Goodman Group (GMG) – Neutral

Goodman Group Ltd (GMG) delivered solid FY18 results, with operating profit of $845.9m slightly above the highest analyst estimate of $845m. The outlook for FY19 also suggests momentum is continuing (with management guiding towards +7% EPS growth versus usual +6% growth) and was largely in line with consensus estimates.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 20/08/18 | GMG | A$10.58 | A$11.00 | NEUTRAL |

| Date of Report 20/08/18 | ASX GMG |

| Price A$10.58 | Price Target A$40.00 |

| Analyst Recommendation NEUTRAL | |

| Sector : Real Estate | 52-Week Range: A$7.47 – 10.63 |

| Industry: Industrial REIT | Market Cap: A$19,052.1m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate GMG as a Neutral for the following reasons:

- Post repositioning of the business, earnings growth should return to the business at high single-digit rates in the near-term.

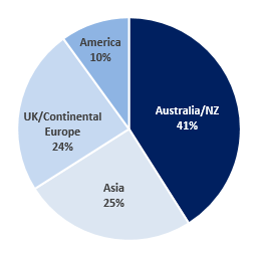

- GMG’s high-quality investment portfolio which is globally diversified and gives exposure to developed and emerging markets.

- Strong property fundamentals which should see valuation uplifts.

- With more than 50% of earnings derived offshore we expect GMG to benefit from FX translation and a prolonged period of lower rates.

- GMG’s solid balance sheet providing firepower and access to expertise to move on opportunities in key gateway cities with demand for logistics space (and supply constraints) and diversify risk by partnering (i.e. growth in funding its development pipeline) or co-investment in its funds and or make accretive acquisition opportunities.

- Expectations of continual and prolonged lower interest rate environment globally (albeit potential rate hikes in the US) should benefit GMG’s three key segments in Investments, Development and Management.

We see the following key risks to our investment thesis:

- Any negative changes to cap rates, net property income.

- Any changes to interest rates/credit markets.

- Any development issues such as delays.

- Adverse movements in multiple currencies for GMG such as BRL, USD, EUR, JPY, NZD, HKD and GBP.

- Any downward revaluations.

- Poor execution of M&A or development pipeline.

- Key man risk in CEO Greg Goodman.

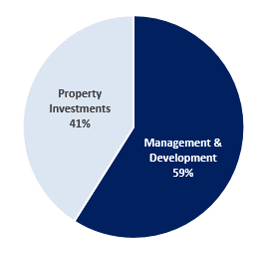

Figure 1: Operating EBIT by Segment

Source: Company

Source: BTIG, Company

ANALYST’S NOTE

Goodman Group Ltd (GMG) delivered solid FY18 results, with operating profit of $845.9m slightly above the highest analyst estimate of $845m. The outlook for FY19 also suggests momentum is continuing (with management guiding towards +7% EPS growth versus usual +6% growth) and was largely in line with consensus estimates.

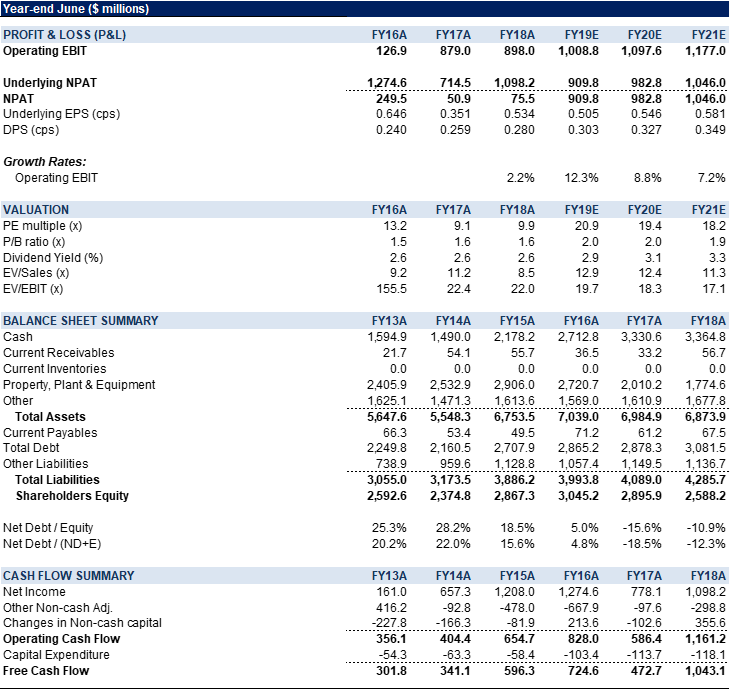

These together saw the share price re-rate higher by +5.3% post result release, with the share price up a strong +30% since our last note in Feb-18. For FY18, GMG delivered EPS growth of +8.3% and DPS growth of +8.1% on pcp.

Whist “fairly full’ trading multiples kept us on the sidelines from becoming more positive on the stock in Feb-18 (clearly a decision we now regret in hindsight), we must admit we see limited catalysts which could lead to the stock significantly de-rating from current levels in the near-term. GMG maintains a very solid balance sheet (low gearing of 5.1%), demand remains strong with occupancy levels at 98%, the Company is positively leveraged to solid structural growth and has access to global opportunities.

With the stock trading on 21x FY19E PE-multiple, we maintain our Neutral recommendation, however we expect the share price to trend higher.

- FY18 results highlights

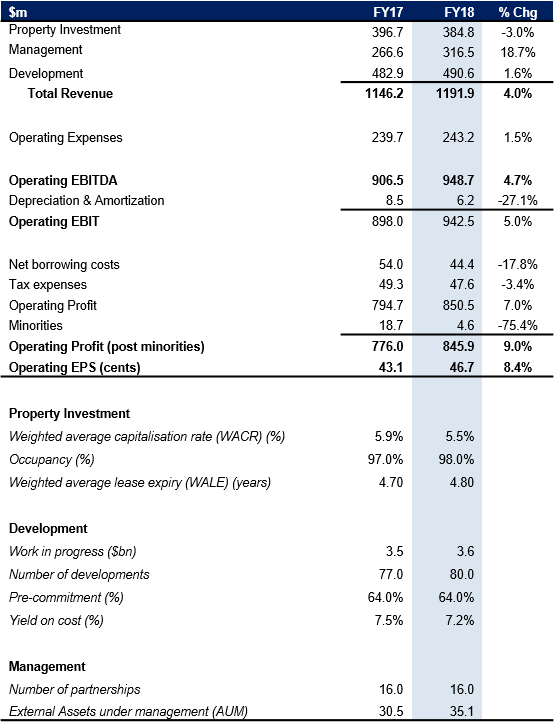

1. GMG delivered strong operating profit of $845.9 million, up +9% on pcp, and operating earnings per share (EPS) of 46.7 cents, up +8.3%. Statutory profit was $1.1 billion and Distribution per security (DPS) was up +8.1% to 28cps. The portfolio performance was the key driver of the operational result with property fundamentals steadily improving in FY18.

2. GMG achieved like-for-like net property income (NPI) growth of +3.2% and 98% occupancy across the portfolio, contributing to an increase in global valuations of $2.8bn.

3. Net tangible assets (NTA) per security was up +10% to $4.64 due to $639.0m in valuation gains.

4. Strong cash flows resulted in gearing reducing to 5.1% from 5.9% (FY17) and interest cover ratio (ICR) of 16.2 times. Management noted that liability management exercises have lowered cost of debt to 2.4% with $3.4 billion of liquidity available, predominantly in cash.

- Solid FY19 guidance. Management noted, “For FY19 market conditions are expected to remain favorable for our industry and Goodman is strategically well-placed given our financial and operational strength”. Consequently, management expects FY19 operating profit to be $913m with operating EPS of 50.0 cents, that is +7% on FY18. GMG forecasted distribution of 30 cps (up +7% on FY18).

- Management & Development segment – Major earnings contributor. The FY18 results saw continued strong contributions from the development and management operations, with the segment now contributing 59% of total EBIT, up from 56% in FY17. Management earnings were up +18.7% due to the positive performance of GMG’s partnerships, with partnership returns averaging 15% driven by their share of the $2.8bn in revaluation gains and $3.5bn of development completions. Performance fee income grew and now represents around one quarter of the revenue from this segment. External assets under management (AUM) were up +15% to $35.1bn, with total assets under management of $38.3bn, up +11% on FY17. Management noted that revaluations and net investment, predominantly through GMG’s development activity, would support further AUM and NPI growth.

GMG’s FY18 RESULTS…

Figure 3: Summary of GMG Results and key trading metrics

Source: BTIG, Company.

Figure 4: GMG Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

Goodman Group Ltd (GMG) own, manage, develop industrial, warehouse and business park property in Australia, Europe, Asia and Americas. GMG actively seeks to recycle capital with development properties providing stock for ownership by either the trust or third party managed funds, with fees generated at each stage of the process.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >