Navitas Ltd (NVT) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 08/08/18 | NVT | A$4.13 | A$4.32 | NEUTRAL |

| Date of Report 08/08/18 | ASX NVT |

| Price A$4.13 | Price Target A$4.32 |

| Analyst Recommendation NEUTRAL | |

| Sector : Consumer Discretionary | 52-Week Range: A$3.87 – 5.64 |

| Industry: Education Services | Market Cap: A$1,540.2m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate NVT as a Neutral for the following reasons:

- Trades in line with our valuation.

- Offers exposure to attractive business in University Partnerships which is operating at a maintainable ~22% EBITDA margin, is showing increasing and high student retention rates (+80%) and successful pass rates (+84%) as well as CAGR growth of +5% going forward.

- Risk of losing college contracts with partner universities reduced with renewal of six contracts in FY18 and only three contracts due for renewal in the next year.

- Potential short-term risk from anti-immigration policies in the US and UK which affect enrolment growth.

We see the following key risks to our investment thesis:

- Negative surprises around remaining three contract renewals with partner universities over the next year.

- Increased regulatory hurdles for immigration and visa in the US and UK may impact earnings.

- Slowdown in migrant arrivals and potential government cuts to funding for migrant English services, for the PEP business.

ANALYST’S NOTE

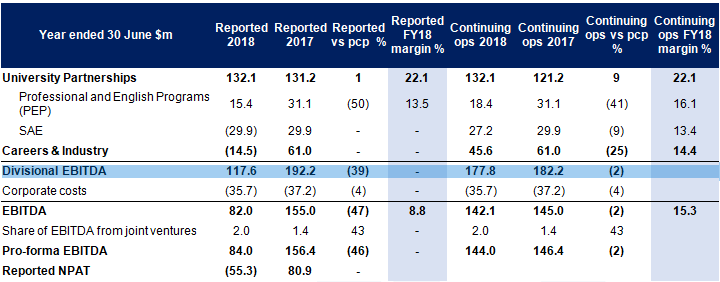

Navitas (NVT) reported disappointing FY18 results in our view given the write-downs (but the results were largely in-line with market expectations); with revenue of A$931m (down -3.0%), EBITDA of A$82m, -47.0% lower than FY17 equating to a margin of 8.8% (below FY17 margins of 16.2%).

NVT reported after tax loss of A$55.3m, a significant decline due to A$123.8m of one-off charges associated with the plan to rationalize the business portfolio of Careers and Industry Division.

We retain our Neutral recommendation: we like (1) NVT sees a longer term +5% CAGR growth in student enrolment across its colleges on decent margins (as per its 2020 targets) and (2) some risk in loss of college contracts has been reduced given six contracts being renewed in FY18 and two new universities recently agreed to partner with NVT; but we are currently waiting for indicative signs of positive outcomes as NVT undertakes its rationalization of its Careers and Industry Division before going positive on the stock.

At 21.8x PE19, ~4.4% dividend yield, and with the share price in line with our valuation, we think the stock is fairly priced at this point.

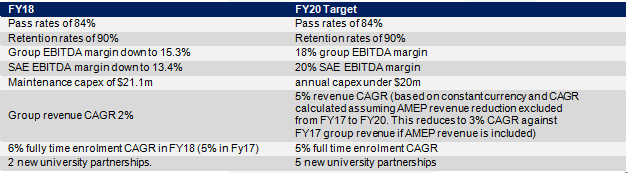

- No immediate outlook but longer term guidance reaffirmed. CEO David Buckingham highlighted that “NVT is well positioned to excel in an evolving education sector” despite some market uncertainty. Management reaffirmed its 2020 growth targets of

1. CAGR growth of +5% group revenue;

2. 18% group EBITDA margin;

3. Enrolments in University Partnerships is expected to grow at 5% CAGR

4. Capex is expected to reduce below A$20m p.a.

- Strong longer term global growth in enrolments expected but short-term risk with anti-migration policies. NVT saw +6% growth in student enrolment across its University Partnerships (excluding closed colleges) on continued strong demand for quality education opportunities by international students. Average fee growth of +3% was marginally offset by a change to lower priced courses due to courses in Australia and Canada being cheaper than courses in the U.S and UK. In Australia and New Zealand, enrolments increased +11% due to Simplified Streamlined Visa Framework (SSVF) partially offset by changes in working rights (tougher work visa conditions). UK enrolments increased +6% as European students seek admissions in UK universities before Brexit. North American enrolments were flat on pcp with growth in Canada offset by declines in the U.S. on increased visa rejections under the new U.S. administration. In our view, we expect the higher visa rejection rates and uncertainty around immigration policy changes to impact U.S. enrolments and presents a short-term risk to NVT’s earnings.

- College contract loss risk reduced with the renewal of its majority contracts. New contracts were obtained with the Virginia Commonwealth University in the U.S. and Murdoch University in Dubai which bodes well for future earnings. Six contracts were renewed under similar terms and conditions, leaving only three contracts due for renewal in the next two years, reducing previous potential downside risk to earnings. Swansea College was converted to a Joint Venture. Contracts up for renewal include University of Canterbury (November 2018), University of Portsmouth (February 2019), University of Plymouth (March 2019).

- Rationalization of the Career and Industry portfolio. NVT has decided to rationalize its Career and Industry division with divestment of U.S. SAE business, closure of SAE sites in LA and San Joes, closure of divestment of Health Skills Australia (HSA), closure of SAE Oxford and conversion of SAE Indonesia into a licensed operation. In our view the decision should improve EBITDA margin of SAE.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

FY18 RESULTS SUMMARY

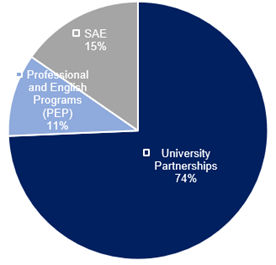

Figure 1: Revenue by segment

Source: Company

Figure 2: FY18 Results Overview

Source: Company

Outlook + reaffirms 2020 targets. On the analyst conference call, management noted global demand for education services is expected to continue despite uncertainty in some markets. Management reaffirmed its 2020 growth targets of:

(1) CAGR growth of +5% group revenue;

(2) 18% group EBITDA margin;

(3) enrolments in University Partnerships is expected to grow at 5% CAGR;

(4) Capex is expected to reduce below A$20m p.a.

Figure 3: FY18 results vs FY20 target

Source: Company

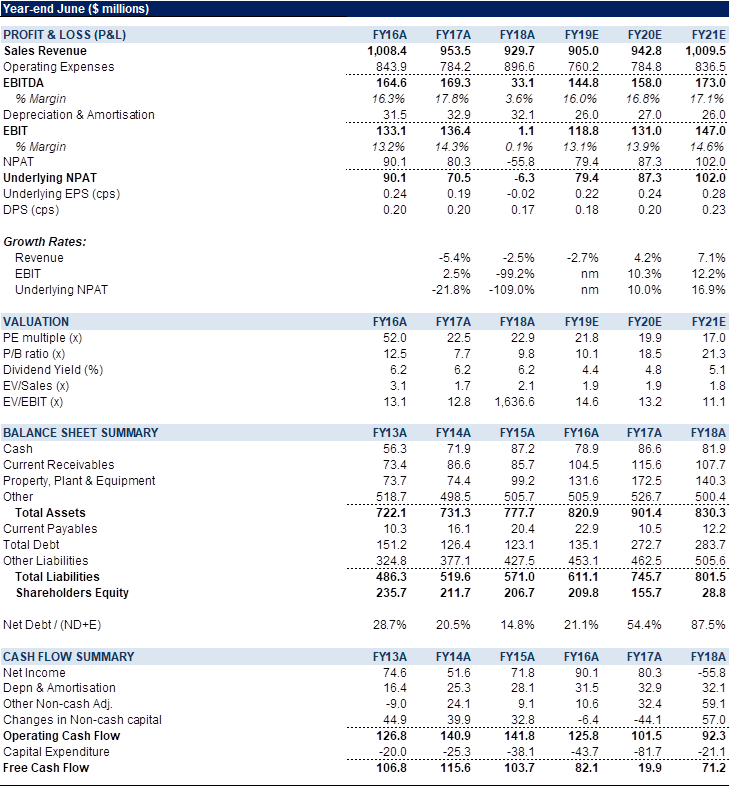

VALUATION

Our price target of A$4.71/share is based on an equally weighted blend of a DCF and PE valuation. Based on our DCF with FCF estimates forecasted till FY22, utilising a WACC of 9.0%, we arrive at a valuation of $4.41/share. Based on PE valuation, we arrive at A$4.25/share, which is based on an average of FY19-21E EPS estimates and our target PE multiple of 17x, which reflects near-term contract renewal risk (and at a discount to the global averages of Education-based businesses at 23.0x).

Figure 4: NVT Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

Navitas Limited (NVT) provides educational services for students and professionals in Australia, the United Kingdom, Europe, Asia, Canada, the United States, and internationally. The Company operates two main segments in (1) University Partnerships; (2) Careers & Industry which is made up of SAE Colleges and Professional and English Programs (PEP). The University Partnerships segment offers a core pathway program where NVT partners with universities to provide students, a pathway into those universities. Local and international students transition from NVT colleges generally into the second year of the university degree. The division operates in three regions; Australasia, North America and Europe. SAE is a chain of over 50 creative media education providers focused on providing programs in audio, film and television, multimedia, gaming and animation, in 26 countries. PEP is a collection of businesses delivering education and training, both at a vocational and at higher education level as well as language and integration services to new migrants in Australia.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >