James Hardie (JHX) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 13/08/18 | JHX | A$21.70 | A$22.35 | NEUTRAL |

| Date of Report 13/08/18 | ASX JHX |

| Price A$21.70 | Price Target A$22.35 |

| Analyst Recommendation NEUTRAL | |

| Sector: Materials | 52-Week Range: A$17.03 – 24.19 |

| Industry: Construction Materials | Market Cap: A$9,671.0m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate JHX as a Neutral for the following reasons:

- Largest producer of non-asbetos fibre cement – approximately 85% of the market share in the US, Australia and New Zealand.

- Ongoing momentum in the US housing market, with a positive outlook for housing starts (approximately 1.2m to 1.3m for 2019).

- Fibre cement taking market share from vinyl and other siding products.

- Strong R&D program to stay ahead of competition.

- Leveraged to a falling AUD/USD.

- New CEO may bring a fresh perspective on existing strategy.

We see the following key risks to our investment thesis:

- Competitive pressures leading to margin decline.

- Input cost pressures which the company is unable to pass on to customers.

- Deterioration in housing starts (US, Australia).

- Unable to achieve its growth and market share target, which likely see a de-rating of the stock.

- Adverse movements in asbestos claims.

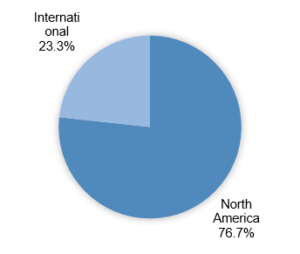

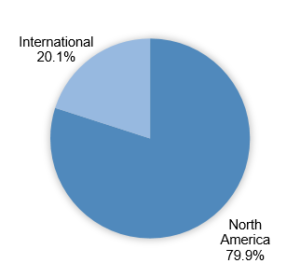

Figure 1: JHX Revenue by Segment

Source: Company

Source: Company

ANALYST’S NOTE

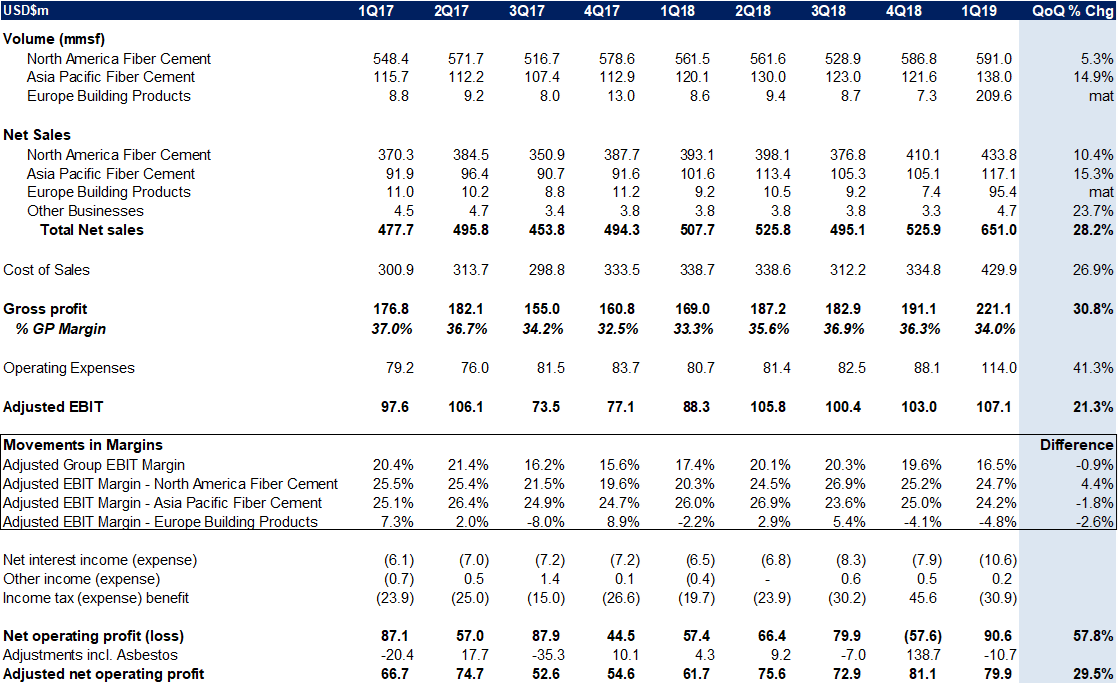

JHX reported a solid 1Q19 result with adjusted net profit of US$79.9m +29% above previous corresponding period (pcp) and adjusted operating earnings (EBIT) up +21% on pcp, with EBIT margins slightly weaker (by -0.9%) at 16.5%.

However, when trading on high PE-multiples, outlook or a miss against expectations can have a very negative share price reaction (JHX price was down approx. -7%). The source of this reaction was disappointing volume growth over the quarter in JHX’s North America Fibre Cement segment (80% of group earnings).

The key market segment of exteriors grew only +1% above market index growth, with management also adding that the order book looks a little light relative to their expectation. Putting this together, investors are questioning whether JHX can achieve its FY19 target of +3-5% above market growth rate.

Further, management’s full year net profit guidance was below market expectations, especially considering the Company is expected to benefit from lower tax rate during the year. Maintain Neutral.

- North America Fiber Cement (80% of 1Q19 EBIT).

1. Sales growth of +10% on pcp was driven by +5% growth in volume and +5.0% in pricing.

2. EBIT jumped by +34.0%, driven by +23% increase in gross profit on higher prices, lower start up costs and lower production costs.

3. Solid gross profit margin (up +3.7%) drove EBIT margin by 4.4% to 24.7%. - North America volume growth disappoints and full year target appears challenging. Management noted that volume grew by +6.5% in exteriors (main driver of group volumes) and +1.0% in interiors. Exteriors market index growth rate was estimated to be 4-5%, which suggest JHX’s FY19 target to achieve 3-5% above market growth (termed primary demand growth or PDG) is now starting to be questioned by investors. Management conceded that they need continued momentum to achieve full year goals.

- Order book below expectations in the North America Fibre Cement segment. Not helping market’s confidence in JHX building momentum in FY19 was management’s comments on a light order book. On the analysts’ conference call, the CEO Mr Gries commented “…right now I’d say our order book is not where I want it…I think it’s a little softer than we should be comfortable with”.

- International Fiber Cement (20% of 1Q19 EBIT).

1. Volume and net sales were up +15.0% for the quarter on pcp, driven primarily by the Australian and Philippines businesses.

2. EBIT was up +7.0%, driven by +9% increase in gross profit (however, gross profit margin declined 2.2% driven by higher production costs, e.g. pulp and freight costs) and higher SG&A expenses (primarily higher labour costs). - FY19 guidance. Management expects full year adjusted net operating profit to be between US$300-340m compared to pre-announcement consensus estimates range US$313-358m. Using the midpoint of these ranges, this equates to a -4.6% miss to consensus expectations. However, the underlying guidance could be much weaker, as the Company expects adjusted effective tax rate for the full year to be 17.1% versus our estimate of 25% (and, in our view, most analysts would be closer to our estimates). This suggests the miss relative to expectations is much higher than ~5%.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

1Q19 results summary…

Figure 3: JHX 1Q19 result summary

Source: Company, BTIG estimates

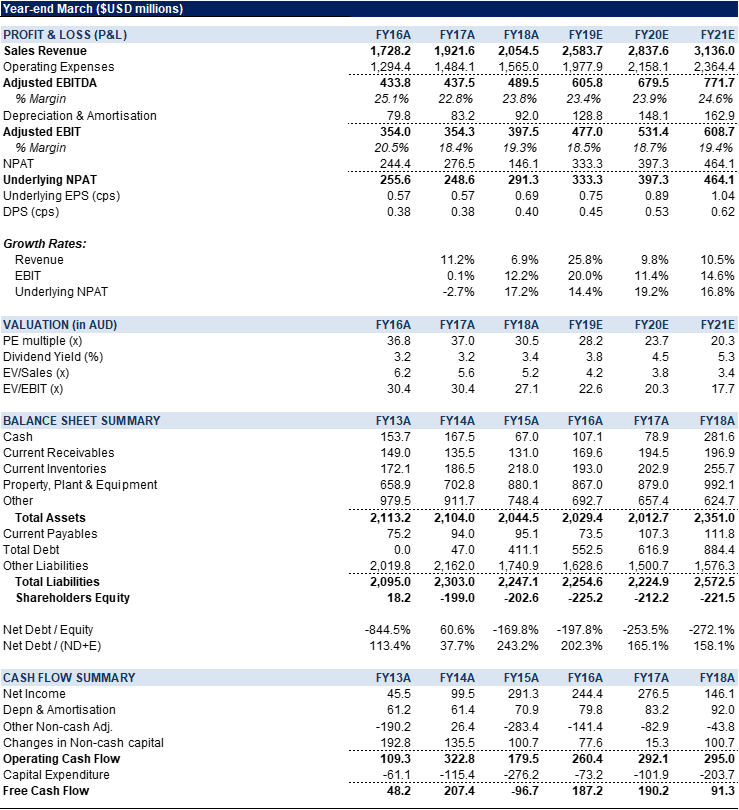

Relative valuation to peer group…

Figure 4: JHX relative valuation – consensus estimates

Source: Bloomberg

Figure 5: JHX Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

James Hardie Industries Plc (JHX) manufactures building products for new home construction and remodeling. JHX’s products include fibre cement siding, backer board, and pipe. The company operates in the US, Australia and New Zealand.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >