Insurance Australia Group (IAG) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 20/08/18 | IAG | A$7.78 | A$7.63 | NEUTRAL |

| Date of Report 20/08/18 | ASX IAG |

| Price A$7.78 | Price Target A$7.63 |

| Analyst Recommendation NEUTRAL | |

| Sector: Financials | 52-Week Range: A$6.08 – 8.69 |

| Industry: P&C Insurance | Market Cap: A$18,419.3m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate IAG as a Neutral for the following reasons:

- We expect volume and pricing pressure to affect GWP growth in the short to medium term, albeit, relative to peers, IAG is achieving one of the highest underlying margins in general insurance driven by its market position in Australian and NZ.

- Prospect of an uplift in margins from cost-out programmes.

- Ongoing exit out of Asia to potentially yield better business performance

We see the following key risks to our investment thesis:

- Premium rates are cyclical and any tough point or downward trend in the insurance cycle will affect margins.

- Any adverse catastrophe claims without warning with inadequate reinsurance results in lower combined operating ratios.

- Benefits and targets from cost-out initiatives not achieved.

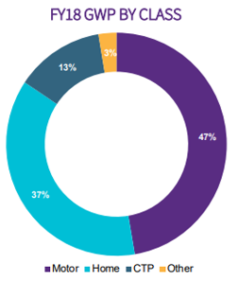

Figure 1/2: IAG’s Consumer Division(FY18) GWP by Class/State

Source: Company

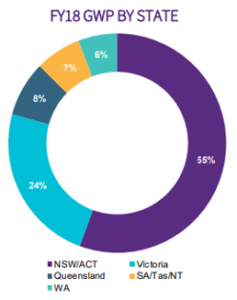

Figure 3: IAG’s Business Division (FY18) GWP by Segment

Source: Company

ANALYST’S NOTE

While IAG performed well in its underlying insurance business for FY18, it saw weak performance from shareholder fund returns.

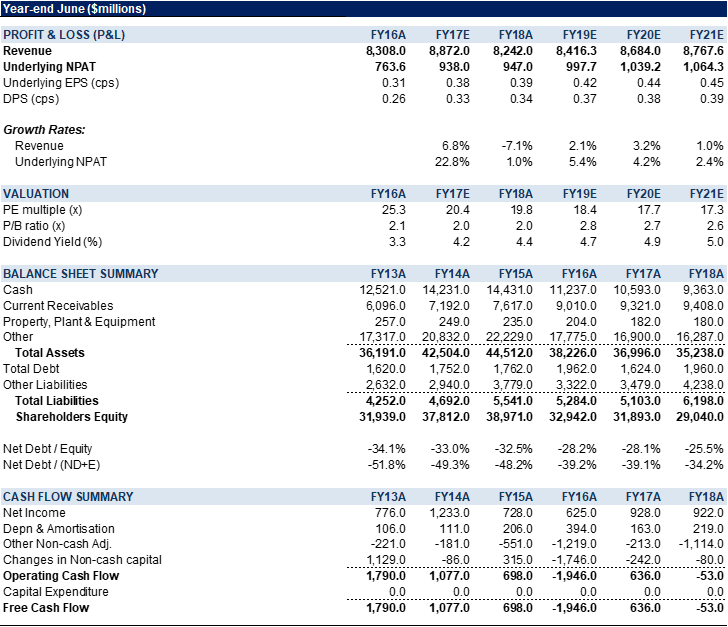

Underlying GWP growth was strong and margin improved significantly, largely due to a quota share agreement. However, a sharp decline in funds income (-32.9%) resulted in FY18 NPAT being -0.6% below FY17.

On the analyst call with management, IAG reiterated much of the recent investor day and highlighted “strategic review of options for our Asian operations [has] seen in our sale of the three operations in Southeast Asia and we continue to pursue exit options for our investment in China. At this stage, we are obtaining our interests in Malaysia and India and are continuing to assess our position and do not expect to see any further material investment in the region…the sale of our operations in Thailand, Indonesia and Vietnam… will see a net profit north of $200m booked in FY19”.

Interestingly, one source of uncertainty is around the Royal Commission into Banking and Finance which traverses into general and life insurance, in which IAG has booked ~$10m in cost. IAG trades on 17.7x PE20 and 4.9% dividend yield. Reiterate Neutral.

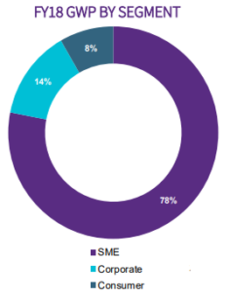

- Improved FY18 results in core business.

1. Gross written premiums (GWP) were up over 4% on a like-for-like basis largely due to rate increases addressing claims inflation in motor and home. Volumes were flat overall (with advances In CTP and NZ motor offset by commercial). Reported GWP growth was only +1.8% due to one-off items taken during the year including discontinued Swann operations, adverse exchange rates, and NSW CTP reforms;

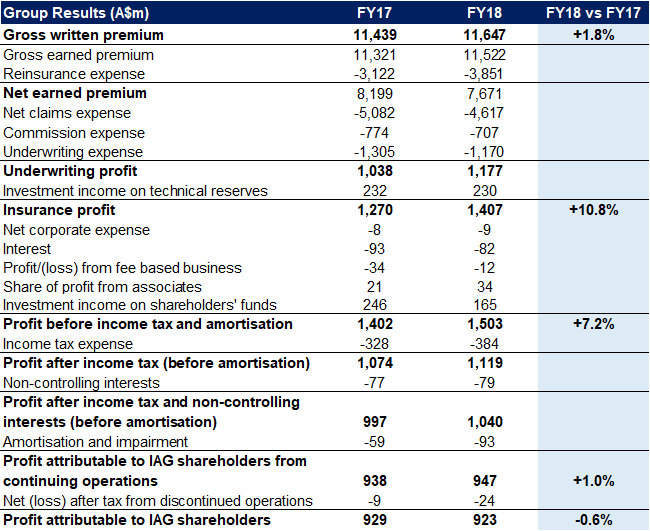

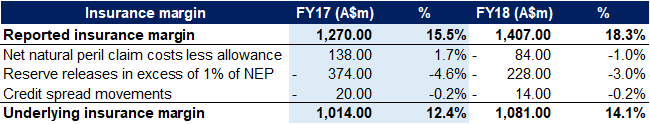

2. Reported margin was up +280bps to 18.3%, above previous guidance of 16-18%, due to favourable variations in peril claim costs, as well as higher than expected reserve releases. Underlying margin at 14.1% improved +170bps against FY17 as motor rates increased, NSW CTP profitability improved, commercial property losses lessened, and a 12.5% quota share agreement came through

3. NPAT was down -0.6% to $923m due to a steep decline in shareholders’ funds income (down -32.9% to $165m). This decline is slightly attributable to FY17 being a bumper year for IAG’s investment arm due to strong performance in the equity markets. Cash earnings were up +4.5% to $1,034m. ROE was up +40bps to 15.6%.

4. Final fully franked dividend of 20cps, consistent with pcp, was declared, bringing FY18 dividend to 34cps (+3% on pcp). - Solid capital position, with upcoming capital management initiatives. IAG’s Common Equity Tier 1 (CET1) ratio is at 1.26x against a target benchmark of 0.9-1.1x. IAG has also announced $592m in upcoming capital management initiatives expected to occur around 26 November involving a capital return of 19.5cps combined with a fully franked special dividend of 5.5cps. A share consolidation is expected around the same time, but the proportionate interest of shareholders will remain unchanged. Post the final dividend, upcoming initiatives and benefits of Asia disposals, CET1 is expected to be around the mid-point of the target benchmark (0.98x).

Reduced franking capacity – of special note is that management highlighted IAG’s dwindling franking credit balance and signalled that IAG may not be able to fully frank dividends from FY19 onwards, guiding franking between 70-100%. - FY19 guidance – further underlying improvement.

1. IAG expects GWP growth guidance of 2-4% citing anticipated rate increases across short-tail personal and commercial classes, and modest increases in volume, combined with residual NSW CTP reform effects.

2. Reported insurance margin guidance of 16-18% driven by improved underlying performance (including benefits of optimisation program activities) as well as the 12.5% quota share impact and lower reserve releases.

3. Assumptions underlying guidance include net losses from natural perils of $608m (per current allowance), reserve releases of ~2%, and no material movements in exchange rates or investment markets. - Optimisation program progressing – whilst the program had a “neutral impact” in FY18, ~$100m of pre-tax benefit are expected in FY19.

IAG’s FY18 Results

Figure 4: IAG’s FY18 Results Summary

Source: Company

Figure 5: IAG’s FY18 Insurance Margin

Source: Company

By divisions:

- Australia. IAG Australia performed well in the Consumer division, while Business margins was also a highlight.

1. Underlying GWP growth was >+3% driven by rate increases across short-tail personal lines, with commercial rates maintaining their increases.

2. Volume was relatively flat overall with growth in CTP offset by lower home and commercial.

3. Underlying margin improved significantly to 12.9% (from 11.5% in FY17) on improved rates and CTP profitability in Consumer combined with rate earn-through and lower large losses in Business.

4. Further improvement is expected in FY19, with margin improving due to 12.5% quota share effect, optimisation benefits, and improved business margin though NSW CTP profitability caps will have adverse effects. - New Zealand. IAG had strong performance in NZ with NZ$ GWP growth of +8.9%. This was attributed to 8% growth in Consumer (led by higher motor rates and volumes) and over 10% in Business, driven by higher commercial rates but offset by decreases in new business volumes. The adverse FX effect (with the NZ depreciating relative to AUD) rendered this GWP growth to be reported at +6.3%. Underlying margin of 17.6% in FY18 was strong due to earn-through of rate increases combined with the quota share benefit. Perils were above allowance but below FY17. Strong performance is still expected going forward in FY19.

Figure 6: IAG Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

Insurance Australia Group (IAG) is one of the two largest general insurance underwriters in Australia and New Zealand. IAG core insurance product categories are in Consumer (Motor, Home, Compulsory Third Party (CTP)) and Business (predominately SME, Specialty Lines, Workers’ Compensation) across Australia, NZ, and Asia.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >