Japara Healthcare (JHC)- NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 30/08/18 | JHC | A$1.77 | A$1.70 | NEUTRAL |

| Date of Report 30/08/18 | ASX JHC |

| Price A$1.77 | Price Target A$1.70 |

| Analyst Recommendation NEUTRAL | |

| Sector : Health Care | 52-Week Range: A$1.63 – 2.23 |

| Industry: Health Care Facilities | Market Cap: A$470.0m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate JHC as a Neutral for the following reasons:

- Ageing Australian population to provide positive tailwind.

- Ongoing Brownfield and Greenfield developments to drive earnings.

- Acquisition and integration strategy to bring on new revenue streams.

- Strong recurring government revenue base.

- Acquisition target or industry consolidation.

- High entry barriers due to capex, regulatory and accreditation requirements.

We see the following key risks to our investment thesis:

- Competitive risk from listed and unlisted providers will intensify following the industry’s deregulation.

- Pricing pressures following the industry’s deregulation will put downward pressure on margins.

- Budget cuts to aged care will increase customers’ out-of-pocket expenses, thereby lowering demand.

- Churn risk as new government initiatives will allow customers to switch between providers, with JHC losing out on any unspent funds.

- New projects fail to deliver the earnings uplift.

- Project development delays or cost blow-outs.

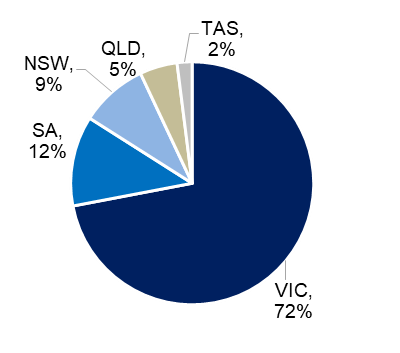

Figure 1: JHC portfolio by region

Source: Company

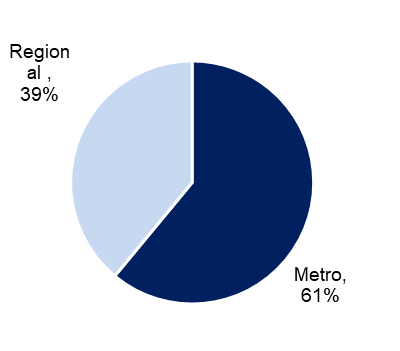

Figure 2: JHC places: metro vs. regional

Source: Company

ANALYST’S NOTE

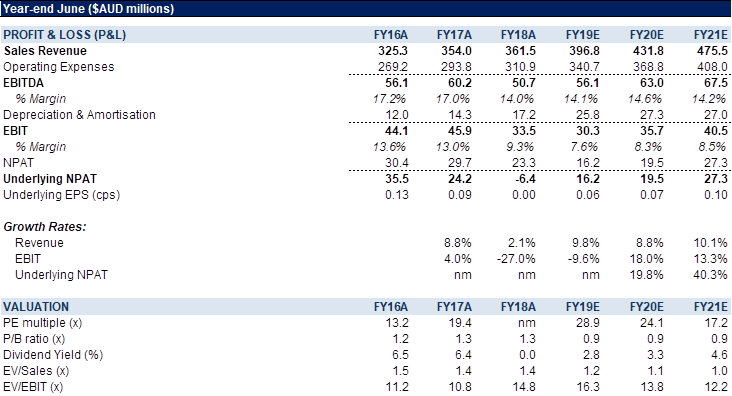

Japara Healthcare (JHC) reported a weak FY18 result, below guidance provided in February 2018. Group revenue was up +3.0% on pcp to $373.2m as occupancy hits were offset by contributions from new Brownfield and Greenfield projects.

Operating earnings (EBITDA) was down -15.8% to $50.7m, falling below guidance estimates as removal of ACFI indexation in FY18 had a material impact upon wage costs and abnormally severe influenza outbreaks caused falls in occupancy (consistent across the industry).

We do note, however that occupancy levels have returned to historical averages between 94-95% in line with Management’s guidance earlier in the year. Maintain Neutral.

- FY18 headline results.

1. Relative to previous corresponding period (pcp), revenue was up +3.0% to $373.2m, operating earnings were down -15.8% to $50.7m and NPAT dropped -21.5% to $23.3m. Management provided a breakdown of the 15.8% decline in group EBITDA, attributing declines to occupancy pressures and the absence of ACFI indexation. Whilst recent completion of brownfields developments and operational initiatives provided strong earnings contribution on top of recurring EBITDA, earnings were significantly impacted by wage rate increases made material due to the absence of ACFI indexation. Management highlighted that such impacts should disappear in FY19 given that ACFI indexation is expected to recommence in FY19.

2. The Board declared a Final Dividend of 3.75 cpu taking full year dividends to 7.75cps. - Occupancy hit remains temporary. Whilst occupancy during FY18 was severely impacted by the unusually severe influenza outbreaks, in line with other aged care providers, 2H18 saw recovery to historical average levels in occupancy of 94-95%. As at 30 June 2018, the Company has reported occupancy levels recovering to 94.4%, excluding places offline for refurbishment.

- Update on development pipeline.

1. Development pipeline.JHC spent $108.2m on land & improvement expenditure during FY18, in line with its development plans to deliver around 300 places per annum on a consistent basis. The current development pipeline now consists of over 1,200 net new places to be delivered by the end of FY2022. Whilst it is evident that such developments provide strong earnings uplift, management has not disclosed any recent figures on the earnings contribution from new projects such as Noosa or Riverside Views which opened late 2017.

2. Significant Refurbishment Program. JHC has also focused on improving asset quality of their portfolio, with all homes identified as requiring significant refurbishment to be completed by FY19. This is anticipated to deliver EBITDA uplift between $3.5-4m.

3. Riveria Health Portfolio acquisition completed. In April 2018, the Riveria health portfolio acquisition was completed, increasing Japara’s presence in the Sydney market. Management is confident that this portfolio will increase future growth opportunities by providing optimal sites in NSW. - FY19 Outlook. Management provided an optimistic FY19 outlook, expecting a 5-10% uplift in EBITDA in FY19 as occupancy continues to normalise to historical averages and ACFI indexation returns. Stronger earnings are expected in the second half due to the timing of developments and operational initiatives.

FY18 RESULTS SUMMARY

Figure 3: JHC FY18 results summary

Source: Company, BTIG estimates; mat = material movement

Figure 4: JHC Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Japara Healthcare (JHC) is one of Australia’s largest private sector enterprises in the aged care and retirement industry. The Company own and operate 43 residential aged care facilities and 5 retirement complexes throughout Australia. The Company has over 3,800 operational places and employs over 5,250 employees. Its agencies are accredited with the Australian Aged Care Quality Agency.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >