InvoCare Ltd (IVC) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 17/08/18 | IVC | A$12.69 | A$13.25 | BUY |

| Date of Report 17/08/18 | ASX IVC |

| Price A$12.69 | Price Target A$13.25 |

| Analyst Recommendation BUY | |

| Sector : Consumer Discretionary | 52-Week Range: A$ 11.40 – 18.15 |

| Industry: Funeral Services | Market Cap: A$1,395.2m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate IVC as a Buy for the following reasons:

- At 18.0x PE20, 5.9% dividend yield – we upgrade to Buy but acknowledge we may be early and believe that IVC is more of a 2020 story.

- Potential for increased death rates.

- Continued cost control from strategic review and operational efficiency.

- Benefits derived from “Protect and Grow 2020 plan”. Management noted on the analyst call “longer term, we believe that market share will benefit significantly from the Protect & Grow plan, which will meet customers’ needs, and we will set the business up for sustainable double-digit EPS growth”.

- IVC benefits from demographics and long-term population growth.

- IVC holds leading market positions in its core markets.

- IVC has strong cash flow conversion and generation.

- High barrier to entry with quality assets and business model that is difficult to replicate.

- Increased competition from budget operators in Australia.

We see the following key risks to our investment thesis:

- Continued reduction in death rate compared to expectations/forecasted trend.

- Increased competition especially around pricing.

- Protect and Grow 2020 does not yield incremental returns as anticipated.

- Underperformance of funds under management.

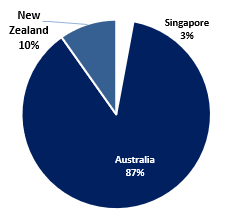

Figure 1 : IVC revenue by Geography

Source: Company

ANALYST’S NOTE

InvoCare Ltd (IVC) reported disappointing 1H18 results which missed market expectations (the share price was down -8.8% as EPS consensus estimates were missed by -5.6%).

Key highlights to the results include:

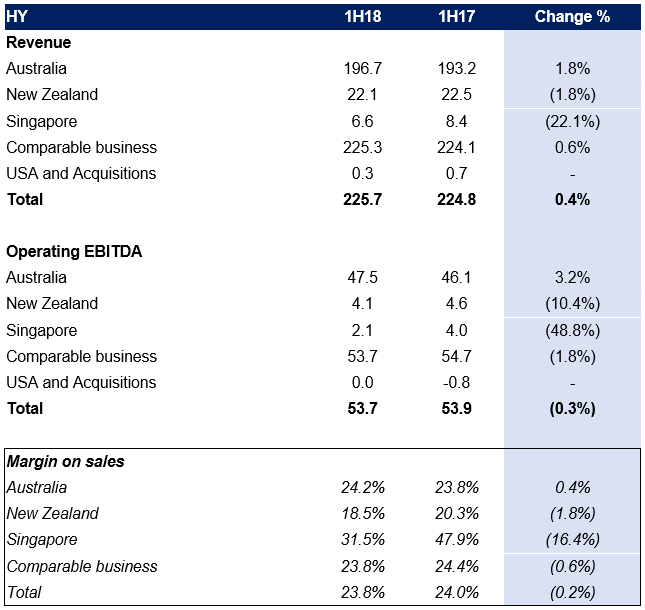

1. Sales revenue up +0.4% to A$225.7m;

2. EBITDA down -0.3% to A$53.7m;

3. IVC saw operating earnings after tax decrease by -7.3% to A$23.5m; and

4. Announced a half-year fully franked dividend of 17.5cps (down -5.4% versus pcp figures).

The key reasons to the soft results were:

1. Soft market conditions (1.2% death rate in Australia compared to the average 1.5%)

2. lower volumes (estimated 650 cases lost due to locations temporarily closed for renovation).

These results are all broadly in line with management’s guidance, with “low single digit growth forecast” for EBITDA (down from high single digits) and EPS expected to be flat. For 2H18, management expects operating EBITDA to show a “small increase” over the previous year, and “mid-single digit decline in operating EPS”.

Regardless, we still see IVC as a superior market leader and note that management have stated that their market share has stabilised in Q2 2018. Market share is expected to increase in 2019 as more locations are renovated, new locations come on-line, and impact of recent acquisitions (Auckland-based provider, William Morrison Funerals) are factored in.

Relative to its ASX peer group, IVC is of superior quality, and in our view, at these levels, it is the time to build a position. We do acknowledge that in the short term, there is risk of weak earnings (and potential for further share price under performance) but believe that much of the negatives are already factored into the share price.

At 18.0x PE20, 5.9% dividend yield – we upgrade to Buy but acknowledge we may be early and believe that IVC is more of a 2020 story (as Protect & Grow progresses well and renovations occur).

- Lower deaths rates squeezing Australia margins. Australian funeral sales decreased -3.5% to A$144.5m. Average revenue per funeral contract numbers also decreased slightly by -1.9%, resulting in ~$2.2m reduction in sales. The number of deaths increased at a weak rate of +1.2%, considerably lower than the +5.0% experienced previously (management notes these rates as not unusual, as such trends seem to bounce back “following a period of lower than anticipated growth”. These lackluster results also reflect strong competition from smaller operators in “contracting market conditions and greater volume of value cremations in isolated markets”, resulting in lower case averages (-2% yoy). Nonetheless, management notes 1H19 has seen a stabilization of market share despite NBO disruptions. Outlook wise, management believes that the case average will revert to traditional levels of +3-4% pa as more locations are renovated. Australian cemeteries and crematoria sales delivered an increase of +18.3% to A$57.6m and will likely see strong FY19 results on the completion of large developments.

- New Zealand market share stable. Sales were down -1.8% to A$22.1m, impacted by unfavourable foreign exchange movements as case volumes were largely stable and in line with the pcp as market share remained stable. However, earnings were 10.4% weaker to $4.1m and margins lower at 18.5% (from 20.3% in 1H17).

- Singapore underperforms… The segment was a heavy drag on IVC performance, with case volume down -23.8% and sales down -22.1% to A$6.6m as a result of temporary parlour closures in 4Q17 for major renovations (reopened in mid 2Q18). Case averages also declined -23.8%, albeit in line with expectations as a result of facilities upgrades.

- FY18 gloomy outlook. Management outlook comments remained largely gloomy. For 2H18, management expects operating EBITDA to experience low single digit growth over the previous year”, and “mid-single digit decline in operating EPS” – due to higher financing costs and NBO related depreciation. Management also cautions that if soft market conditions continue, full year guidance will be impacted, and operating EBITDA may experience a “mid-single digit decline on pcp”.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

IVC FY18 Results Summary

Figure 2: IVC 1H18 Results Summary

Source: BTIG, Company, Bloomberg

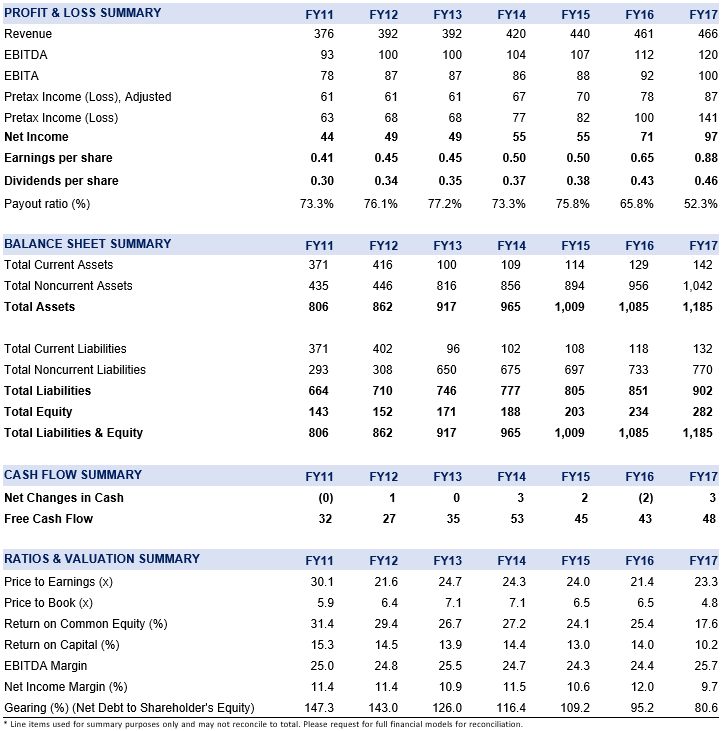

Figure 3: IVC Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

InvoCare Ltd (IVC) is the largest private funeral, cemetery and cremation operator in the Asia Pacific Region. It has leading market positions in countries like Australia, New Zealand, and Singapore.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >