nib Holdings (NHF) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 21/08/18 | NHF | A$6.44 | $6.32 | NEUTRAL |

| Date of Report 21/08/18 | ASX NHF |

| Price A$6.44 | Price Target $6.32 |

| Analyst Recommendation NEUTRAL | |

| Sector : Financials | 52-Week Range: A5.13 – 7.2 |

| Industry: Life and Health Insurance | Market Cap: A$2,997.5m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate NHF as a Neutral for the following reasons:

- Softer management FY19 outlook.

- Given Australia’s growing and ageing population, there will be increased demand for health care services. This will add additional pressure on Australia’s public health care system and the Federal budget and an increased dependence on private health care insurers. NHF offers exposure to the business model of providing a funding mechanism for the high-growth health care sector. Healthcare spending is expected to grow at 5-10% per annum, so without significant tax hikes, the government cannot afford for people to shift back to the public healthcare system.

- Given underlying increases in average premium rates of around 5 – 6% p.a., some policyholder growth (especially at the 30-34-year-old segment), and exposure to upstart investments, we estimate that NHF offers close to double-digit underlying growth in the medium term.

- Solid management team, with an impressive 10-year average combined operating ratio of ~90-95% and strong ~25% ROEs.

- Cost-out strategy which improves the company’s expense ratio.

- Incentives and benefits encourage PHI take-up. They include 1. Tax benefits and penalties for Australian residents (via Lifetime Health Cover, Medicare Levy Surcharge and means tested rebate); and 2. Shorter wait times, a choice of specialist doctor/hospital and coverage of ancillary health services support.

- Growth runways through the JV with Tasly Holdings Group, and also international expansion, through product offerings like NISS.

We see the following key risks to our investment thesis:

- Intensifying competition between top 6 players, putting policy growth targets at risk and any Increases in expected marketing spend going forward will no doubt add further strain on earnings growth.

- Policyholders decline declines unexpectedly despite the encouraging incentives and Australian Government struggling with the rapid increase in healthcare spending and health services demand.

- Registered health insurers cannot increase premium rates without approval from the Government/Minister for Health/PHIAC/APRA. This leaves NHF’s ROE and margins exposed to a political process and pressures if the company is deemed too profitable.

- Regulatory changes especially relating to any changes to tax incentives and benefits which encourage take up of PHI.

- Higher than expected lapse rates and claims inflation as a result of poor insurance policy design, aging population, and costs of new medical equipment, procedures and treatments;

- Poor negotiations with healthcare providers such as private hospital operators leading to unfavourable contractual terms;

- Lower than expected investment returns.

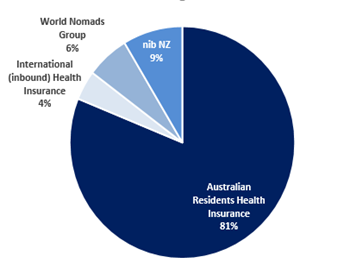

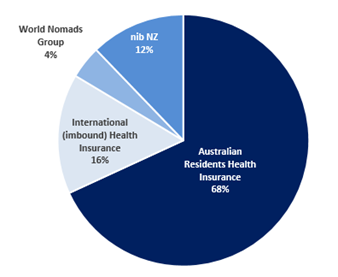

Figure 1: Revenue by segment

Source: Company

Source: Company

ANALYST’S NOTE

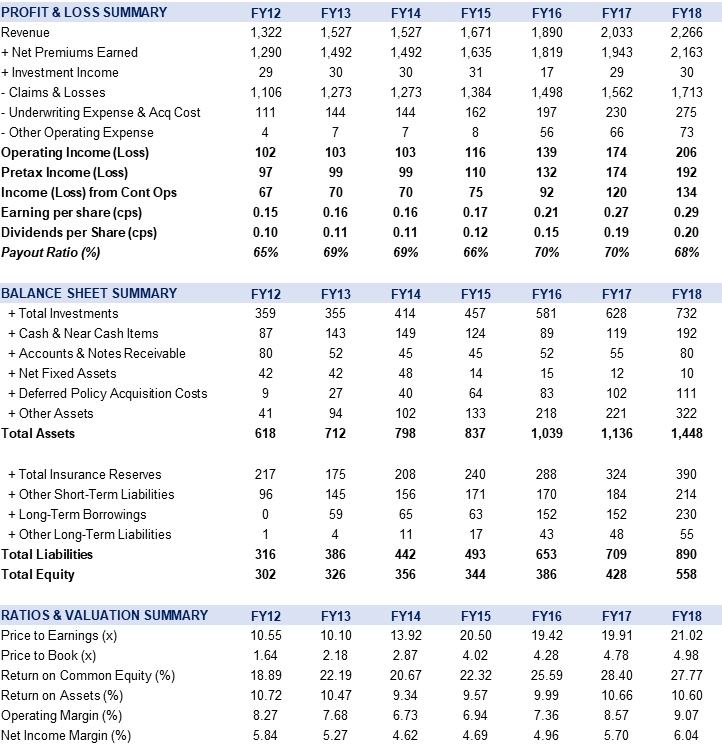

nib Holdings Limited (NHF) announced FY18 results delivering underlying operating profit (UOP) of $184.8m, an increase of +20.2% on the pcp. Net profit after tax (NPAT) grew +11.1% to $133.5m but missed analyst estimate of $135m which saw NHF’s share price slide by -1.8%.

Statutory earnings per share were up by +8.0% to 29.4cps. Management declared a final dividend of 11cps, increasing the full year dividend for FY18 to 20cps (fully franked), representing a gain of +5.3% on payout ratio of 68.5%.

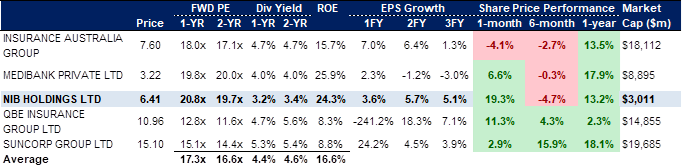

We see nib as having attractive growth avenues through their current JV with Tasly, which would provide an opportunity to sell health insurance in China, however increasing regulatory scrutiny and difficult market conditions in Australia and NZ are likely to have a negative impact on margins and profits in the short term (whilst the long-term investment thesis remains intact). Trading on PE-multiple of 19.7x and yield of 3.2% – maintain Neutral.

- FY19 Guidance.

1. nib anticipates a group UOP of ~$180m and statutory operating profit of ~$159m for FY19.

2. Market conditions in Australian and New Zealand market are expected to be difficult and continue to be affected by macroeconomic factors including affordability and negligible growth in discretionary spending.

3. Arhi segment is expected to deliver organic growth of +3%-4% but management anticipates net margin contraction from 6.9% in FY18 to 5%-6% in FY19. Management expects Federal Opposition’s premium cap proposal to put additional pressure on arhi’s net margins from FY21.

4. nib expects to start selling health insurance in China in collaboration with its JV partner Tasly in 2H19 (subject to regulatory approval).

5. Management noted, “nib is confident that it can navigate its way to meet any additional requirements for regulatory capital while acknowledging the uncertainty around the question.”

6. Management expects dividend payout ratio of 60-70% of NPAT for FY19. - Australian Residents Health Insurance (arhi)-double digit earnings growth. Arhi business delivered strong growth with premium revenue up +12.1% to $1.9bn (of which +6.5% growth was attributable to GU Health acquisition) and UOP up +22.1% to $130.7m driven by strong organic growth and acquisition of GU Health. Net margin grew by 50bps to 6.9%, driven by lower than expected claims growth (reduction in medical prosthetics claims).

- International students and workers. nib’s international students and workers business revenue increased +24.7% to $93.3m and UOP increased +16.5% to $29.6m while margins fell by 230bps to 31.7% due to intense price competition and integration of GU Health. NHF now covers ~160k international students and workers, and they aim to leverage existing capabilities by launching nib International Student Services (NISS), a service provider for international students beyond Australia which would be ready to make sales in FY19.

- World Nomads Group (WNG). Performed strong, delivering sales growth of +7.3%, with international sales up +16.5%. Gross written premium rose +7.7% to $142m, with UOP up +8.0% to $8.1m driven by international policy sales growth in U.S.

- New Zealand. nib New Zealand delivered a solid result despite the loss of a large corporate group client in 2H17, with the loss reflecting in premium revenue offset by policyholder growth in other channels and premium adjustments. While the business grew net policies by 2.8%, UOP was down slightly by 0.4% to $23.4m, negatively impacted by NZD/AUD exchange rates (on NZD basis the business grew premium revenue by +1.9% and UOP by +3.8%).

- QBE Travel insurance acquisition. Management announced acquisition of QBE Travel on 3 August 2018 for a total consideration of $25m (excluding integration costs of ~$11m) to be funded by existing available capital. Management noted that the acquisition would increase gross written premiums of World Nomads Group by +40% and would consolidate the business’ domestic market position.

NHF FY18 RESULTS SUMMARY…

Figure 3: NHF Financial Summary – by segments

Source: Company, BTIG, Bloomberg

Figure 4: FY19 Guidance Breakdown

Source: Company, BTIG, Bloomberg

Figure 5: Australian Insurance Comparable

Source: Company, BTIG, Bloomberg

Figure 6: NHF Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

nib Holdings Limited (NHF) is the Australian private health insurer. NHF operates in four divisions which are private health insurance, life insurance, travel insurance and related health care activities.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >