SCP Property Group (SCP) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 09/08/18 | SCP | A$2.44 | A$2.30 | NEUTRAL |

| Date of Report 09/08/18 | ASX SCP |

| Price A$2.44 | Price Target A$2.30 |

| Analyst Recommendation NEUTRAL | |

| Sector: Financials | 52-Week Range: A$2.15 – 2.58 |

| Industry: Real Estate | Market Cap: A$1,816.7 |

Source: Bloomberg

INVESTMENT SUMMARY

We rate SCP as a Neutral for the following reasons:

- Sustainable distribution yield.

- Strong and experienced management team.

- Current low interest rate environment fosters growth and demand in retail industry.

- Improving trends in supermarket sales growth, with strong performance from Woolworths

- Robust development outlook and potential upside from development pipeline and new acquisitions.

- SCP’s portfolio occupancy rate is 98.4%; has in excess of 1,300 tenants. 53% of gross rent comes from Woolworths and Wesfarmers, and of the other 47%, there is a heavy weighting towards non-discretionary categories.

We see the following key risks to our investment thesis:

- Likely increases in interest rates or deterioration in credit/capital markets in coming years.

- Digital trend of online shopping reducing demand for retail spaces especially with entrance of Amazon in Australian market.

- Any deterioration in property fundamentals especially delays with developments, declining asset values, retailer bankruptcies and rising vacancies.

- Lower sales growth for WES/Coles and WOW because of Costco and Aldi taking market share.

ANALYST’S NOTE

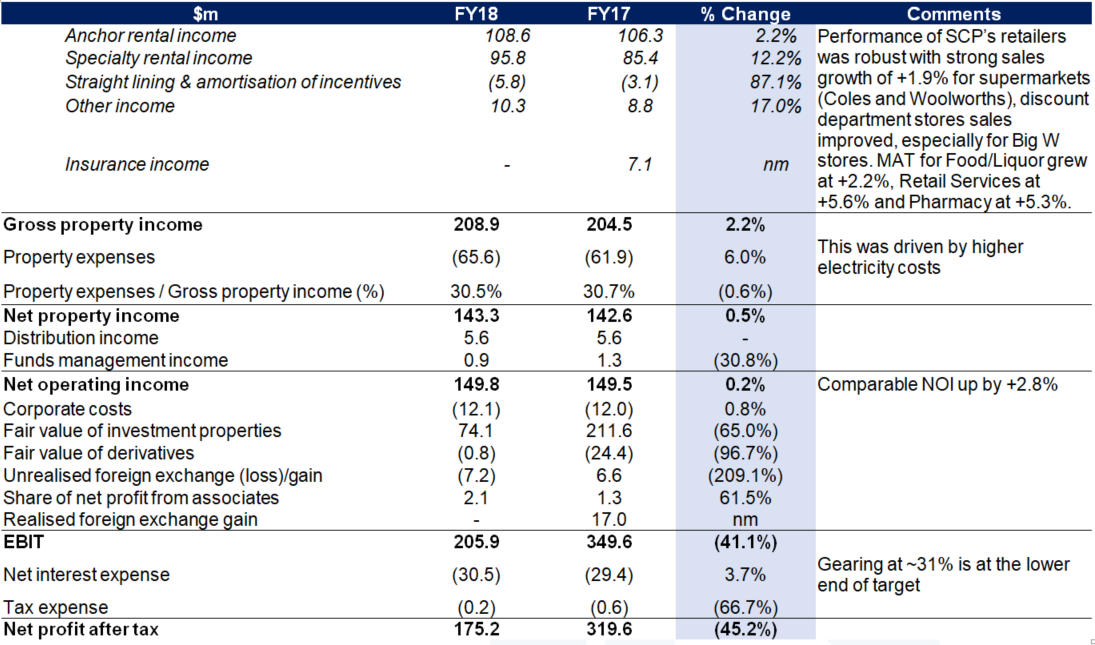

SCA Property Group’s FY18 results were solid with Funds From Operations (FFO) of $114.3 m, up by +5.4% on the prior year and distribution of $0.139, up +6.1% on the same period last year (equates to a payout ratio of 91%). Net tangible assets (NTA) of $2.30 per unit, is up +4.5% from $2.20 last year (largely due to asset revaluations). This means that SCP’s share price is trading at a ~10.1% premium to its NTA.

We still view the share price in a trading range bound. Whilst the current low interest environment should encourage retail sales (especially specialty sales) as well as the recent pick-up in supermarket sales growth, at current valuations, a discount would be required given that:

1. An overleverage domestic consumer base with minimal to no wage growth;

2. Potential rate hikes to come affect bond-proxy stocks and their yield and debt books;

3. Greater online shopping trend with entrance of Amazon to Australian market; and

4. New entrants in supermarket industry such as Aldi and Costco which may ultimately take away market share from Woolworths and Coles and hence adversely impact rental growth.

- Solid guidance going forward. On the conference call with management, the company highlighted

1. For FY18, “comparable NOI growth of 2.8% [despite] increased electricity costs…[and] We continue to expect solid comparable earnings growth as we progress through our first specialty rent renewal cycle through to FY20”.

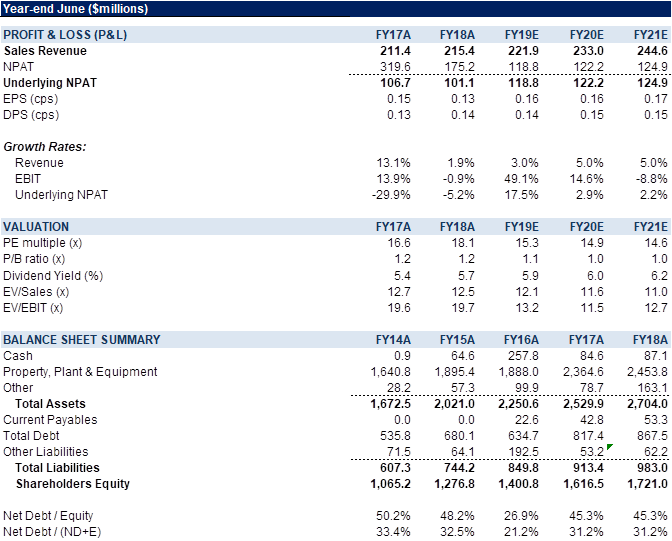

2. Guided “for FY19 FFO is 15.6 cpu (2.0% above FY18 actual), and our guidance for FY19 Distributions is 14.3 cpu (2.9% above FY18 actual). The FFO guidance includes the acquisition of Sturt Mall in August 2018 and the launch of SURF 4 in late FY19 but does not include any further acquisitions or divestments”.

- Gearing stable. SCP’s weighted average cost of debt remains stable at 3.8% per annum. SCP’s gearing of 31.2% remains within the Company’s target gearing range of 30% to 40%, and management’s preference for gearing to remain below 35% at this point in the cycle.

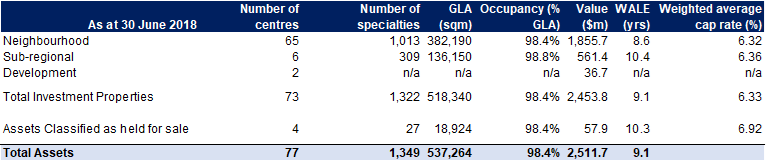

- Property portfolio performance across FY18.

1. The portfolio has a weighted average cap rate of 6.33%.

2. Occupancy rate is 98.4% and has remained relatively stable since December 2014 at between 98.4% and 98.8%. Specialty vacancy rate of 4.8% of GLA was in line with management’s target range of 3% to 5% and our expectations.

3. In our view, SCP’s portfolio has relatively young centres with lower specialty rent per square metre than more mature centres (owned by other listed REITs) and SCP’s average specialty occupancy cost at 9.8% appears sustainable (relative to other REITs at ~15-20%).

4. Developments which were completed include Kwinana WA (Coles third anchor) and Mount Gambier SA (Bunnings replacing Masters). Development at Bushland Beach QLD (new Coles anchored neighbourhood centre) completed in July 2018 and Shell Cove NSW (new Woolworths anchored neighbourhood centre) expected to complete in 1H FY19.

- SCP’s retailers are performing well. Considering much talk of Amazon’s forays into Australia (and online taking share off bricks and mortar retailers) and Australian consumers with leverage problems, the surprise in the result would be the performance of SCP’s retailers with robust sales growth of +1.9% for supermarkets (Coles and Woolworths), discount department stores sales have improved, especially for Big W stores. MAT for Food/Liquor grew at +2.2%, Retail Services at +5.6% and Pharmacy at +5.3%.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

Figure 1: SCP’s Property Portfolio Summary

Source: Bloomberg

FY18 Results Summary

Figure 2: SCP FY18 Results summary – Profit and Loss

Source: Bloomberg

Valuation

We arrive at our $2.30 valuation based on a blend of asset-based valuation and DCF methodology. Our asset-based valuation arrives at a $2.39 per share (using a conservative average cap rate of 8.0%). Our DCF valuation arrives at a $2.16 per share valuation (using a conservative WACC of 8.2% and long-term growth rate of 2.5%).

Figure 3: SCP Financial Summary

Source: Bloomberg

COMPANY DESCRIPTION

SCA Property Group (SCP) owns a diversified shopping centres portfolio located throughout Australia. The portfolio consists of 77 centres independently valued at $2,511.7 million. SCA Property Group predominantly focuses on convenience retailing through its ownership and management of a quality portfolio of neighborhood and sub-regional shopping centres and freestanding retail assets. ~53% of gross rents are derived from Woolworths (~39%) and Wesfarmers (~14%).

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >