Praemium Ltd (PPS) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 15/08/18 | PPS | A$0.92 | A$1.00 | NEUTRAL |

| Date of Report 15/08/18 | ASX PPS |

| Price A$0.92 | Price Target A$1.00 |

| Analyst Recommendation NEUTRAL | |

| Sector: Information Technology | 52-Week Range: A$0.39 – 1.07 |

| Industry: Internet Software & Service | Market Cap: A$366.4m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate PPS as a Neutral for the following reasons:

- Increasing diversification via geography and product offering.

- Very attractive Australian industry dynamics – Australian superannuation assets expected to grow at 8.1% p.a. to A$9.5 trillion by 2035.

- Disruptive technology and hold leading position to grow funds under advice via SMAs.

- The fallout from the Royal Commission into Australian banking has lead to increased inquiries for PPS’ products/services.

- Growing and maturing SMSF market = more SMSFs demand for tailored and specific solutions.

- Bolt-on acquisitions to supplement organic growth – the Company has not explicitly highlighted any but noted they remain on the lookout.

- Takeover target – we believe PPS represents an attractive takeover target for a larger, less technologically advance player or international financial services company looking for exposure to the Australian market.

We see the following key risks to our investment thesis:

- Execution risk – delivering on PPS’s strategy or acquisition.

- Contract or key client loss.

- Competitive platforms/offering (new technology).

- Associated risks in relation to system, technology and software.

- Operational risks related to service levels and the potential for breaches.

- Regulatory changes within the wealth management industry.

- Increased competition from major banks and financial institutions.

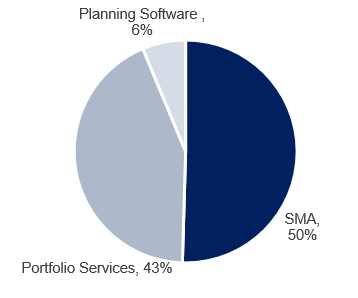

Figure 1: PPS revenue by segment

Source: Company, FY17 results

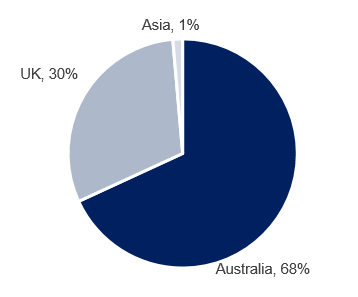

Figure 2:PPS revenue by geography

Source: Company, FY17 results

ANALYST’S NOTE

PPS reported a strong FY18 result which again highlighted the ongoing momentum in the business which is benefiting from the strong growth in SMAs.

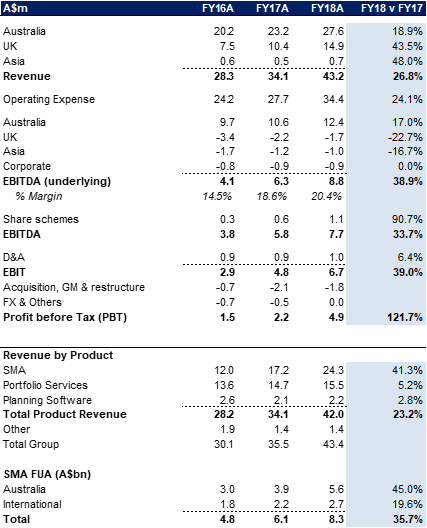

Relative to previous corresponding period (pcp), group revenue was up +27%, underlying operating EBITDA was up +40% and underlying operating EBIT was up +44%, highlighting the significant operating leverage and scalability in the business.

This performance was driven by +41% growth in SMA revenue and SMA FUA increased by +36% to a record $8.3bn. Whilst rest of the world (UK and Asia) is still a drag on earnings, the losses are moderating and should turn to positive contributors in the near-term. We downgrade our recommendation to Neutral.

Since our last note on the stock on 14 Feb-18, the share price is up +36% versus ASX200 +8%. We have revised our DCF estimates and forecast revenue CAGR of +16% and earnings CAGR of +32% over the next 5 years.

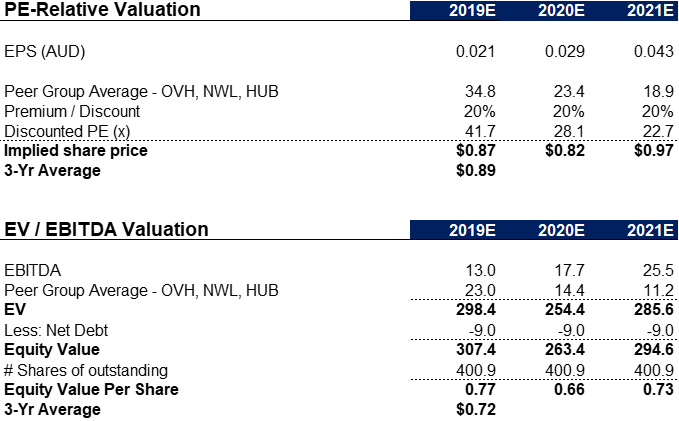

Our revised DCF valuation and price target is $1.00. Trading on a PE-multiple of 44x for FY19E and 31x for FY20E, on our numbers, we believe the near-term growth trajectory is adequately priced in.

- FY18 numbers compared to prior year.

1. Solid top line growth of +27% driven by SMA (up +41%) with positive contributions from Portfolio Services (up +5%) and Planning software (up +3%).

2. In terms of revenue by geography, Australia (up +19%) and the UK (up +44%) were the main drivers. Asia, whilst had strong growth, is still immaterial at the group level.

3. Underlying group EBITDA was up +39% to $8.8m, driven by moderating losses in the UK and Asia, whilst Australia saw EBITDA grow by +17% (with margin down slightly to 45%).

4. FUA growth over the year was again solid, with Australia platform up +45% to $5.6bn and International platform & Smartfunds up +20% to $2.7bn. Total FUA grew +36% to $8.3bn.

5. Operating cash flows was strong in line with higher operating earnings (EBITDA).

6. Balance sheet in a solid position with $12.1m in cash. - Investment is a positive. Management continues to invest in the business to drive top line growth, with the Company increasing its expenditure on sales & marketing and information technology as a percentage of revenue. Further the Company also accelerated its R&D investment in proprietary technology, with $2.1m to expand PPS platform. This expense will be capitalized. In our view, expanding its cost base is not a negative if it supports group FUA growth and revenue base. The Company can still afford to forgo margin at this stage, in order to increase its share of the pie.

- Competition will pick up. PPS’ growth trajectory is not without risk, as we do expect competitors to also increase investment into their respective platforms and compete on pricing. This is likely to bring into question the long-term growth trajectory in margins.

- SMAs growth a structural story, in our view. Through its platform, PPS offers separately managed accounts (SMAs). We see this as a major positive for PPS for two reasons:

1. investors can easily buy international investments (something that is not readily available to investors through some other platforms from our understanding) and more importantly

2. we believe investors will increasingly gravitate towards SMAs given the flexibility it offers versus clients’ money being locked with one asset managers and/or investor style.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

FY18 Results Summary…

Key headline numbers for the full year versus pcp are presented in the table below.

Figure 3: Key FY18 results

Source: Company, BTIG

PPS Valuation…

We have used a DCF methodology to arrive at our valuation and price target.

DCF Val $1.00 per share. We forecast cash flows out to 5-years and then apply a terminal value. The DCF method allows us to apply our assumptions around top line growth and margin assumptions. From our forecast period, we estimate revenue to grow at a CAGR of 16.3% versus market growth (SMAs) of +35% p.a. Further, we forecast earnings to grow by +32.2% over the same period (reflecting a highly scalable platform). Other key DCF assumptions: risk-free rate of 4.0%, ERP of 5.5%, beta of 1.2 and long-term growth rate of 3.0%. We also assume zero leverage in the capital structure. Using these assumptions, we arrive at a DCF valuation and price target of A$1.00.

Whilst we have not used PE and EV/EBITDA methodologies to arrive at our price target, for the sake of completeness we have provided these valuations below. For our PE-multiple and EV/EVBITDA multiple we have used peer group average using consensus numbers. It is worth highlighting if we were to use an equal weighted average of the three valuation methodologies, we would arrive at a valuation of A$0.94 per share.

Figure 4: PPS relative valuations – EV/EBITDA and PE

Source: BTIG estimates, Bloomberg

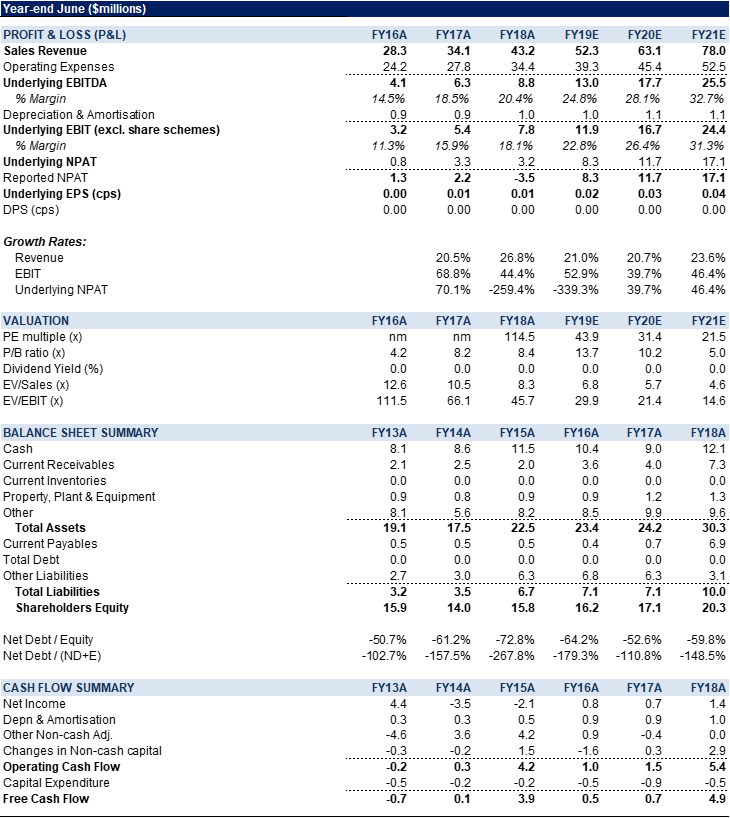

Figure 5: PPS Financial Summary

Source: BTIG estimates, Company, Bloomberg

COMPANY DESCRIPTION

Praemium Limited (PPS) is an Australian fintech company which provides portfolio administration, investment platforms and financial planning tools to the wealth management industry. The Company has offices around the globe (including Australia, London, Hong Kong, Shenzhen and Dubai) and supports over 700 clients, which range from small corporations to large institutional clients.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >