Fortescue Metals Group (FMG) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 21/08/18 | FMG | A$4.21 | A$5.10 | BUY |

| Date of Report 21/08/18 | ASX FMG |

| Price A$4.21 | Price Target A$5.10 |

| Analyst Recommendation BUY | |

| Sector: Materials | 52-Week Range: A$4.07 – 6.07 |

| Industry: Steel | Market Cap: A$13,093m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate FMG as a Buy for the following reasons:

- Construction and manufacturing projects continue to support iron ore inventory levels especially in China however we remain vigilant over the iron ore inventory stockpiling (and hence short to medium term outlook for iron ore prices).

- Strong balance sheet provides flexibility on continual retirement of debt.

- Strong cash flow generation.

- Advancing plans to introduce higher quality products

- Quality management team.

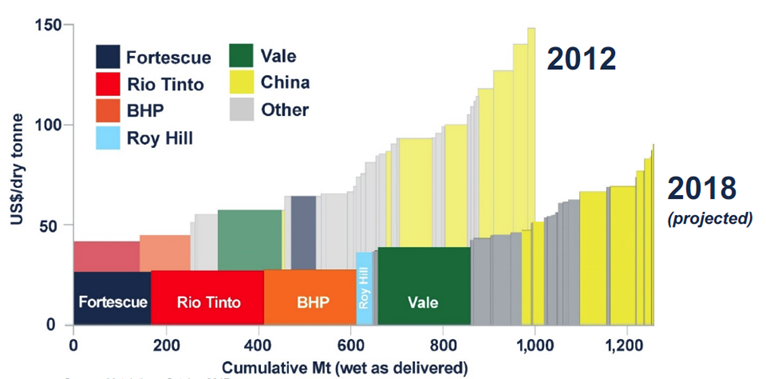

- Continues to be on the lower end of the cost curve relative to peers; with ongoing focus on C1 cost reductions should be supportive of earnings.

- Strong dividend payout on the back of a favourable result should add to positive sentiment towards the stock.

We see the following key risks to our investment thesis:

- Decline in iron ore prices especially infrastructure investment in China forecasted to slacken through to FY20.

- Cost blowouts/ production disruptions.

- Cost out strategy fails to yield results.

- Company fails to deliver on adequate capital management initiatives.

- Potential for regulatory changes.

ANALYST’S NOTE

Fortescue (FMG) FY18 results came in below market expectations, after FY18 underlying EBITDA of US$3.18bn missed consensus estimates of US$3.25bn by -2.1%. Top line revenue of US$6.89bn missed market estimates of US$7.05bn.

The Company reaffirmed FY19 shipment guidance of 165-173m tons. Compared to the prior corresponding period (pcp); revenue was down -18.5%, underlying EBITDA declined -32.9%, underlying NPAT was down -49.4% and EPS declined -58.1% – the result was owing to negative seasonal impacts from China driving the average iron ore price lower and higher shipping costs.

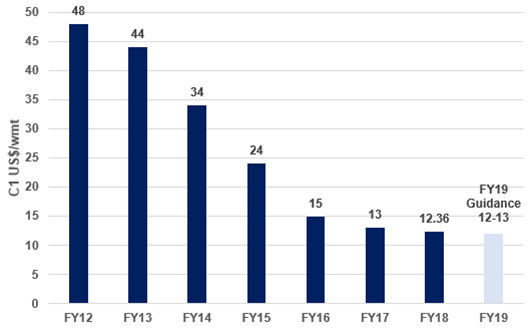

On a positive note FMG reduced its C1 cost by -4.0% and restructured its debt profile on investment grade terms reducing the financing costs by US$130m. Management noted that some China steel mills are expecting reduced impact from nation’s winter capacity curbs due to improvement in their pollution control, which we think is positive news for FMG.

FMG is responding to the shift to higher quality raw materials by advancing plans to introduce higher quality products of its own, West Pilbara Fines, in 2019 that will have 60% iron content versus current average of 58% (which is lower than benchmark 62%).

- Key FY18 headline numbers. Compared to the prior corresponding period (pcp):

1. Revenue was down -18.5% to US$6,887m due to a drop in average iron ore price to US$44/dmt from US$53/wmt in FY17.

2. Underlying EBITDA declined -32.9% to US$3.2bn.

3. Underlying NPAT was US$1.1bn, down -49.4%.

4. EPS was down -58.1% to US28.2cps.

5. A fully franked final dividend of A12cps was declared bringing the total FY18 dividend to A23cps representing a dividend payout ratio of 62%.

6. 170mt of iron ore was shipped.

7. C1 cost of US$12.36 per wmt, improvement of +4% compared to pcp.

8. Net debt increased +18.2% to US$3.1bn which included US$863m in cash. Revolving credit facility of US$525m remained undrawn, providing US$1.4bn of liquidity.

9. Cash from operations declined -39.7% to US$3bn.

10. Capital expenditure for FY18 was US$890m. - 60% iron content strategy. FMG will introduce West Pilbara Fines product in FY19 from existing operations will mean higher margin and access to product until the full-scale completion of the Eliwana project. The Company provided little details on expected tonnes from the initial operations. The Eliwana is estimated to have maiden reserve of 213mt at an average of 60.1% iron grade.

- Improvement in costs. On a positive note, C1 operating costs saw improvement to US$12.36/wmt from US$13/wmt in FY17, a reduction of -4.9%. An increase in shipping cost to US$1.15bn from US$929m in FY17 was offset by reduced Government royalties to maintain total delivered costs at US$22/wmt over FY18.

- FY19 guidance.

1. C1 costs of US$12–13/wmt.

2. An average strip ratio of 1.5.

3. Shipments of 165-173mt.

4. Total capex of US$1.2bn allocated to sustaining capital (US$580m), Eliwana project (US$340m), exploration (US$100m), development expenditure (US$100m) and ore carriers and towage (US$80m).

5. D&A of US$7.10/wmt.

6. A dividend pay-out ratio in the range of 50 – 80% of NPAT.

7. West Pilbara Fines (60% iron ore content) to be launched in 2H19.

FMG FY18 RESULTS SUMMARY…

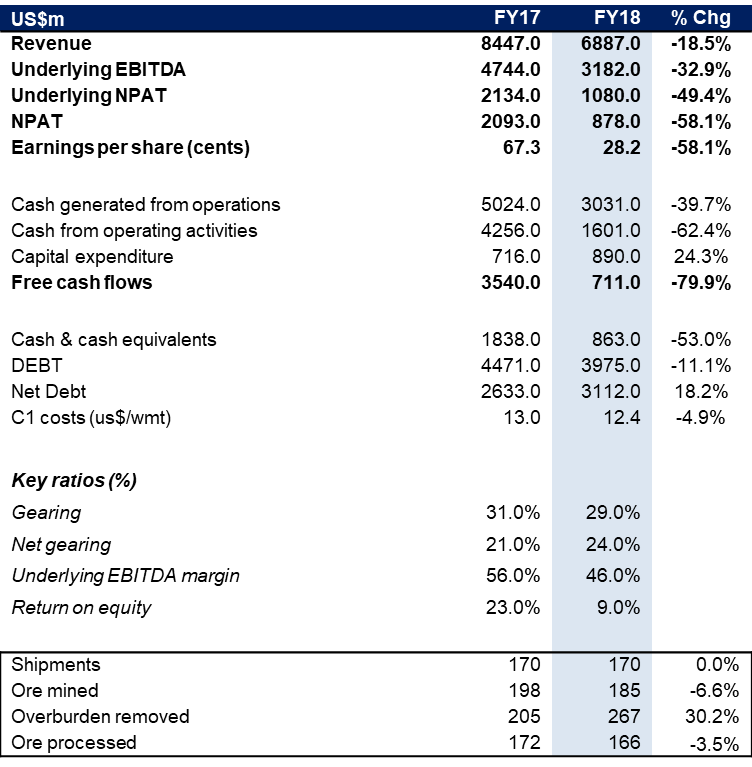

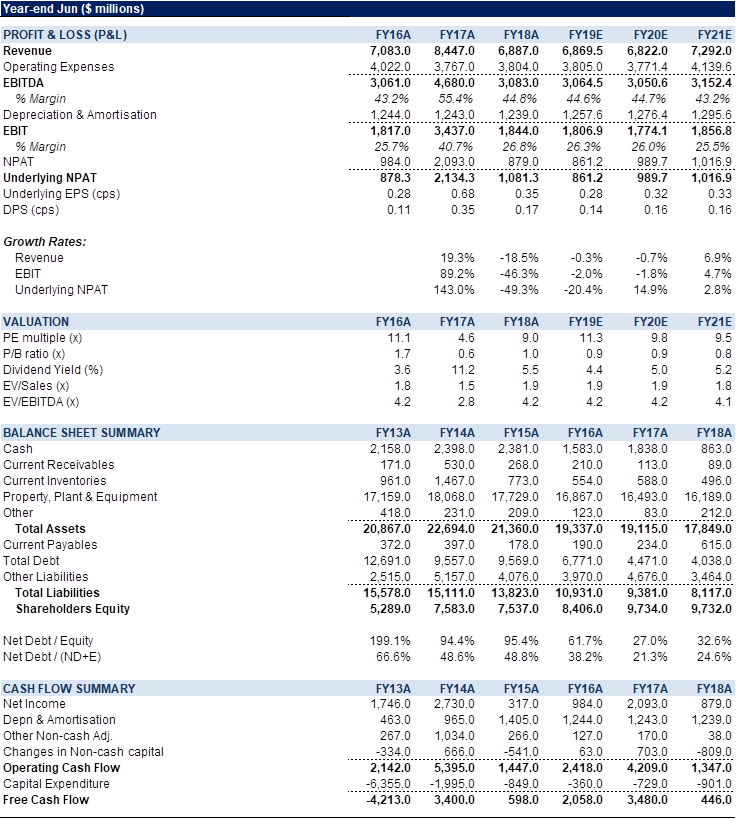

Figure 1: FMG Financial Summary

Source: Company

Key FY18 headline numbers. Compared to the prior corresponding period (pcp):

1. Revenue was down -18.5% to US$6,887m due to a drop in average iron ore price to US$44/dmt from US$53/wmt in FY17.

2. Underlying EBITDA declined -32.9% to US$3.2bn.

3. Underlying NPAT was US$1.1bn, down -49.4%.

4. EPS was down -58.1% to US28.2cps.

5. A fully franked final dividend of A12cps was declared bringing the total FY18 dividend to A23cps representing a dividend payout ratio of 62%.

6. 170mt of iron ore was shipped.

7. C1 cost of US$12.36 per wmt, improvement of +4% compared to pcp.

8. Net debt increased +18.2% to US$3.1bn which included US$863m in cash. Revolving credit facility of US$525m remained undrawn, providing US$1.4bn of liquidity.

9. Cash from operations declined -39.7% to US$3bn.

10. Capital expenditure for FY18 was US$890m

Debt portfolio restructured. During FY18 FMG restructured its debt portfolio on investment grade terms and lowered annual interest costs by US$130m following the repurchase of the Solomon Power Station and the repayment and refinancing of the 9.75% senior secured notes. Gross debt reduced -11% to US$4bn from US$4.5bn in FY17 and net debt increased +18.2% driving the net gearing up by 300bps to 24%.

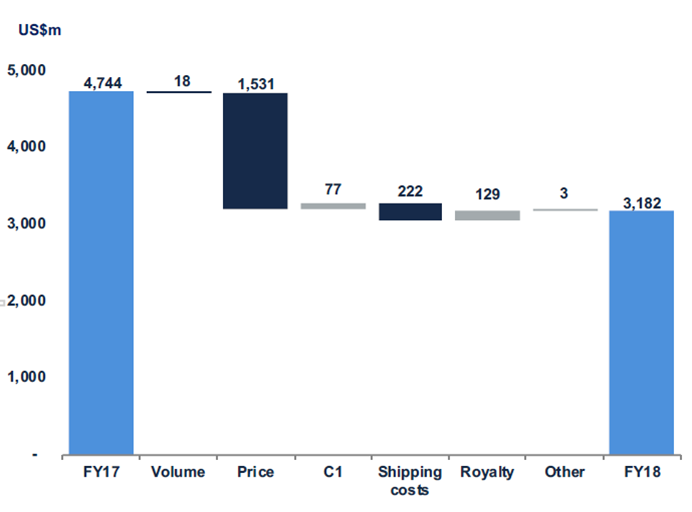

Figure 2: Underlying EBITDA drivers

Source: Company

Figure 3: FMG C1 Cost Reductions

Source: Company

Figure 4: FMG maintaining its position on the cost curve

Source: Company

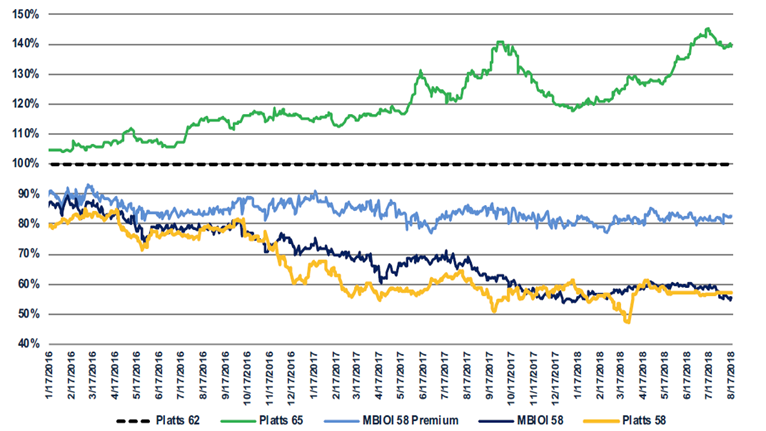

Figure 5: Variation between iron ore products driven by high steel mill profitability

Source: Company

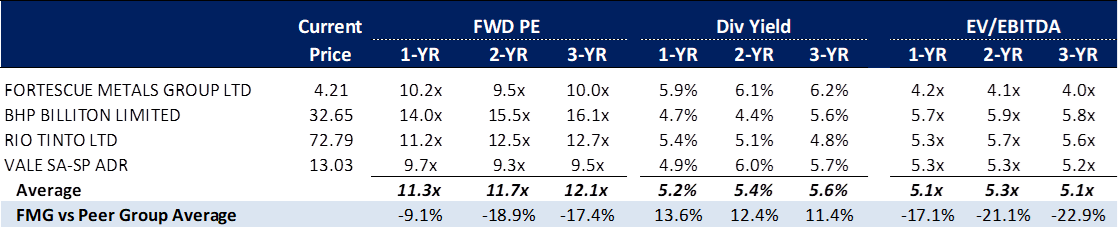

Figure 6: FMG Comparables

Source: BTIG, Bloomberg

Figure 7: FMG Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

Fortescue Metals Group Ltd (FMG) engages in the exploration, development, production, processing, and sale of iron ore in Australia, China, and internationally. It owns and operates the Chichester Hub that consists of the Cloudbreak and Christmas Creek mines located in the Chichester Ranges in the Pilbara, Western Australia; and the Solomon Hub comprising the Firetail and Kings Valley mines located in the Hamersley Ranges in the Pilbara, Western Australia. The Company was founded in 2003 and is based in East Perth, Australia.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >