Audinate Group Ltd (AD8) – Meeting Notes

Reach Markets publish the notes from our analyst meetings with company management. They should be read in conjunction with the research we’ve completed. Reach Markets endeavour to provide self-directed investors a seat at our investment meetings. We publish these notes in a conversational format to get these out as quickly as possible for your consumption.

We recently had a one-on-one meeting with Rob Goss, CFO of Audinate Group Ltd (AD8). Audinate is an innovative digital audio networking provider located out of Ultimo, Sydney that has developed a platform (Dante), which distributes digital audio signals over computer networks and is designed to bring the benefits of IT networking to the professional AV industry. AD8 remains on our watchlist as we track its pathway to sustainable profitability.

Key products:

(1) Dante Adapter Modules are compact pre-programmed Dante interface modules, designed for production of cost-effective audio adapters.

(2) Dante Chips deliver Dante networking for medium and small channel-count applications like small mixers, power amplifiers and conferencing solutions.

(3) Dante soundcard increases performance of recording solutions by supporting 256 uncompressed audio channels with very low round trip latency.

(4) Dante AVIO adapters deliver interoperability by connecting traditional audio gear with any Dante-connected system.

(5) Dante Domain Manager is a software that helps manage the Dante network by making audio networking more secure and more controllable. Comes in 3 versions; platinum, gold and silver which sell for for US$10,000, US$4000 and US$1000 respectively out of which 30% of the amount is paid to the system integrator.

Figure 1: Product mix and customers

Source: Company

Priceline and margins:

The small chips (Ultimo) sells for US$10-11, medium size chip (Broadway) sells for US$25-29 and the Brooklyn module sells for US$80. The customers also have to purchase a product development key for US$10,000 per product. The company has a blended gross margin of 75%.

Dante Video:

The company has signed a Software Defined Video Over Ethernet (SDVOE) alliance with Semtech Corporation to manufacture video chips which could potentially replace an HDMI cable with an ethernet cable. The company plans to release the video chip by end of FY19.

New IPO

Gold explorer currently undergoing an IPO. Seeking fast track to production. Register to receive the prospectus upon approval.

Customer base:

Audinate currently has 420 customers across the world who have licenced its technology, including some well renowned names like Yamaha, Bose, Shure, Sony etc. 221 of these customers are already shipping Audinate’s products and the rest are in various stages of getting the product to the market.

IP protection

Audinate protects its IP by signing a licence agreement with all its customers for trade protection of IP.

Competitive advantage:

(1) Rapid product development – supports OEMs and have the best toolkit and the easiest technology to integrate because the interface is standard.

(2) Plug & play and simplified connection management – devices support auto discovery and one click routing, and the software has a simple and logical user interface with real time network monitoring.

(3) Interoperability – between all Dante enabled devices regardless of manufacturer.

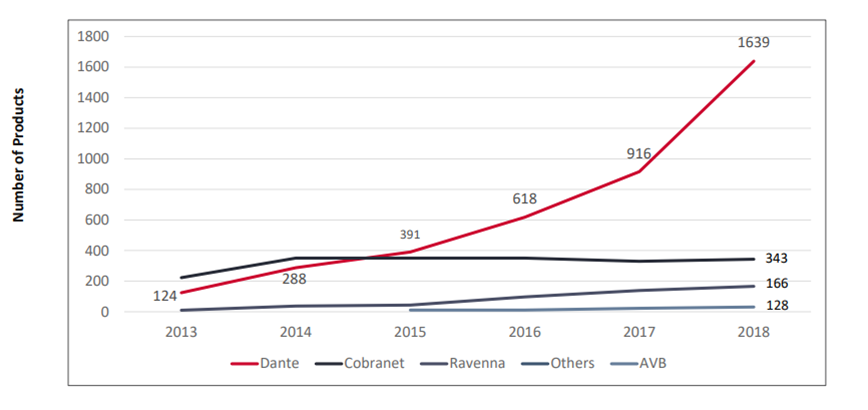

(4) Product ecosystem – five times bigger product catalogue than its closest competitor (Cobranet, owned by Cirrus Logic), with 1639 products currently in the market.

Figure 2: Competitive landscape – Networked Audio Products

Growth strategy:

The company divides its growth strategy into 4 phases and is currently in phase 1;

(Phase 1) Mass proliferation of technology – get as many audio signals on the platform as possible.

(Phase 2) Increase market awareness of Dante products – educate end users and system designers & integrators to increase adoption of Dante products in AV systems.

(Phase 3) Dante control manager – selling more services like monitoring, alerting and remote access to the Dante control manager platform.

(Phase 4) Processing of audio from the cloud.

Clean balance sheet:

The company has a clean balance sheet with $13.6m cash and cash equivalents and no debt.

Outlook:

Goss noted in the words to the effect of, “core business is delivering 26%-31% CAGR over a 3 or a 4-year period and we think this growth rate should increase but it will be minimum 26%-36. We currently have 75% blended gross margin (software is 100% and hardware is about 65%), for FY19 we expect that gross margin to be maintained. Longer term software will grow quicker than the hardware which will have a favourable long term impact on gross margins. In the near term if there is outperformance, its most likely to come from adapters and we think there will be a short term adverse impact on gross margins in FY19 if they outperform according to our expectations.

We were EBITDA positive this year and we are planning to put on 24 FTEs during the course of FY19 to drive and build out support channels and sales channels, so in the near term EBITDA number will improve but our focus is driving the revenue growth rather than optimising for EBITDA at this point.

FY20 onwards you will start to see the leverage in the operating model. There will be bit of investment in marketing this year and beyond FY19 it will be a more steady state incremental head count and you will start to see the JAWS widening. If I look at 5 years without being massively heroic on revenue assumptions you could easily see a 35% EBITDA margin/ We expect to be operating cashflow positive but net negative for FY19 and overall cashflow positive in 2H19 and on a full year basis we will be cashflow positive in FY20. There are some acquisition opportunities and we would probable look more at acquisition opportunities in video space”.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >