Nuheara Ltd (NUH) – Meeting Notes

Reach Markets publish the notes from our analyst meetings with company management. They should be read in conjunction with the research we’ve completed. Reach Markets endeavour to provide self-directed investors a seat at our investment meetings. We publish these notes in a conversational format to get these out as quickly as possible for your consumption.

We recently had a one-on-one meeting with Justin Miller, who is Co-founder and Managing Director of Nuheara. Located out of Perth and San Francisco (America), NUH is an innovative audio wearables company that has developed proprietary and multi-functional intelligent hearing technology that augments a person's hearing and facilitates cable free connection to smart devices. The key points were:

- Co listed on the stock exchange via RTO (reverse takeover) in March 2016 @ 2.5cps. Current market cap $74m. Justin noted all the legacy issues (shareholders etc) from the RTO have now washed through and the Company is clean from that perspective.

- NUH is already earning revenue, with global sales of $4m in FY18 (vs. $2.5m in FY17).

Key products

1. IQbuds Classic released in Jan-17, average age of user 38 years, and retail price US$300.

2. IQbuds Boost released May 2018, includes EAR ID Personalisation technology, average age of user 50 years, and retail price US$500. Management noted they very quickly sold out of first 2,500 units.

New products:

1. Live IQ to be released Q4 2018, which will be progressive to DVT with possible OEM opportunities (white label for clients);

2. IQbuds Max to be released in 2019, which will have maximum intelligence and personalization

Source: Company

Pricing

NUH’s products retail for US$300 – 500 per unit versus average mid-range digital hearing aid $7,000 (up to $14,000).

New IPO

Gold explorer currently undergoing an IPO. Seeking fast track to production. Register to receive the prospectus upon approval.

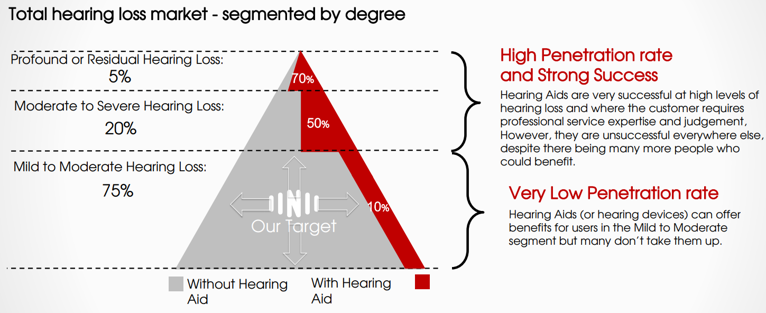

Target market

The company is targeting a market, which they believe is under serviced at this moment – the mild to moderate hearing loss segment (which makes up 75% of the total hearing loss market). The theory is that mild to moderate hearing loss patients are normally turned away given the cost for a hearing plant is so high. If an affordable and accessible device is provided to mild to moderate patients, they are more likely to consider it given the difference device makes to one’s hearing. For the retailers it opens a new market to service which they would normally be turning away. Company believes its total U.S. market potential p.a. is $2.52bn (U.S. always tends to be the largest market) and Total Global market potential is at $6.3bn. Product cycle is roughly 3 years.

Source: Company

Retail distribution

NUH is already well represented on Amazon, Best Buy, Selfridges, Harrods, Bloom, Brookstone etc – approximately 1,500 global outlets. The issue has been that while the product is available, it needs a consultative approach to sales – that is, sales rep need to understand the product to be able to talk to customers and it needs to be properly positioned in the shop (cannot be lumped in with headphones…Best Buy has in fact now created a separate marketing area specifically for these types of products in their shops to help with this product differentiation). NUH has recently signed with a major Italian Optical chain Vision Group to extend trials across 300 stores (initially started with 50), with the potential to roll out across 2,500 stores. These stores are like Spec Savers, which provide a more consultative approach to selling NUH’s products.

Data

Via its existing customers, the Company is collecting significant amount of data which will be very useful (customer trends, usage, applications etc).

New IPO

Gold explorer currently undergoing an IPO. Seeking fast track to production. Register to receive the prospectus upon approval.

Key positives:

1. Approaching the critical selling period of December, which will be a good test to see how the new retail strategy executes and results delivered.

2. Significant experience operating in the U.S., given it a key and large market.

3. Appears to have a creditable management team, with the Executive Chairman / CEO Justin Miller already successfully running a similar company Sensear (smart digital headsets) but in the industrial space globally with clients such as ExxonMobil, Chevron, ConocoPhillips, BP, Shell.

4. Recently appointed Chief Sales Officer with previous experience from Samsung Electronics Australia.

Key weakness:

1. Will require more capital raisings to fund growth;

2. Larger competitors decide to move into this space;

3. slow uptake of sales may disappoint investors;

4. new competitors (not just large corporations with balance sheet firepower);

5. key may risk (Executive Chairman / co-founders);

6. product recall or device failure; and

7. the product and market need more awareness / education (this will require additional investment).

Initial view

Like the market, pricing point and new sales distribution opportunity (understand how they need to pull through sales). Management has execution experience globally and the company is already generating sales. Interesting play on a thematic we are already playing via COH in the large cap space. Still highly speculative.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >