IDP Education Ltd (IEL) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 24/08/18 | IEL | A$10.68 | A$10.74 | NEUTRAL |

| Date of Report 24/08/18 | ASX IEL |

| Price A$10.68 | Price Target A$10.74 |

| Analyst Recommendation NEUTRAL | |

| Sector : Consumer Discretionary | 52-Week Range: A$5.23 – 10.92 |

| Industry: Education Services | Market Cap: A$2,459.1m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate IEL as a Neutral for the following reasons:

- Relative to its peer group, currently trades on a fair value and in line with our valuations.

- IEL maintains solid margin and strong earnings/revenue growth/strong cashflow generation.

- Good management team

- Strong synergies and cross business opportunities derived from acquisition of Hotcourses Group.

- Global growth opportunities in international student population and education industry.

- Opportunities for stronger growth with introduction and planned roll out of online IELTS delivery.

We see the following key risks to our investment thesis:

- Sporadic growth is unpredictable with IEL’s business model and unable to forecast periods of slower growth.

- Currency conversion risk.

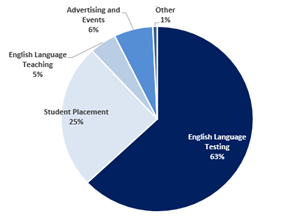

Figure 1: Revenue by segment

Source: Company

ANALYST’S NOTE

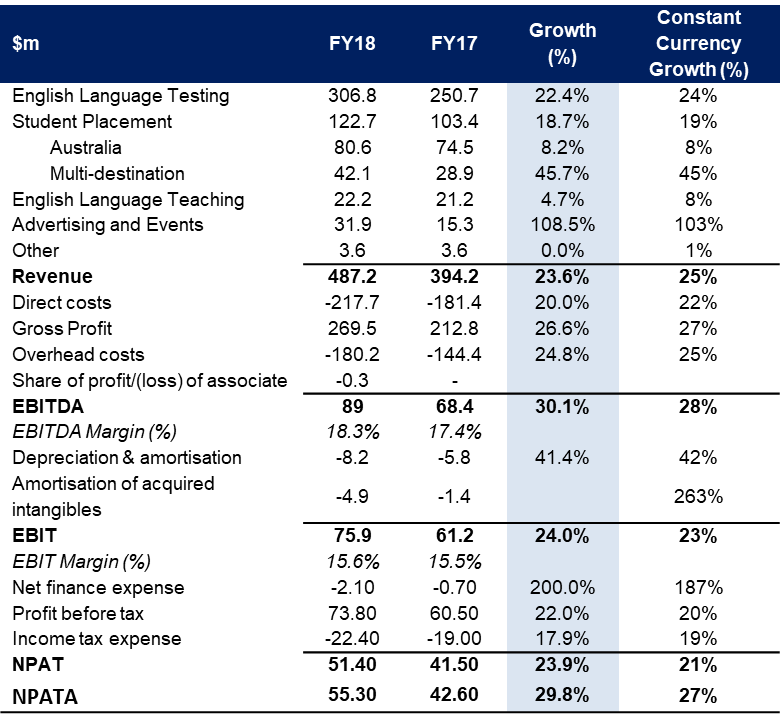

IDP Education (IEL) announced FY18 results with a revenue increase of +25% on a constant currency basis to $487.2m and EBITDA was up +28% to $89m, in line with market consensus.

NPATA was up +27% on constant currency basis to $55.3m contributed by strong volume growth across all segments. IEL delivered strong cash generation, with gross operating cashflow of $101m and balance sheet remained strong with cash balance of $48.8m, an increase of +6.8% from previous corresponding period.

English language testing segment performed well delivering +24% growth in revenue despite a fall of -1% in average test fee and IEL successfully integrated Hotcourses group into the wider business, which drove the advertising revenue up by +108.5%. We see strong growth continuing for IEL and identify that IEL is a quality business, which justifies the valuation and trading multiples – Neutral.

- FY18 Results – key highlights.

1. Revenue of $487.2m was up +25% on a constant currency basis over pcp, with volume growth across all segments underpinning revenue growth.

2. EBITDA at $89m, up +28% on a constant currency basis. EBITDA margin was 18.3%, an increase from 17.4% in FY17, driven by IELTS margin expansion and inclusion of Hotcourses earnings which are at +90% margin.

3. NPATA up to $55.3m, which equates to +27% gain on a constant currency basis.

4. The board declared a final dividend of 6.5 cents per share (60% franked).

5. Strong cash generation with gross operating cash flow of $101m, up +31%, reflecting 113% conversion from reported EBITDA.

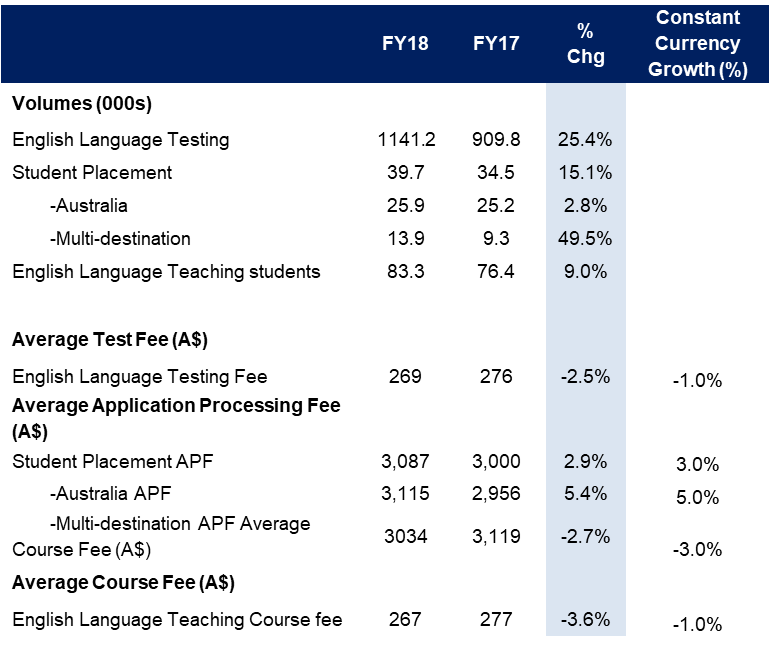

6. Capex of $28.5m, with major investments being SP digital platform and new SP offices. - English Language Testing (IELTS) (~63% of revenue). Revenue of $306.8m was up +22.4% (+24% on a constant currency basis), driven by +25% increase in IELTS volume, with IEL expanding its IELTS services to Uzbekistan, Nigeria and Switzerland and IELTS India returning to strong growth following the impact of demonetization in FY17. The average test fee for IELTS declined -2.5% to A$269 (on a constant currency basis, the average test fee fell -1%), adversely impacted by currency and mix shift. IEL has begun its global rollout of computer delivered IELTS with the online test now being offered in 11 countries

- Student Placement (~25% of revenue). Total revenue increased +19% to $122.7m, on a constant currency basis, driven by strong growth of +45% in revenue of multi-destination student placements. IEL saw volume up +15.1% to 39,700 driven by multi-destination volume growth of +49.5% with a notable +126% growth in volumes in Canada and +60% growth in volumes in India. However multi-destination fee fell -3% on a constant currency basis. Australia posted moderate growth in volumes (up +3%) reflecting tighter new migration policies in the country, however the Average Application Processes Fee in Australia rose +5%, benefitting from contract changes.

- English Language Teaching (~5% of revenue). Revenue increased +4.7% (+8% on constant currency) to $22.2m with course numbers up +9% on pcp to 83,300. Average prices decreased -3.6% but were mostly flat (-1%) on a constant currency basis.

- Advertising and Events (~6% of revenue) – Strong growth. Revenue of $31.9m was up +108.5% driven by the newly acquired Hotcourses business, providing +26% increase in international web traffic. Hotcourses revenue was up +22% with margin of 90%.

- No guidance for FY19. No specific guidance was provided but the CEO noted, “Company’s priorities remain the roll-out of both computer-delivered IELTS and the global digital platform and we are excited to build on the positive momentum gathered this year as we progress these industry-transforming initiatives.”

FY18 RESULTS SUMMARY

Figure 2: IEL FY18 Results Overview

Source: Company

Figure 3: IEL Operating Metrics

Source: Company

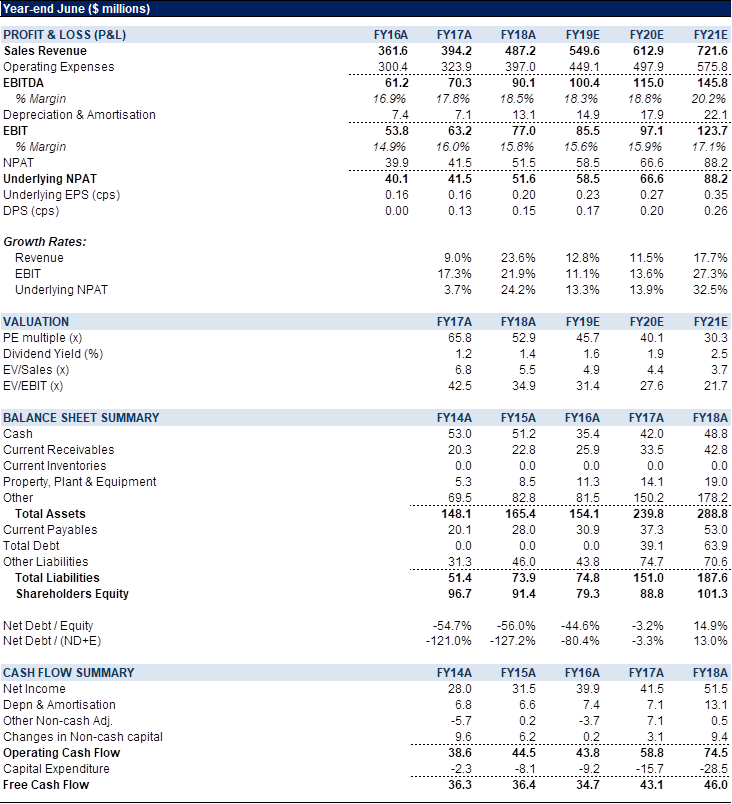

VALUATION

Our price target of A$10.74 per share is based on a DCF valuation. Based on our DCF with FCF forecasted to FY22, utilising a WACC of 8.4%, and increased LTGR to 5%, we arrive at a valuation of $10.74/share.

Figure 4: IDP Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

IDP Education Ltd (IEL) offers 1) Student placement: student recruitment/placement in 93 offices across 30 countries into~600 universities, schools and colleges globally in 5 destination countries; and 2) co-owner of IELTS, an English language proficiency test which foreigners must pass in order to obtain certain visas and permanent residency in Australia. IEL is 50% owned by Education Australia Ltd – a business in which 38 Australian universities own a 50.1% stake.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >