Estia Health (EHE) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 20/08/18 | EHE | A$2.98 | A$3.00 | NEUTRAL |

| Date of Report 20/08/18 | ASX EHE |

| Price A$2.98 | Price Target A$3.00 |

| Analyst Recommendation NEUTRAL | |

| Sector : Health Care | 52-Week Range: A$2.97 – 3.94 |

| Industry: Healthcare Services | Market Cap: A$776.6m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate EHE as a Neutral for the following reasons:

- Market-leading position in the industry.

- Ageing Australian population to provide positive tailwind.

- Ongoing brownfield and greenfield developments to drive earnings.

- Portfolio positioned in key geographic locations.

- New management is doing a good job of turning around the business.

- Solid balance sheet.

We see the following key risks to our investment thesis:

- Competitive risk from listed and unlisted providers will intensify following the industry’s deregulation.

- ACFI indexation freeze.

- New projects fail to deliver the earnings uplift.

- Falls in occupancy rates due to poor public image after being put on notice for poor facility conditions.

- Pricing pressures following the industry’s deregulation will put downward pressure on margins.

- Budget cuts to aged care will increase customers’ out-of-pocket expenses, thereby lowering demand.

- Churn risk as new government initiatives will allow customers to switch between providers, with EHE losing out on any unspent funds.

- Project development delays or cost blow-outs.

- Instability on the management level following Peter Arvanitis, Paul Gregerson and Pat Grier’s departure last year. Poor history of earnings downgrades.

ANALYST’S NOTE

EHE’s FY18 results came in line with management’s guidance. For FY18 vs. previous corresponding period (pcp), group revenue was up +4.1% and operating earnings (EBITDA) were also up +4.1%, with employee costs increasing +6.1% over the year.

Management was able to reduce Non-wage expenses over the year to ensure earnings growth kept up with revenue. The Company also provided FY19 guidance, expecting mid-single-digit EBITDA growth, all else being equal.

We maintain our Neutral recommendation. In our view, management is doing a good job in a tough trading environment, however we do not see some of the pressures abating in the short to medium term (e.g. wage pressure).

On a positive note, the Company’s strong balance sheet (gearing 0.7x EBITDA) provides room to fund growth initiatives.

- FY18 headline numbers. Group revenue was up +4.1% to $524.6m and operating earnings (EBITDA) over the year were also up +4.1% to $86.5m. However, due to higher depreciation, EBIT declined -6.2%. Over the period, the Company achieved average occupancy of 94.2%. The Company declared a fully franked final dividend of 8cps, which represented 100% of NPAT.

- Cost pressures persisting, although an industry wide issue. During the year, EHE’s employee benefits expenses were up +6.1% year on year, well ahead of revenue growth of +4.1%. Management was able to offset this by reducing ‘non-wage costs’ -1.9% year-on-year. Management noted staff cost inflation reflected the EBA (Enterprise Bargaining Agreement) increases and associated accrued leave uplifts.

- Solid balance sheet position. EHE solid balance sheet position gives the company flexibility to fund growth initiatives. As at 30 Jun-18, net debt was $63.8m, which equated to gearing ratio of 0.7x EBITDA (well below target range). Management has ample headroom to fund development and potential acquisitions. On the analysts call, management noted that they were looking at small scale acquisitions.

- Solid operating performance. In our view, management did a solid job over FY19 despite the clearly evident wage cost growth and freeze on ACFI (Aged Care Funding Instrument) indexation. Over the period, operating earnings (EBITDA) margin remained stable at 16.5%. However, management has pulled the efficiency lever in non-wage costs, which were down to $44.80 POBD (Per Occupied Bed Day) over the year (from $46.30 in pcp) or 16.8% of revenue (down from 17.8% in pcp). Importantly, management has invested in staff over the past 12 months, with staff to revenue ratio increasing to 65.8% (from 64.7% in pcp). Occupancy levels have also slightly ticked up during the year to 94.2% (from 93.5%)

- FY19 guidance. Management expects FY19 EBITDA to grow by “mid-single digit percentage” on its existing portfolio of homes, subject to no material changes in market or regulatory conditions. Management expects gearing to remain within its target range of 1.5x – 1.8x EBITDA. Further, management expects to distribute at least 70% of NPAT as fully franked dividends.

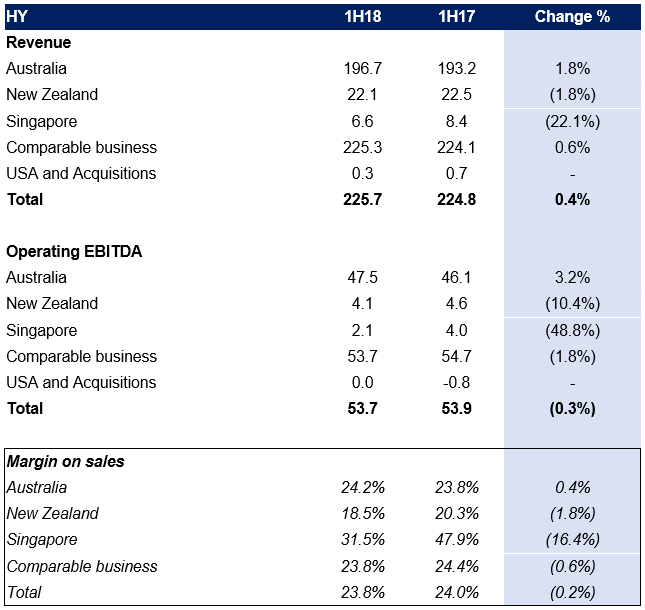

FY18 RESULTS SUMMARY…

Figure 1: EHE FY18 P&L

Source: Company

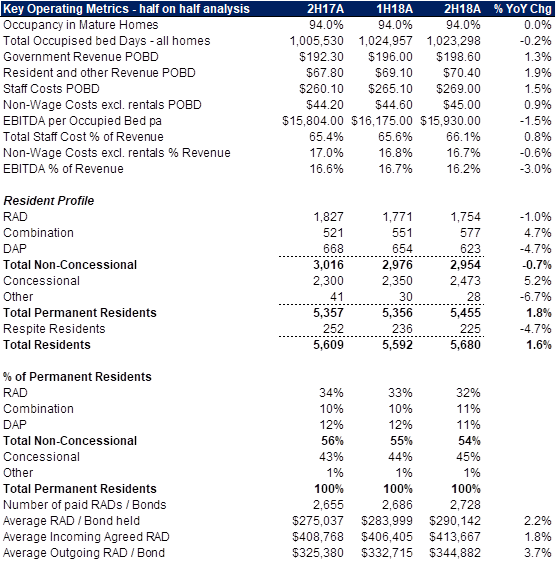

Figure 2: EHE FY18 key operating metrics

Source: Company

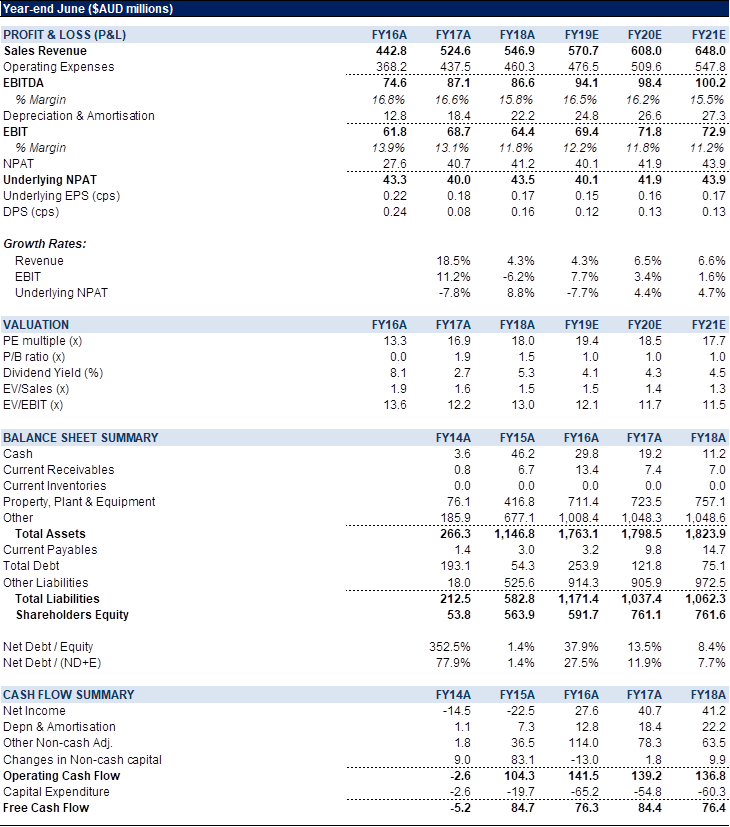

Figure 3: EHE Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Estia Health Ltd (EHE) was formed in 2005 and is currently one of the largest residential aged care providers in Australia with 68 facilities, 5,910 operating places and more than 7,000 employees across Victoria, South Australia, New South Wales and Queensland.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >