GPT Group (GPT) – Neutral

GPT Group’s (GPT) 1H18 results were solid with Funds from Operation (FFO) growth per security of +3.4% and distribution growth per security up +2.5% on pcp, representing a payout ratio of 97.7%.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 20/08/18 | GPT | $5.25 | $5.15 | NEUTRAL |

| Date of Report 20/08/18 | ASX GPT |

| Price $5.25 | Price Target $5.15 |

| Analyst Recommendation NEUTRAL | |

| Sector : Real Estate | 52-Week Range:A$4.59 – 5.53 |

| Industry: Diversified REIT

| Market Cap: A$9,439.6m |

Source: Bloomberg

INVESTMENT STATEMENT

We rate GPT as a Neutral for the following reasons:

- Solid portfolio across Retail, Office and Logistics.

- Diversified with Funds Management business generating income.

- Balance sheet strength, gearing ratio at 24.7% below target range of 25%-35%.

- Strong tenant demand for the GPT east coast assets.

- Upside from development pipeline, coming online in FY17, the Charlestown and Casuarina Shopping Centres.

We see the following key risks to our investment thesis:

- Breach of debt covenants.

- Inability to repay debt maturities as they fall due.

- Deterioration in property fundamentals, especially delays with developments.

- Environment of expected interest rate hikes.

- Downward asset revaluations.

- Retailer bankruptcies and rising vacancies.

- Outflow of funds in the Funds Management business reducing GPT’s income.

- Tenant defaults as economic landscape changes.

ANALYST’S NOTE

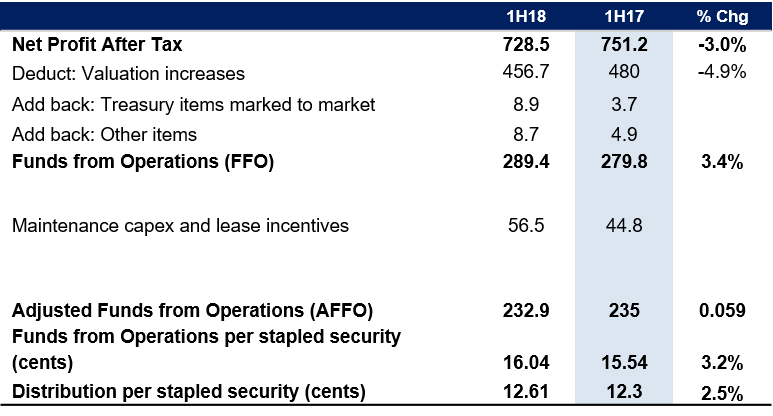

GPT Group’s (GPT) 1H18 results were solid with Funds from Operation (FFO) growth per security of +3.4% and distribution growth per security up +2.5% on pcp, representing a payout ratio of 97.7%.

Profit After Tax (NPAT) for the group was $728.5m, a decrease of -3% on pcp, despite strong like for like income growth of +3.9% and a high occupancy rate of 97.4%. GPT’s balance sheet remains strong with net gearing of 24.7%.

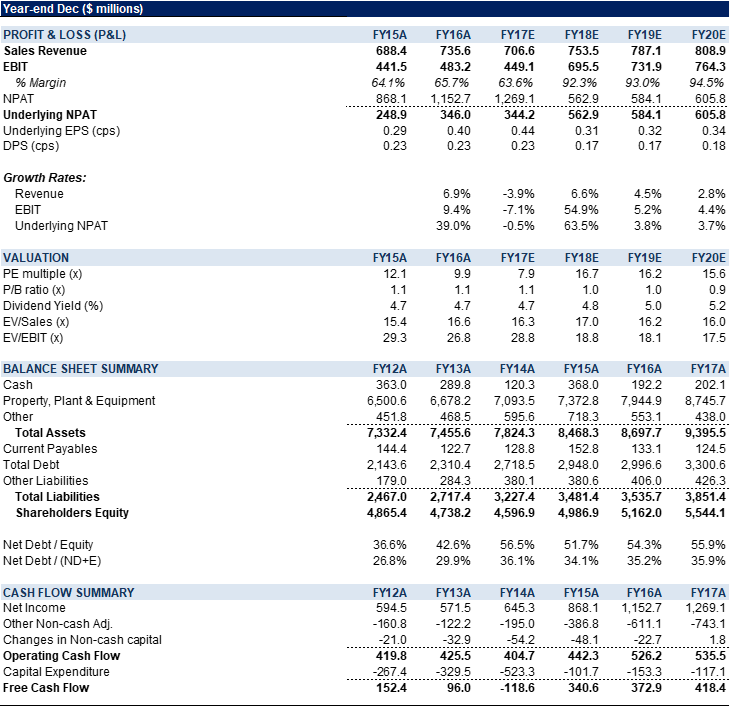

Trading at a price to book of ~1.0x and yield of 4.8%, we prefer a significant discount to NTA, so we rate GPT as a Neutral and would wait for a more significant dip in price.

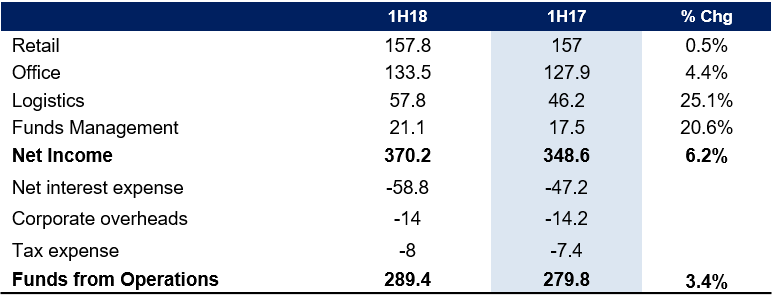

- 1H18 results overview. NPAT of A$728.5m was down -3% on pcp and FFO of $289.4m equated to growth of +3.2% driven by fixed rent increases across the portfolio and contribution from acquisitions and completed developments in logistics partially offset by elevated electricity costs and increased downtime in retail and a higher interest rate. GPT’s performance was underpinned by strong valuation gains of $457m across the group’s investment portfolio, particularly in Office which benefited from strong rental growth. GPT delivered distribution per security growth of +2.5% on pcp and NTA per security increased +5.4% to $5.31. Retail portfolio performed well delivering MAT growth of +4.4% and occupancy rate of 99.7%. Management noted, “GPT remains in strong financial shape, with net gearing of 24.7% and a weighted average debt term of 6.6 years.”

- FY18 Outlook reaffirmed. Management noted that they expect office and logistics sectors to perform well. Office valuation growth is expected, underpinned by strong fundamentals and GPT is on track for 2019/2020 new developments delivery. Management expects a 1.5% population growth, low inflationary pressures and stable interest rates for FY19. Management reaffirmed FY18 guidance of +3% in FFO per security growth and +3% DPS growth.

- Retail segment drives growth. Retail delivered total portfolio returns of +9.5% and like for like income growth of +2.3% in 1H18, with total specialty sales growth of +4.4%. Property net Income rose +3.2% to $156.8m, with Rouse Hill Town Centre, Melbourne Central and Charlestown Square being the strongest performing assets. The portfolio recorded a valuation gain of $53.5m for the period. Management confirmed, $420m expansion of Sunshine Plaza, in which GPT has a 50% interest, is due for completion in 2H19 and good progress has been made in securing retail tenants for the expansion, with 75% of the leasing deals completed for the development.

- Office performs well delivering return of 14.4%. The Office portfolio delivered +5.5% like-for-like income growth for 1H18, with net operating Income increasing +4.4% to $132.9m compared to the previous corresponding period driven by strong occupancy rate of 96.6% and WALE of 5.3 years. The portfolio recorded a $377.9m valuation gain during the period, driven by the increase in market rents in Sydney. Management expects further valuation growth in Sydney and Melbourne office markets as a result of the strong market fundamentals.

- Logistics continues to deliver strong leasing results. The Logistics portfolio saw total portfolio return of 10% and strong leasing results, with 49,500 sqm of lease signed during the half, with a further 73,900 sqm of terms agreed. Like for like income growth of +3.6% for 1H18 was supported by healthy occupancy levels increasing to 96.6% and the weighted average lease expiry (WALE) of 7.4 years. GPT acquired Sunshine Business Estate in Melbourne for a total consideration of $74m and continued to deliver its logistics development pipeline with construction of two facilities; 11,000 sqm in Huntingwood and 30,000 sqm in Eastern Creek, set for completion in 2H18.

- Funds Management delivers strong return. Total assets under management grew by +15.9% to $12.4bn, with strong demand for units from existing and new investors across both funds, delivering total return of 13.5% and profit growth of +20.6%. The GPT Wholesale Office Fund, delivered returns of 13.9%, and the GPT Wholesale Shopping Centre Fund delivered 8.4%.

GPT 1H18 RESULTS…

Figure 1 – GPT Financial Summary

Source: Company

Figure 2: GPT 1H18 Results summary – By Segments

Source: Company

Figure 3: GPT Financial Summary

Line items used for summary purposes only and may not reconcile to total. Please request for full financial models for reconciliation.

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

GPT Group (GPT) owns and manages a portfolio of high quality Australian property assets, these include Office, Business Parks and Prime Shopping Centres. Whilst the core business is focused around the Retail, Office and Logistics, it also has a Funds Management (FM) business that generates income for the company through funds management, property management and development management fees. GPT’s FM business has the following funds, GPT Wholesale Office Fund (GWOF – A$6.1b) launched in July 2006, GPT Wholesale Shopping Centre Fund (GWSCF – A$3.9b) launched in March 2007 and GPT Metro Office fund (GMF – A$400m) launched in 2014.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >