Origin Energy (ORG) – BUY

ORG’s share price took a hit post FY18 results release, with management expecting FY19 Energy Markets EBITDA of $1.5bn – 1.6bn, indicating a 12-17% decline year-on-year and well below consensus estimates.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 20/08/18 | ORG | A$8.89 | A$9.90 | BUY |

| Date of Report 20/08/18 | ASX ORG |

| Price A$8.89 | Price Target A$9.90 |

| Analyst Recommendation BUY | |

| Sector : Energy | 52-Week Range: A$6.96 – 10.27 |

| Industry: Oil, Gas & Consumable Fuels

| Market Cap: A$15,245.6m |

Source: Bloomberg

INVESTMENT STATEMENT

We rate ORG as a Buy for the following reasons:

- Higher oil prices benefit ORG’s APLNG project (higher revenues).

- Balance sheet position is being restored with management focused on getting the debt covenants back to an investment grade level.

- Achieving milestones within the APLNG project.

- On-going focus on operating cost and capital expenditure reduction.

- Reinstating dividends (however, unlikely until FY19).

- Rationalisation of asset portfolio, including asset sales and the IPO of its conventional upstream business should help improve the balance sheet position.

We see the following key risks to our investment thesis:

- Exploration and production risks.

- Lower energy prices, particularly oil price (for its APLNG project).

- Structural change in energy markets & increased competition.

- Not meeting cost-out targets.

- Highly geared balance sheet, with the company not be being to reduce debt fast enough.

ANALYST’S NOTE

ORG’s share price took a hit post FY18 results release, with management expecting FY19 Energy Markets EBITDA of $1.5bn – 1.6bn, indicating a 12-17% decline year-on-year and well below consensus estimates.

APLNG continues to perform in line with expectations and the long-term outlook for that business remains positive. Further, management noted that subject to market conditions, the Board will look to introduce dividends in FY19 (in line with our expectations).

We maintain our Buy recommendation given the improving debt position of the Company, improving cash flows (with APLNG providing significant delta) and reinstatement of dividends in FY19.

Whilst we concede Energy Markets business is facing challenges, we believe within the FY19 guidance, the Company has largely re-based earnings expectations. In due course, we believe investors will refocus on the significant cash flow opportunity from APLNG and returning dividends profile.

- Key FY18 results highlights.

1. From continuing operations, group revenue was up +7%, underlying EBITDA up +35.6% to A$2.95bn, and underlying profit up +109.5% to $838m.

2. Energy Markets saw underlying operating earnings (EBITDA) increase +21% on pcp driven by increased output and higher wholesale prices, and +13% increase in natural gas sales.

3. Integrated Gas underlying EBITDA jumped +67%, driven by record production at Australia Pacific LNG, up +11% on pcp and a recovery in commodity prices.

4.Cash flow (net cash flow from operating and investing activities) was up +$1.27bn (or +92%) to $2.65bn. driven by earnings, asset sales and higher cash flow from Australian Pacific LNG.

5. Net debt on an adjusted basis reduced by $1.6bn to $6.5bn, with gearing reduced to 35% from 42% (in FY17). - FY19 guidance disappoints. Management expects FY19 Energy Markets EBITDA of $1.5bn – 1.6bn, indicating a 12-17% decline year-on-year, driven by:

1. predominantly a $160m charge due to change in accounting treatment of certain electricity hedge premiums; and

2. $80m impact of absorbing an expected 3% electricity price increase in NSW. The guidance is well below consensus estimates and therefore the negative share price reaction. - Dividends to return in FY19. As per our expectation, the Board did not declare a dividend in FY18. However, the Company noted that “subject to Board approval and no material adverse change in business conditions, our medium term outlook supports recommencement of dividends in FY19”. We note our estimates were already assuming a payout ratio of 40% in FY19 and 50% in FY20 (and beyond).

- APLNG guidance. Management reiterated their target to reduce sustaining capex and operating expenditure. FY18 distribution breakeven guidance was lowered to US$39-44/boe (from US$45/boe). APLNG is targeting operating breakeven of US$22-26/boe.

ORG FY18 RESULTS SUMMARY…

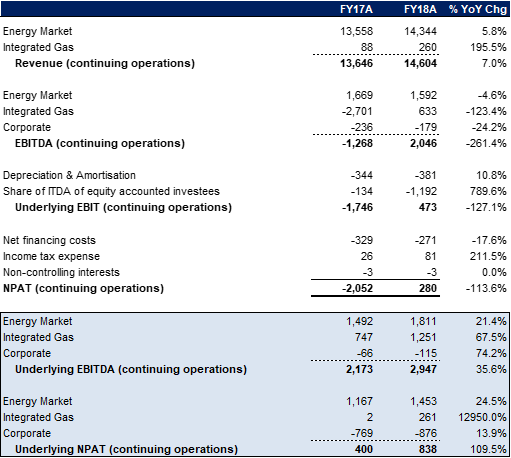

Figure 1: FY18 key headline numbers

Source: Company

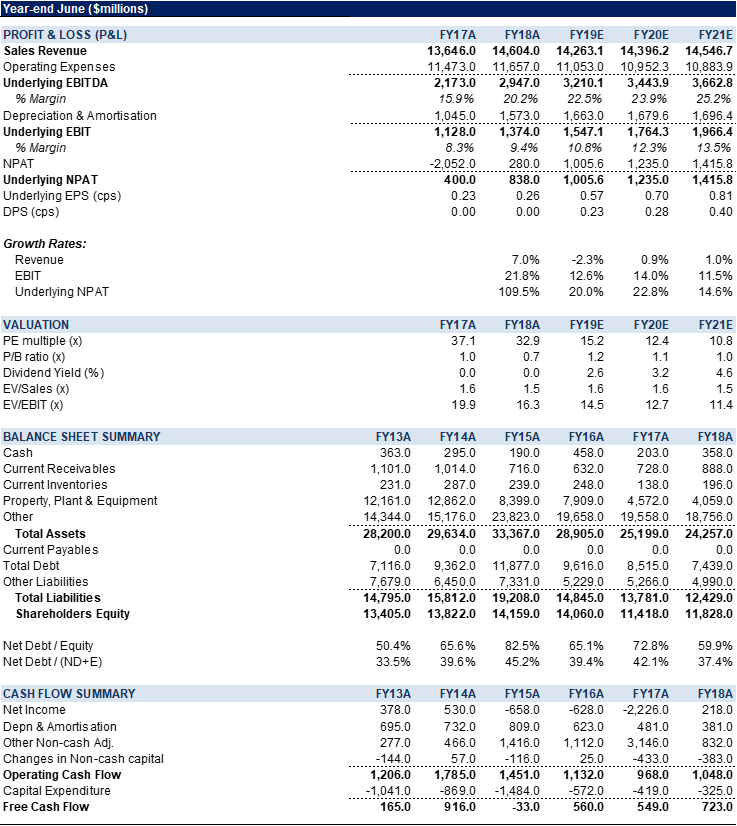

Figure 2: ORG Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Origin Energy (ORG) is an integrated energy company with operations in exploration, production, generation and the sale of energy to millions of households and businesses across Australia. The Company has extensive operations across Australia and New Zealand, and pursuing opportunities in the fast-growing energy markets of Asia and South America. The Company has two main segments:

1. Energy Markets – retail sales of electricity, gas and other customer solutions; electricity generation; and wholesale trading of electricity and gas.

2. Integrated Gas – consists of upstream exploration, development and production; the segment also holds the 37.5% ownership in Asia Pacific LNG project.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >