QBE Insurance Group (QBE) – BUY

QBE Insurance (QBE) reported improved 1H18 results where management amended its FY18 combined operating ratio guidance slightly to 95.0% – 97.0%, albeit tightened its investment returns expectations to 2.25% – 2.75% (to exclude LatAm operations).

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 17/08/18 | QBE | A$11.07 | A$11.90 | BUY |

| Date of Report 17/08/18 | ASX QBE |

| Price A$11.07 | Price Target A$11.90 |

| Analyst Recommendation BUY | |

| Sector : Financials | 52-Week Range: A$9.28 – 11.99 |

| Industry: Insurance | Market Cap: A$14,875.7m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate QBE as a Buy for the following reasons:

- As a global insurer, QBE’s operations are much more diversified than domestic peers which means insurance risk is more spread out.

- Solid global reinsurance program should insulate earnings from catastrophe claims.

- Earnings upside from any hike in interest rates (which benefit QBE’s investment portfolio).

- Committed to the share buyback program announced last August, of $1bn over 3 years should be supportive of share price.

- Renewed emphasis on core operations, and the divestment of the volatile LatAm operations for a premium, render QBE well placed.

We see the following key risks to our investment thesis:

- Prolonged period of pricing pressures.

- Adverse CAT claims.

- Ongoing prolonged period low interest rates and volatility in credit spreads which affects QBE’s predominately defensive portfolio.

- As a global insurer, QBE’s operations are much more diversified than domestic peers which means insurance risk is more spread out. However, at the same time, as it underwrites across the globe, the business it is more difficult to forecast and analyse claims and pricing environment as well as reinsurance.

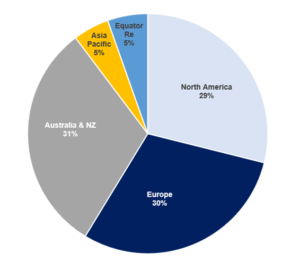

Figure 1: QBE Revenue by Segment

Source: Company

ANALYST’S NOTE

QBE Insurance (QBE) reported improved 1H18 results where management amended its FY18 combined operating ratio guidance slightly to 95.0% – 97.0%, albeit tightened its investment returns expectations to 2.25% – 2.75% (to exclude LatAm operations).

Other key highlights to the results include:

1. ROE of 8.2% (versus 6.6% in 1H17);

2. Cash profit after tax up 3% to $385m (from $372m in HY17);

3. Management noted adjusted net profit after tax down 18% to $380M3 (from $464m in HY17) due to “a reduced level of positive prior accident year claims development and lower investment returns”.

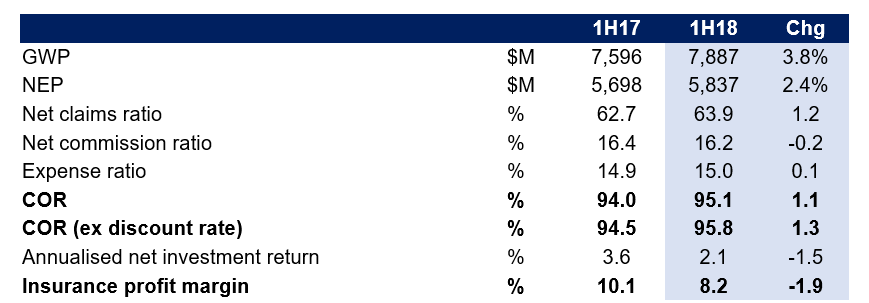

4. Average Group-wide premium rate increased 4.6% (HY17 1.0%) (from continuing operations and excluding CTP), however overall gross written premium was only up 1% to $7,887m (versus $7,590m in HY17). Pricing conditions “improved across all divisions, most notably in European, North American and Asia Pacific Operations. Premium rate momentum accelerated in Australia & New Zealand Operations from an already strong level”.

5. Adjusted combined operating ratio of 95.8% was slightly higher than 94.5% seen in HY17.

6. Annualised net investment return of 2.1% was much weaker than the 3.6% return in HY17.

7. Debt to equity ratio reduced to 36.9% (FY17 40.8%); Indicative APRA PCA multiple strengthened to 1.74x (FY17 1.64x).

Management continue to execute “Brilliant basics”, with the sale of their LatAm divisions, Thailand division, AU/NZ travel insurance business and commenced exiting North American Personal lines operations. QBE trades on below our valuation and undemanding multiples of 12.7x one year forward PE and 5.3% dividend yield.

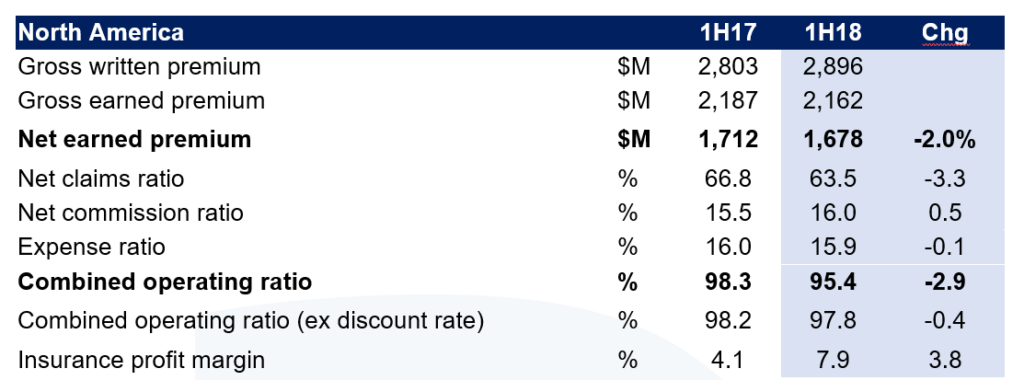

- North America (~29% of net earned premiums, NEP) – recovery after poor 2017. Following the extreme catastrophe experience in 1H17 (primarily in North America and resulting in a FY17 net cost of US$1.23bn), the division achieved an increase of +3.1% on average premium rates during the half (compared with only +0.9% over the pcp) and an improvement in COR at 97.8% (from 98.2% in the prior period).

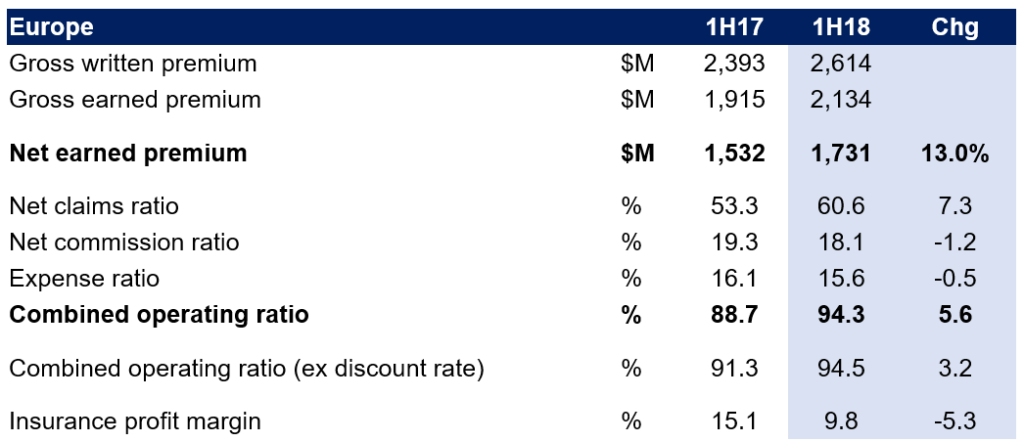

- Europe (~30% of NEP) – continues to perform well. European Operations continued to deliver strong results, with a COR of 94.5% (despite being up from 91.3% in the prior period. Although strong competition persists (evidenced by lower business volumes) and softer pricing cycles affect revenue, average premium rate increases of +4.8% have more than offset negative impacts.

- Australia & NZ (AU & NZ) (~31% of NEP) – remains the highlight. AU & NZ COR remained broadly flat at 92.3%, attributable to a 1.4% improvement in attrition claims ratio. Premium rates averaged also rose +6.6% (+5.0% in the prior period). On the analyst call, management pointed to “the increases were particularly strong in commercial property, up 18%, commercial motor, plus 8%, workers’ comp plus 9%”.

- Investment returns. 1H18 investment returns of 2.1% (annualized) was below expectations due to the adverse impact of rising yields and a modest widening of credit spreads. In our view, with an expected rising rate environment, particularly in U.S. dollars, this will support a higher investment yield going forward for QBE. The running yield on QBE’s fixed income book is now at 2.1% versus 1.7% in Dec 2017 and duration at 1.6 years. Management has flagged that they will lengthen “asset duration in selected currencies as interest rates revert to more normal levels. This is particularly the case in U.S. dollars”.

- Capital management; dividend stable, share buyback program on track.

1. QBE has maintained solid balance sheet from improvement in north America, progress in the Asia pacific remediation, European operations’ current accident year profitability and improvement in AUS/NZ results. After the write-downs, QBE holds a 1.74x PCA multiple after the receipt of LatAm sale funds (this is approximately at the midpoint of the 1.6x to 1.8x target range).

2. QBE declared an interim dividend of 22cps, in line with 2017 interim dividend, both franked at 30%

3. During 1H18, QBE purchased A$100m. Management remained committed to the share buyback program announced last August, of $1bn over 3 years. On the analyst call, they noted that the “intention this year will be to do $330m”. ~$239m has been completed thus far.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

QBE 1H18 RESULTS SUMMARY…

Key profit and loss numbers are presented in the table below.

Figure 2: QBE 1H18 Financial Summary

- North America (~29% of net earned premiums, NEP) – recovery after poor 2017. Following the extreme catastrophe experience in 1H17 (primarily in North America and resulting in a FY17 net cost of US$1.23bn), the division achieved an increase of +3.1% on average premium rates during the half (compared with only +0.9% over the pcp) and an improvement in COR at 97.8% (from 98.2% in the prior period). According to management on the analyst call, “accident and health was particularly strong at around 10% rate growth. Our homebuilders has booked about 8% and property rates generally were more supported in the cat affected areas”.

- Europe (~30% of NEP) – continues to perform well. European Operations continued to deliver strong results, with a COR of 94.5% (despite being up from 91.3% in the prior period. Although strong competition persists (evidenced by lower business volumes) and softer pricing cycles affect revenue, average premium rate increases of +4.8% have more than offset negative impacts. Europe “saw overall rate increases of plus 5%. Again cat-impacted classes have seen positive rate, international properties at plus 12%, QBE Re property plus 7%, but also elsewhere, U.K. Motor plus 10%, international liability plus 5% were also encouraging”.

- Australia & NZ (AU & NZ) (~31% of NEP) – remains the highlight. AU & NZ COR remained broadly flat at 92.3%, attributable to a 1.4% improvement in attrition claims ratio. Premium rates averaged also rose +6.6% (+5.0% in the prior period). On the analyst call, management pointed to “the increases were particularly strong in commercial property, up 18%, commercial motor, plus 8%, workers’ comp plus 9%”.

- Asia Pacific (~5% of NEP) – trading in tough conditions. The segment continued to perform poorly with a COR of 108.5% (albeit better than the 109.1% achieved in the prior year). Premium rates stablised, with an average increase of +0.3%, compared to a -3.9% reduction in the prior period. Management noted “market conditions remain very tough, the early benefits of our remediation program are becoming evident with more selective underwriting, exit from certain unprofitable lines of business, reducing retention as designed but also starting to drive better growth in our rate there”.

Figure 3: QBE 1H18 North America Results

Source: Company

Figure 4: QBE 1H18 Europe Results

Source: Company

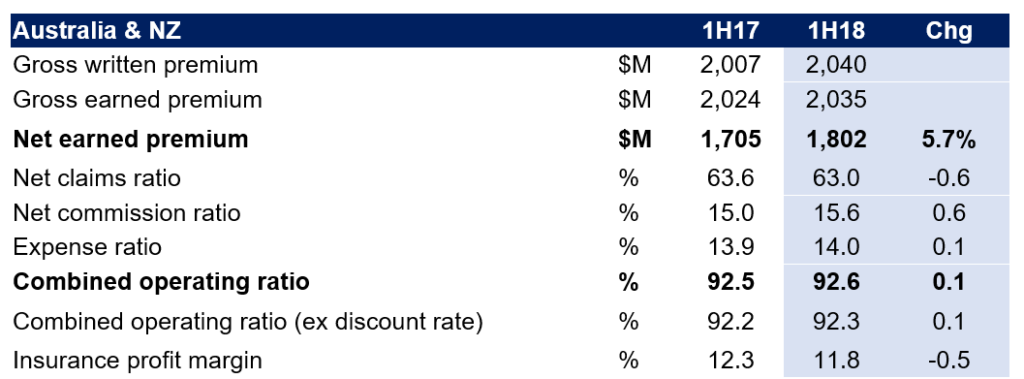

Figure 5: QBE 1H18 Australia & NZ Results

Source: Company

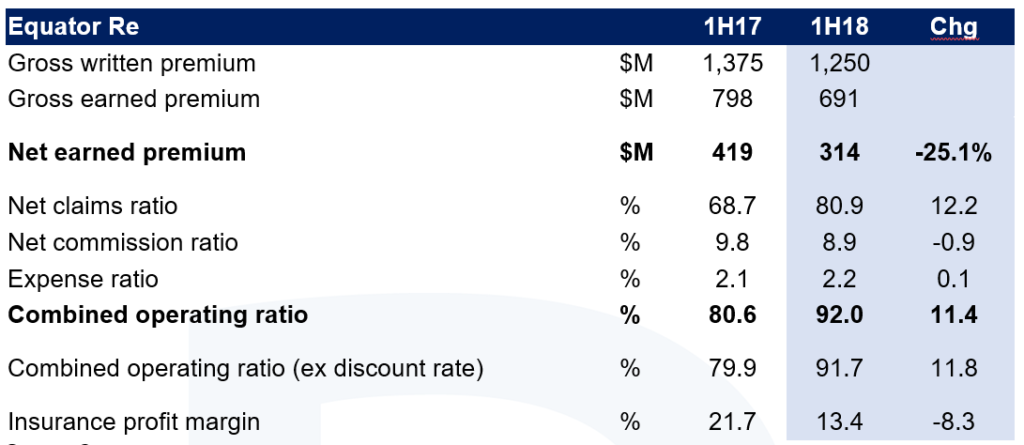

Figure 6: QBE 1H18 Equator Re Results

Source: Company

Figure 7: Insurance Comparable Table

Source: Company

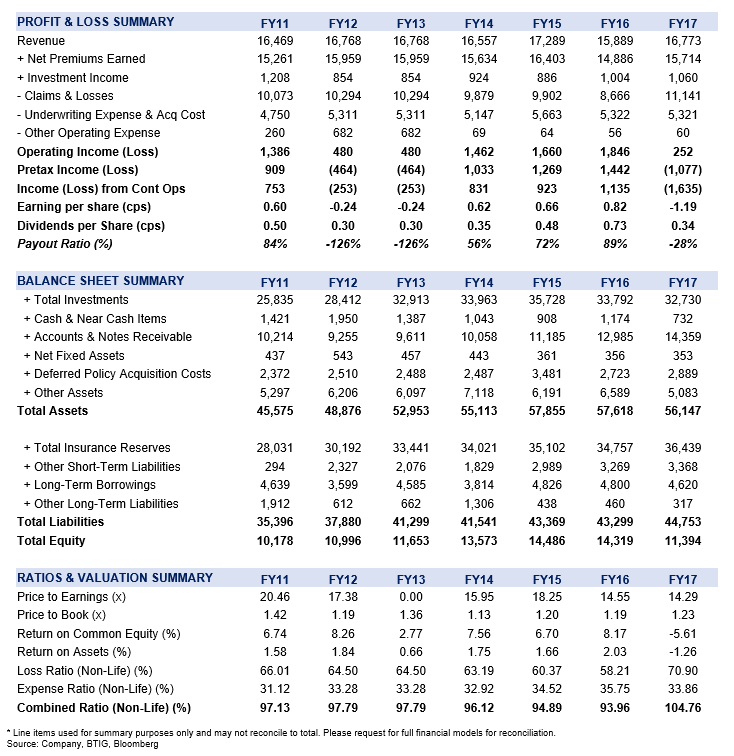

Figure 8: QBE Financial Summary

Source: Company

COMPANY DESCRIPTION

QBE Insurance Group Ltd (QBE) is a global general insurer that underwrites commercial and personal policies across North America, Australia and New Zealand, Europe and emerging markets. QBE’s Equator Re segment is its captive reinsurer, providing reinsurance protection to the entire Group’s operating divisions.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >