of 17.3x and yield of 4.6%.

- Share buyback is supportive of current share price.

- CCL has a strong global brand portfolio with diversified product offering.

- International segments provide growth options and diversification from Australian economy.

- Management is focused on cost out and reinvestment, growing efficiency and margins as a result.

- Company meets or exceeds its full year guidance.

We see the following key risks to our investment thesis:

- Management not meeting their full year guidance.

- Increased competitive pressures.

- Cost pressure eroding margins, including the NSW container deposit scheme.

- CCL not being able to push through price increases to clients.

- Share buyback is

- International segment fail to deliver growth or become a drag on group earnings.

- Structural challenges – consumers moving away from carbonated soft drinks (CSD).

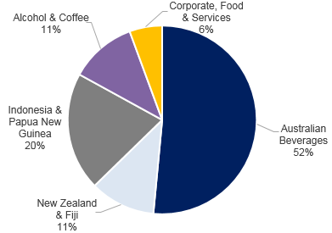

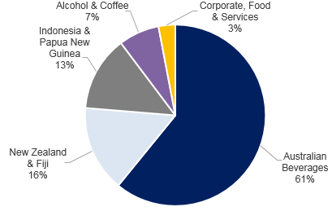

Figure 1: CCL Revenue by Segment

Source: Company

Source: Company

ANALYST’S NOTE

CCL’s 1H18 result highlighted improving conditions in the core Australian Beverage segment, ongoing strength in the NZ / Fiji business, whilst Indonesia continues to disappoint due to overall macro conditions (according to management).

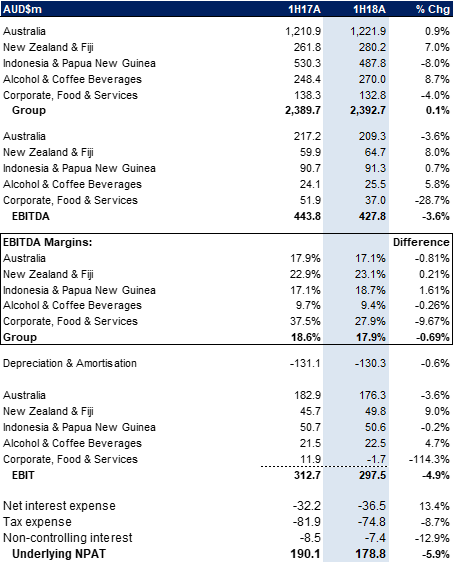

For 1H18, underlying group EBIT was down -4.9% on pcp $297.5m, driven by:

1. Australian Beverages down -3.6%;

2. NZ & Fiji up +9%;

3. Indonesia & PNG flat (-0.2%);

4. Alcohol & Coffee +4.7%.

The Company has started a strategic review of the struggling SPC business, as the segment remains a drag on group performance. No change to our view, as we see the share price range bound in the short term. Maintain Neutral.

- Group results. On an underlying basis relative to pcp, EPS was down -1.6%, NPAT was down -5.9% to $178.8m and operating earnings (EBIT) was down -4.9% to $297.5m. The Company declared an interim dividend of 21cps, which was unchanged on pcp and represents a payout ratio of 85%.

- Regional / segment commentary.

1. NZ and Fiji saw strong performance over the period.

2. Australia is showing signs of improvement with growth in revenue and volume in both Sparkling and Still Beverages.

3. Indonesian market remains soft, which is flowing through to earnings despite ongoing focus on efficiency.

4. PNG was cycling a tough comp in pcp (pre-election stimulus) and management noted they also experienced operational issues during the period.

5. Alcohol & Coffee had a solid half, with revenue up +8.7% and EBIT up +4.7%, with management calling out strong performance in spirits and premix segments.

- SPC strategic review. The Company has announced that it has commenced a strategic review of its SPC business (fruit and vegetable processor). The review will look at growth options for the business going forward after recently completing its 4-year $100m co-investment program with the Victorian Government. The Company will consider change in ownership, alliances or mergers as part of this review.

- Container deposit scheme (CDS) impact. Management noted that the CDS had a negative impact on volumes in NSW during the half, with volumes down -1.6% compared to other states where volumes are actually up +0.3%. CCL reduced its CDS charge in NSW in August, to reflect lower than anticipated redemptions. In June, the ACT commenced CDS, with QLD expected in November and WA in early 2020.

- When +5% GDP growth is not enough. From our point of view (and probably the broader market) the Indonesian business has disappointed. During 1H18, the segment revenue was down -8.0% and earnings (EBIT) was mostly flat (-0.2%) due to cost outs. Whilst +5% GDP growth is solid for any economy, as management noted, Indonesia really needs to grow at a much higher rate for CCL to benefit and stated “…for Indonesia, economists would tell us that it really needs to be somewhere in the 6s or closer to 7% [GPD growth] to be generating sufficient growth for that young population to be continuing to improve their standard of living. So we have seen some pressure on consumer spending. And people, obviously, with an absolute low — relatively low level of income making some choices, unfortunately, away from our categories, which tend to be more discretionary…” Over the long-term we continue to see significant opportunity for this segment and could become a meaningful driver of group earnings.

1H18 RESULTS SUMMARY…

Figure 3: Summary of Results and Segments

Source: Company, BTIG.

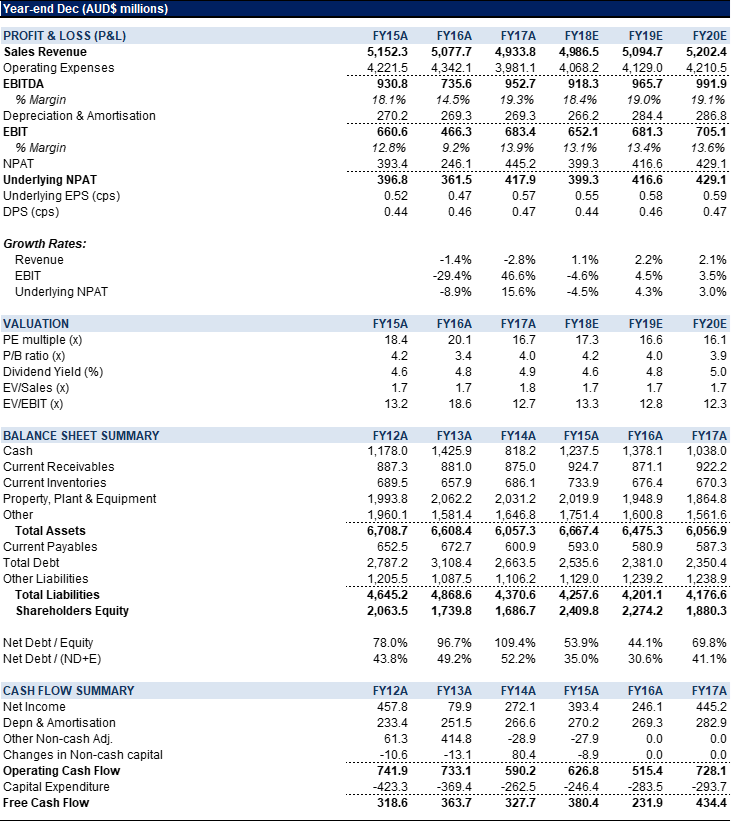

Figure 4: CCL Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Coca-Cola Amatil (CCL) manufactures, distributes and sells carbonated soft drinks along with still and mineral waters, fruit drinks, ready-to-drink coffee and tea and flavoured milk drinks. CCL also rents and services commercial refrigeration equipment to food/beverage manufacturers.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >