G8 Education Ltd (GEM) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 28/08/18 | GEM | A$2.02 | A$2.50 | BUY |

| Date of Report 28/08/18 | ASX GEM |

| Price A$2.02 | Price Target A$2.50 |

| Analyst Recommendation BUY | |

| Sector : Consumer Discretionary | 52-Week Range: A$2.01 – 4.71 |

| Industry: Commercial Services | Market Cap: A$950.0m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate GEM as a Buy for the following reasons:

- Post recent share price drop we see value re-emerge in GEM’s valuation.

- Long-term outlook for childcare demand remains positive with growing population (organic and net immigration).

- New management team (CEO and CFO), with a greater focus on organic growth as well as acquired growth.

- Increasing exposure to offshore markets (Asia).

- Strategic investor in China First Capital Group (12.45% stake in GEM) could see a partnered expansion into the Chinese market.

- National footprint allows the Company to scale better than competitors and mum and dad operators.

- Potential takeover target by a global operator.

We see the following key risks to our investment thesis:

- Execution risk with achieving its FY19 earnings per share (EPS) target.

- Increased competition leading to pricing pressure.

- Increased supply in places leading to reduced occupancy rates.

- Value destructive acquisition(s).

- Offshore expansion execution risk.

- Adverse regulatory changes or funding cuts to childcare.

- Recession in Australia.

- Dividend cut

ANALYST’S NOTE

GEM’s first half calendar 2018 (1H18) highlighted that the current oversupply in the industry is not abating and will likely keep downward pressure over the next 12 months on occupancy levels with management expecting some sort of balance to the supple/demand equation in late 2019.

What further disappointed the market and us was the jump in operation costs (wages and support staff). With occupancy levels down 250bps, underlying operating earnings (EBIT) down -21.3%, dividend cut (implementing new dividend policy sooner) and underling NPAT down -24%, all contributed to a significant de-rating of the share price (down -16.5% yesterday).

On a positive note, the Company has undertaken refinancing and restructuring of its debt on more favourable terms and existing self-help initiatives should provide some support going forward.

Having said that, there is no doubt near-term earnings and trading conditions remain tough. Our confidence has been shaken but not completely broken (yet). In our view, the challenges remain are of a cyclical nature and not structural.

What keeps us interested:

1. Government funding should provide some support;

2. Call centre pilot is showing encouraging signs with improved occupancy and conversion rates;

3. The supply / demand equation can only be pushed so far before it becomes untenable (in this scenario large operators with scale have some advantage weathering the storm), however we are seeing signs of pipeline of firm/commenced development applications (DAs) moderating. Maintain Buy.

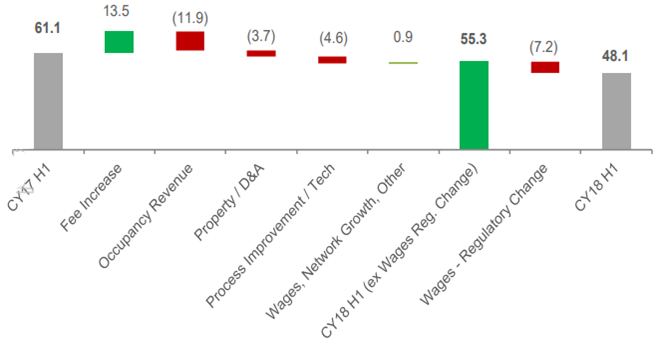

- Regulatory changes impact wages. Management noted wage growth saw a $7.2m uplift in costs due to regulatory changes. Management noted the time it took for GEM’s wage efficiency initiatives to help offset this impact took longer than expected. However, current wage trends point to improved group performance in this front in the second half of the year.

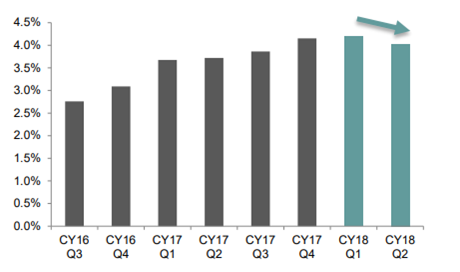

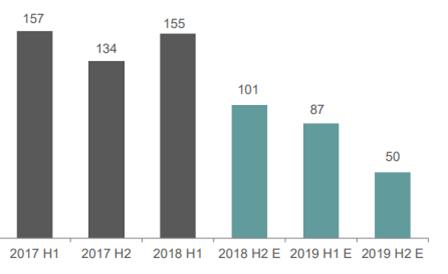

- Market dynamics – supply/demand pushed out. The overall market has been characterized by oversupply in recent years, with second quarter of CY18 seeing +4.0% supply growth led by ACT (+4%), SA (+7.2%) and VIC (+8.0%). However, management noted supply has started to moderate with encouraging signs it may be more balanced by mid to late 2019. The pipeline of firm/commenced development applications (DAs) are forecast to moderate. Having said that, market conditions are expected to remain challenging over the coming 12 months.

- New pilot indicates positive early signs. The Company is currently running a pilot call centre, which during the first half of the year delivered positive results in line with expectations. The pilot which is currently being tested across 17 centres experienced approximately +1.5% increase in occupancy vs. rest of the group, with conversion rates doubled from 20% to 40%. The Company will look to roll out this strategy to the rest of the group in the early part of 2019.

- New subsidy causing some disruption. Management noted that, as expected, the new rules coming into effect 1 July 2018 (providing additional $3.5bn to the early learning sector) has caused disruption. With those not meeting the requirements dropping off but management also seeing a healthy pick up offsetting these, pointing out “…probably did have some parents reducing their days and also some leaving our centres. They were actually more than offset by new parents and parents increasing their days, as we had good levels of occupancy growth in July and August.”

1H18 RESULTS SUMMARY…

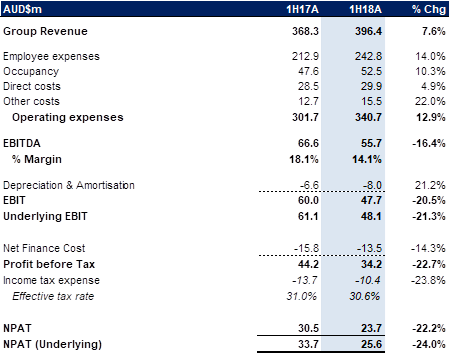

Figure 1: GEM 1H18 results summary

Source: Company

Operating earnings. Underlying EBIT of $48.1m was -21.2% below pcp, with the decline predominantly driven by:

1. a $10.6m increase in wage expense (regulatory changes to staff ratios);

2. Icreased costs in support costs and higher depreciation costs; and (3) occupancy decline.

Figure 2: GEM underlying EBIT drivers

Source: Company

Regulatory changes impact wages. Management noted wage growth saw a $7.2m uplift in costs due to regulatory changes. Management noted the time it took for GEM’s wage efficiency initiatives to help offset this impact took longer than expected. However, current wage trends point to improved group performance in this front in the second half of the year.

Occupancy levels drop. GEM’s occupancy levels dropped 250bps to 70.1% during 1H18, with a decline felt in across all States (ACT was most impacted down 410bps). We have previously noted that +/- 1% occupancy levels result in a +/- $10m impact at the EBIT line (all else being equal). On a positive note, this has seen a steady improvement in occupancy levels since February 2018.

New pilot indicates positive early signs. The Company is currently running a pilot call centre, which during the first half of the year delivered positive results in line with expectations. The pilot which is currently being tested across 17 centres experienced approximately +1.5% increase in occupancy vs. rest of the group, with conversion rates doubled from 20% to 40%. The Company will look to roll out this strategy to the rest of the group in the early part of 2019.

Cash flow & Balance sheet. Cash flow conversion was solid at 99% of EBITDA. The Company made good progress on refinancing upcoming maturities, with a $400m credit approved and progressing towards securing an additional $100m debt facility.

Dividends. During the half, the group applied its new dividend policy (was meant to start in 2019), with a target payout ratio of 70-80% of NPAT. The Company declared an interim dividend of 4.5cps (85% of underlying NPAT).

Market dynamics – supply/demand pushed out. The top 5 players in the sector hold approximately 20% of market share, with the remaining 70% shared among smaller operators. The overall market has been characterized by oversupply in recent years, with second quarter of CY18 seeing +4.0% supply growth led by ACT (+4%), SA (+7.2%) and VIC (+8.0%). However, management noted supply has started to moderate with encouraging signs it may be more balanced by mid to late 2019. The charts below highlight the acceleration in supply over the past 2 years, however pipeline of firm/commenced development applications (DAs) are forecast to moderate. Having said that, market conditions are expected to remain challenging over the coming 12 months.

Figure 3: National Long Day Care Supply (% Chg YoY)

Source: Company, ACECQA / Cordells

Source: Company, ACECQA / Cordells

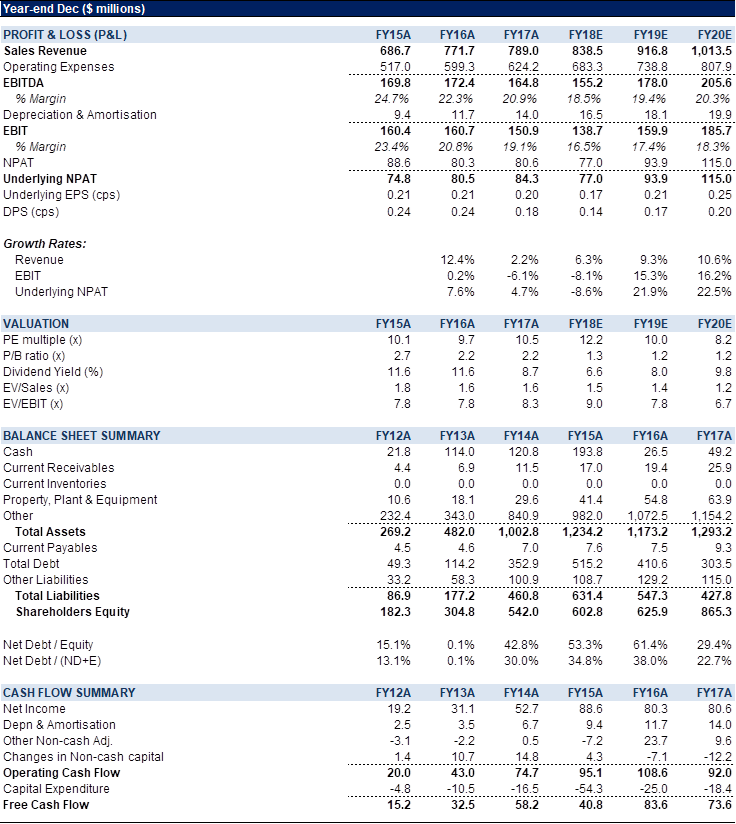

Figure 5: GEM Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

G8 Education Limited (GEM) owns and operates care and education services in Australia and Singapore through a range of brands. The Company initially listed on the ASX in December 2007 under the name of Early Learning Services, but later merged with Payce Child Care to become G8 Education.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >