Senetas (SEN) – Half Year 2019 Result

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 13/03/19 | SEN | $0.069 | N/A | N/A |

| Date of Report 13/03/19 | ASX SEN |

| Price $0.069 | Price Target N/A |

| Analyst Recommendation N/A | |

| Sector: Technology | 52-Week Range: $0.068 – $0.125 |

| Industry: Technology Services | Market Cap: $74.5 million |

Source: Bloomberg

SENIOR ANALYST

David Spry

03 9607 1371

March 2019

INVESTMENT PROPOSITION

Senetas is well positioned to participate in the growth of the global hardware encryption market. The US, Asia, European and Middle-East markets represent significant growth opportunities for Senetas with governments, defence departments and commercial organisations becoming increasingly aware of the risks of cyber-attacks and the integrity of data in motion.

The distribution agreement with its partner Gemalto secures access to its global sales, partnering and support locations, enabling Senetas to penetrate new major markets and gain from cross-selling opportunities. With a growing presence in international markets, superior technology, positive industry fundamentals, a robust balance sheet and with a number of new products coming to market, Senetas remains a long-term growth story.

EVENT

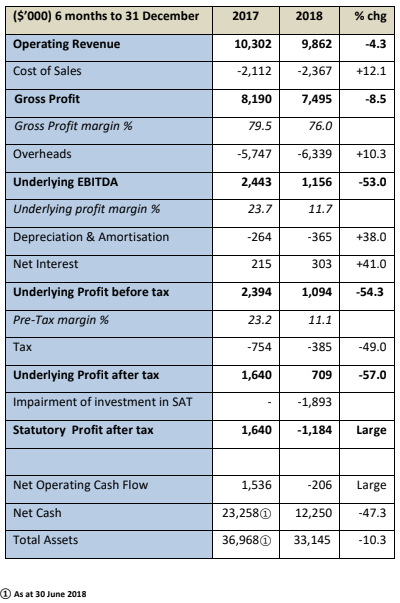

Senetas released its first half 2019 result to the market on 27 February 2019 (refer below). The result was in line with company guidance of Pre-AASB15 $1.68m before tax (excluding the SAT impairment of $1.89m and the share of Votiro’s loss of $0.324m).

In accordance with the new accounting standard AASB15, Senetas is required to estimate and recognise the revenue expected to be earned from customer contracts, rather than waiting for the actual end sale before recognising the revenue. The net accounting impact on first half 2019, was to reduce revenue and net profit before tax by $0.26m compared to what would have been recognised under the previous standard.

ANALYSIS AND COMMENT

The lower operating profit outcome in first half 2019 was driven by lower than expected revenue and higher costs. Revenue was impacted by the loss of a major customer with maintenance revenue slightly lower (36% of total revenue) as a key customer continues to transition from SONET products to Senetas’ lower cost Ethernet products. Revenue received from Senetas’s global distributor Gemalto NV was in line with the prior period with revenue from the ANZ region slightly lower. The growth in 100Gbps sales for first half 2019 ($1.6m compared to $0.6m for FY2018) were offset by lower sales of 10Gbps encryptors. Sales trends of the 100Gbps encryptor are encouraging with sales to four new customers highlighting the ability of Senetas to attract new customers. We expect continued growth of 100Gbps encryptor sales during second half 2019 and beyond as customers continue to transition to higher speed networks.

Higher costs reflected the re-measurement of contingent consideration relating to the earn out provisions of the agreement to acquire SureDrop in FY2017, the equity accounted loss related to Votiro of $0.324m, and the higher cost of the 100Gbps products with regard to components which impacted on the gross margin (76% compared to 79% in first half 2018). Over time, we would expect the cost of components to decline as volumes build.

The significant decline in net operating cash flow to -$0.206m ($1.5m) reflected lower receipts from customers resulting from lower sales, higher R&D costs and increased inventory levels. Income tax was also paid in first half 2019 reflecting changes to the timing of tax instalment payments. Despite the lower operating cash flow, Senetas remains in a strong financial position with net cash of $12.3m (FY2018 net cash $23.3m). The lower cash position is due to the initial investment of $6.4m in Votiro and the $4m dividend payment to shareholders during half year 2019. Working capital remained in line with the prior period. Senetas expects the cash balance to increase to between $16.5m and $17.0m at 31 March 2019, placing Senetas in a strong position to undertake further acquisitions and/or capital management initiatives.

R&D spend for FY2019 is expected to be up to $1m higher than FY2018 and will continue to be the core of value creation for Senetas. The substantial investment undertaken by Senetas over the past few years is reaping rewards with new products and technologies being introduced to the market. Senetas has now become a multi-product company with hardware and virtual (software based) encryption capability across layers 2,3 and 4 networks with additional capabilities to conform with public cloud environments. This enables customers to use Senetas’s devices interoperably between the networks which opens up new distribution channels and substantially increases the addressable market for its existing hardware range. Senetas is progressing European certification for its core hardware products which will broaden market opportunities.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

FINANCIAL SUMMARY

KEY POINTS

- Operating revenue declined 4.3% to $9.8m (post AASB15) with product revenue and maintenance revenue both marginally lower.

- Pre-AASB15 operating profit before tax of $1.68m (excluding SAT impairment and Votiro loss) at upper end of company guidance.

- Gross profit margin declined to 76% (79% previous period) largely reflecting higher input costs for the 100Gbps product.

- Cash on hand remains strong at $12.2 million with no debt providing flexibility for strategic investments and capital management.

- Earnings forecasts reduced for FY2019 and FY2020 due to weaker than expected first half 2019 result.

- Traditional and new hardware encryption products, virtual technologies, SureDrop and cybersecurity awareness across public and private sectors to drive growth over next few years.

INVESTMENTS UPDATE

Votiro recorded a loss of $0.32m for first half 2019 which was in line with expectations at the time the investment was undertaken. This acquisition has given Senetas increasing exposure to the fast growing area of CDR technology which is increasingly being recognised as critical for cybersecurity protection with its technology being recognised by Gartner. Content based attacks are on the rise and represent a significant risk where content is exchanged from outside to inside an organisation. The number of users attacked with malicious office documents has risen more than 4x compared with the first quarter 2017. With the assistance of Senetas’s global distribution capabilities, Votiro is expected to grow strongly over the next twelve months as distribution expands beyond its traditional Asian markets.

SureDrop has undergone successful testing during first half 2019 with positive feedback. A distribution agreement has been signed with Gemalto and early signs are encouraging. The SureDrop technology was acquired by Senetas in FY2017 on an earn out basis with no upfront payment. With sales expected to occur shortly, Senetas has recognised a contingent charge in its accounts.

Smart Antenna Technologies has been placed in administration as previously advised by Senetas due to lack of funding following a disagreement with SAT management over future strategy. With uncertainty over the future carrying value of the investment, the value of the investment has been written down to zero. There is no impact on cash.

OUTLOOK

We remain positive on Senetas with the significant pipeline of new products being released to the market and with the increased cybersecurity awareness across governments and the private sector. The continued growth in data flows across Layer 2 networks and the requirement for software based encryption solutions for Layer 3 and 4 networks provide substantial growth opportunities for Senetas’s products. Larger scale virtual encryption with Layer 3 compatibility and new opportunities in Europe with further certification should also drive growth.

Until the new virtual encryption SureDrop and transport layer independent hardware products start to build sales momentum in late 2019, revenue will continue to be driven by the traditional hardware encryption products. While we expect sales of the 100Gbps will continue to grow, profitability in FY2019 will be impacted by higher input costs and increased investment in R&D. A larger portion of overall revenue in the future will be derived from software based solutions which are delivered as a service (SaaS). This will increase annuity style income which should be far more predictable.

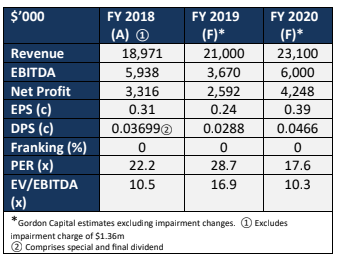

We have reduced our forecasts for FY2019 and FY2020, but are still expecting solid revenue growth of at least 10% per annum over the next few years. For FY2019, we are forecasting a 22% decrease in operating profit after tax to $2.592m (excluding the impact of the impairment charges in FY2018 and FY2019) on revenue growth of 10.6%. For FY2020, we expect operating profit after tax to increase 64% to $4.248m on revenue growth of 10% as margins improve.

With the stock selling on an EBITDA multiple for FY2020 of 10.3x based on our forecasts, we believe the current valuation does not fully reflect the potential of Senetas’ new products, many of which, will open up significant new growth markets.

BUSINESS OVERVIEW

The core business of Senetas is the design and manufacture (under contract) of high performance encryption hardware. The product range known as CypherNet is capable of encrypting nearly any LAN/WAN infrastructure with no loss of performance. Senetas’s layer 2 technology encrypts voice, video, or data streams at a wire speed up to 100Gbps, significantly reducing the complexity and importantly the cost in meeting data protection and privacy requirements. They are purpose built to satisfy security requirements from small branch locations to high speed corporate and data centre environments.

Senetas CN is a complete family of high-performance purpose built encryptors for ETHERNET, SONET, FIBRE CHANNEL, LINK and ATM networks. Products include: CN4000 series 10Mbps to 1Gbps encryptor – compact and versatile ideal for SME’s; CN6000 series 1Gbps to 10Gbps encryptor rack mounted and carrier grade true end to end network encryption; and the CN8000 10 by 10Gbps multi-link/multi-port which are efficient hub and spoke encryptors.

Product enhancements and new developments have included: the CN4010 low cost encryptor, the CN6010 cost reduced 1Gb rackmount encryptor and more recently the CN9000 ultra-high speed high assurance encryptor designed to secure data at 100Gbps. The CN9000 supports complex, ultra-fast network topologies; enabling 100% security for Cloud Computing, Big Data and data centre services. Senetas has FIPS approval allowing sales of its new 100Gbps encryptor to US government agencies and other organisations that provide services to the government.

Senetas has also developed a customised algorithm product for customers and virtualised encryption products (CV1000 released June 2018) which have opened up Layers 3, 4 and more Layer 2 markets. The CV series virtualised encryptor enables rapid scalability, flexibility and cost-effective data protection to the virtual edge. The successful development of this product reinforces Senetas’s capability to deliver cost effective encryption solutions with global applications. It has opened up significant new market opportunities for Senetas as data networks continue to grow in size enabling new business efficiencies. With the continued increase in cyber threats and stronger data protection laws, the case for strong encryption solutions is growing. The CV1000 enables customers to encrypt their large sale and extended virtualised network links that otherwise may not be protected. The market potential for these products is significant. Senetas is continuing to explore opportunities to work with technology partners to address the potential opportunities in large scale networks in order to further expand its customer reach, having recently entered into a technology partnership and distribution agreement with ADVA.

Senetas has the most certifications and is the only global player in Layer 2 high assurance encryption: Common Criteria EAL4+, FIPS 140-2 Level 3, Communications-Electronics Security Group (CAPS) for its Ethernet IG product in the UK and NATO (North Atlantic Treaty Organisation) information security product certification covering NATO member states. This gives Senetas a distinct advantage over its major competitors ATmedia, Certes Networks and InfoGuard, when selling to the government sector and major commercial organisations as it provides assurance that its products conform to the highest quality and technical standards. Senetas is currently progressing additional certifications in Europe and in Eastern Europe for its custom algorithm encryptor.

Senetas operates a ‘go to market’ model whereby Gemalto is currently its distributor in global markets (excl. Australia and NZ) under its SafeNet Identity and Data Protection Solutions brand. Gemalto has substantial global market reach with a sales force located across 45 countries servicing their global customer base. Senetas shares in revenue from product sales as well as maintenance sales and also provides customer support services.

For Senetas’ virtualised encryption technologies, ADVA also represents a route to market through its technology partnership and distribution agreement. This enables Senetas to embed its high-speed networking encryption technology into ADVA’s industry-leading virtualisation technology, Ensemble Connector. ADVA is a leading provider of network solutions for the delivery of cloud and mobile services. By combining ADVA’s Ensemble suite with Senetas’ virtual encryption engine will provide a disruptive solution for site-to-site and site-cloud encrypted VPN’s resulting in substantial cost savings to users and a significant new market opportunity for Senetas.

The ADVA agreement complements the distribution agreement with Gemalto with Senetas now having two independent routes to the market for its two different virtualised encryption technologies.

In Australia and NZ, Senetas sells and distributes its products through a number of channel partners including UXC Ltd, Nextgen and HP.

BUSINESS DRIVERS AND GROWTH PROFILE

Senetas has a sustainable business model and having the most product certifications with access to a global distribution channel through its partner Gemalto, is well positioned to exploit the large growth opportunities existing in the high speed data encryption market.

In a globally interconnected environment, organisations are experiencing unprecedented growth in valuable digital assets in the form of intellectual property, scientific data, business information and government privacy and secrets. Market Analyst Data Corporation (IDC) is forecasting exponential growth in data volumes and valuable digital assets. The digital universe size is expected to increase by 40% per annum to 2020, which requires high speed data throughput. It is estimated that only around 50% of this growth rate is being protected.

To cater for this growth, enterprises, carriers, and content delivery networks are upgrading their networks to ensure that this information can be shared at very high speed. With data now flowing at up to 100Gbps across hundreds of millions of kilometres of optical fibre cable, there is plenty at stake if data interception occurs.

While vast amounts of money are invested in securing data at rest (intrusion detection systems, email and malware security and firewall protection), organisations often underestimate the magnitude of risk to critical data while it is in transit across private or public networks. Cyber intrusions are clearly the largest threat to these digital assets while they are stored, moved and shared. Cyber criminals are increasingly targeting high volume/high value data and unsecured networks and the breach landscape is continuing to evolve. Approximately 1.4 billion data records were compromised in 2016, 1,792 breach incidents were reported and 59% of the breaches were motivated by theft. In 2016, only 4% of the breaches involved encrypted data with the stolen data rendered useless.

The Australian government has highlighted the risks of not protecting data in recent papers. The new Australia Cyber Security Centre (ACSC) became operational in late 2014 and brings cyber security capabilities from across government into one location. It is a hub where the private and public sector can collaborate and share information to combat serious cyber security threats. The Defence Signals Directorate (DSD) reported a 30% increase in the average number of serious online attacks against the government in 2013 that required a heightened response and the ACSC in its 2015 Threat Report warned that the number of state and cyber criminals with capability will continue to increase. Senior intelligence officials remain concerned about the vulnerabilities across “hardened” areas including the major banks, telecommunications, Governments and infrastructure utilities. Corporations globally are now recognising the need to protect valuable data that is being transported at very high speeds across sophisticated IT networks. New data privacy and protection regulations have been introduced by governments with heavy penalties for breaches.

Data privacy and protection regulations have been introduced by governments with heavy penalties for breaches. Australia’s new federal data breach notification laws came into effect in February 2018 which requires businesses to report cyber incidents to the Australian Information Commissioner and individuals impacted by data breaches which are likely to result in serious harm. With Europe’s new data privacy and security laws now in effect, businesses conducting business in Europe will be subject to significantly tighter data privacy requirements. This includes businesses based in the European Union as well as businesses based elsewhere but dealing with European Union businesses. In the US, all but two states have laws requiring consumer notification of security breaches involving personal information. This will increase the importance of encrypting data and potentially will be positive for Senetas who now have the ability to provide encryption products across various protocols.

The key growth markets for Senetas’ products remain the US, where the encryption hardware market is forecast to reach US$65b by 2020 and in the UK where the Government has estimated the cost of cyber-crime to be at least £27b per year across corporations, government and private individuals. Other potential growth markets include Asia, Eastern Europe and the Middle-East.

The majority of global networks are still Layer 3 IP/TCP routed networks (80%). With the substantial growth in network traffic (volume and reach), the high-bandwidth applications such as data-centre connectivity, disaster recovery/business continuity measures and data storage replication, organisations and network providers are increasingly embracing the benefits of layer 2 Ethernet services. Layer 2 encryption is designed to be transparent to end users with little or no impact on network performance and the cost per gigabyte is the lowest.

With the growth in data volumes, driving greater adoption of Layer 2 networks and the increased awareness of the need to protect valuable data travelling around networks at very high speeds, Senetas being the market leader in Layer 2 encryption technology and with its proven range of certified encryption protection solutions for governments, defence departments and the commercial market is a major beneficiary of this trend.

Senetas is actively pursuing new technology partnerships with vendors specialising in Layer 2 networking and CCTV Technologies. In January 2015, Senetas completed a technology partner agreement with Avaya a major international data network provider. Avaya’s standards based SPB fabric Connect solution is based on Layer 2 Ethernet technology as a foundation for building virtualised data networks for the Datacentres, Campus LANs, MANs and WANs. This provides Gemalto/Senetas access to Avaya’s network technology and its customer base.

Senetas’s highly innovative and responsive R&D program remains the key focus and will be the major growth driver in the future. During FY2017, there were a number of milestones reached with the commercialisation of development of the 100Gbps encryptor, the customised algorithm products and the virtual encryption product.

Senetas’s ultra-high speed 100Gbps ethernet encryptors having received FIPS certification with Common Criteria pending and successfully completing trials is now available for sale. This product was developed to satisfy the requirement of large customers who are upgrading their networks from 10Gbps to 100Gbps. This represents a natural progression for many organisations that move a lot of sensitive information at fast speeds. Early sales have been encouraging and while it is difficult to accurately estimate the full potential of this product, the market for 100Gbps is growing strongly and is expected to account for at least 50% of data centre activity in 2019. Senetas is well positioned to capitalise on this significant growth opportunity.

Senetas has developed its ‘custom algorithm’ encryptors for new and growing markets particularly in Eastern Europe, which allows customers to select their own algorithm giving them security control as a result. Sales will commence when the certification process is complete (expected FY2019). This represents a new and large market for Senetas and there are no competing products that match its product capabilities.

Senetas’s virtual encryption product was released ahead of schedule and represents the first virtualised encryptor to provide strong encryption for large scale multi-layer (layers 2, 3, and 4) networks carrying sensitive data across thousands of end-points. This has opened up large scale market opportunities for Senetas well beyond its current core customers and provides for significant revenue growth opportunities over the next few years and beyond. Also, being a subscription based model will help to offset the lumpiness of product sales aiding predictability and cash flow.

Senetas’ technical skills enable it to re-engineer encryptors using its core technology – hardware and virtual to suit the requirements of the customer. This was behind the recent successful technology and distribution agreement with ADVA, the leading provider of open networking solutions for the delivery of cloud and mobile services. With Senetas’s high speed networking encryption technology being embedded into ADVA’s virtualisation technology, significant new market opportunities across service provider customers and enterprise-focussed resellers as well as the large public cloud providers have been created by the provision of a solution for site-to-site and site-cloud encrypted VPN’s. While it is too early to predict the potential financial impact on Senetas, revenue is expected to commence in FY2019 and should continue to accelerate as product volumes build.

Senetas is investing in non-core technologies which are aligned with its competencies; leveraging encryption, security and networking skills. The capital cost of these investments is modest and they expand Senetas’s product suite in global markets potentially accelerating growth and adding value for shareholders over the longer-term. Current investments include:

- Acquired SureDrop on an earn out basis with no upfront capital outlay. SureDrop provides a Drop Box file sharing capability incorporating the best security based on the same technologies used in Senetas’ multi-certified high-speed encryptors. The target markets of SureDrop are large commercial enterprises and governments. It is in the early stages of release to the market but there has already been significant interest in the product with trials being undertaken by customers in conjunction with a large Australian telecommunications company. Sales are expected to build in FY2019. The revenue model is based on user subscription and will add a source of recurring revenue.

- Senetas has made an US$8M investment in a leading international provider of content disarm and reconstruction (CDR) technology, Votiro Cybersec Global Ltd. The investment is by way of 3 tranches of convertible notes which will provide Senetas with a majority shareholding on conversion. The initial investment of US$4 million was made on 14 November 2018, with the balance expected to be paid by 30 June 2019 from existing cash reserves.The investment in Votiro represents an exciting opportunity for Senetas with substantial upside as new markets are penetrated and scale builds from a relatively low base. Votiro was established in 2010, by Israeli cybersecurity experts Aviv Grafi and Itay Glick who designed and developed the File Disarmer, a patented solution that automatically scans and sanitizes every file sent or shared in an organisation and reconstructs a fully functional file free of any threats in less than a second. Votiro currently has around 400 customers and 1.5m end users largely based in the Asia Pacific region across financial services, critical infrastructure and government departments. The company has strong patent protection for its technology with limited competition and has received leading industry recognition, various Government certifications and industry awards recognising its world leading intellectual property.

CDR is increasingly being recognised as critical for cybersecurity protection with its technology being recognised by Gartner. Content based attacks are on the rise and represent a significant risk where content is exchanged from outside to inside an organisation. The number of users attacked with malicious office documents has risen more than 4x compared with Q1 2017. The most advanced security systems are unable to protect organisations from sophisticated, customised malware attacks against unknown vulnerabilities coming in via infected files. The majority of incoming files are not processed through an effective sanitisation system and can easily bypass the organisation’s cybersecurity defence layers.

By scanning and deconstructing, validating file attributes against specifications and blocking threats before they become widespread within an organisations systems cybersecurity threats are effectively eliminated. Votiro provides an advanced API that organisations can integrate into content and various applications providing protection against content-based threats from all communication channels (mail, Disarmer API, content collaboration platforms, removable devices, file transfers and the web). This technology can also prevent a ransomware attack, rather than trying to fix the content once the damage is done. There are few products on the market able to do this in sharing platforms like Box and Dropbox. This provides for significant synergies with SureDrop with an opportunity to integrate with CDR technology to enhance capabilities taking Votiro from a defensive product to a broader business tool.

With global regulatory changes being introduced and the increasing frequency and sophistication of cyber- attacks, there is a need for new technology to combat the useability/security constraints of sandbox software. Votiro can provide protection across multiple end user markets (Web Gateway, Identity and Access management, Content Services, Email Gateway and CASB).

- Invested US$1m in DeepRadiology Inc., a medical learning and artificial intelligence company. It has developed the first autonomous radiology scan interpretation and reporting system and provides the technology base for Senetas and DeepRadiology to research and develop machine learning solutions for analysing and protecting data in transit. Senetas has board representation. FDA approval for the technology has not yet been received and the value of this investment has been written down to nil due to uncertainty over the carrying value.

- EON Reality Inc. is a world leader in Augmented and Virtual Reality based knowledge transfer for industry and education based in California. Senetas made a US$2m investment (preferred stock with cumulative dividend) in 2000 which has a carrying value of zero on the balance sheet. EON is planning to list on the NASDAQ having formed an IPO committee, which will create some value for Senetas when listing takes place. The timing of an IPO and potential value of the investment remains unclear. Senetas has board representation.

- A 6% equity interest in Smart Antenna Technologies (SAT) an international smart antenna technology company based in the UK. Senetas has board representation. The carrying value of this investment has been written down from $1.89m to zero due to uncertainty over the value with the company having been placed in receivership following funding issues and differences over the strategic direction of the company.

GENERAL ADVICE WARNING: The information contained in this Report is only of a general nature and does not constitute personal financial product advice. In preparing the advice no account was taken of the objectives, financial situation or needs of any particular person. Therefore, before acting on the advice readers should consider the appropriateness of the advice with regard to their particular objectives, financial situation and needs. Readers should obtain and consider any relevant Product Disclosure Statements before making any decisions about the subject matter of this Report and should seek independent professional advice.

DISCLOSURE: This publication has been prepared by Gordon Capital Pty Ltd, as Authorised Representative of InterPrac Financial Planning Pty Ltd, Australian Financial Services Licence No. 246638. The registered office of InterPrac Financial Planning Pty Ltd is Level 8, 525 Flinders St, Melbourne, VIC 3000.

Please note that Gordon Capital has been retained by SENETAS CORPORATION LIMITED to provide this report for a fixed fee. Gordon Capital does not provide specific investment recommendations and does not receive any additional benefit for the provision of this report. Gordon Capital aims to provide a balanced and objective analysis in this report.

DAVID SPRY the analyst responsible for this report does not receive any indirect benefits or assistance from SENETAS CORPORATION LIMITED. Our remuneration is not linked to the views expressed in this report. At the time of writing the report we do not hold shares in SENETAS CORPORATION LIMITED.

Please see our Analyst Qualifications and Financial Services Guide, available at www.gordoncapital.com.au or by calling 03 9607 1371 for further information.

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected]. This document is provided by Gordon Capital Pty Ltd (Gordon Capital) and InterPrac Financial Planning Pty Ltd (InterPrac). The material in this document may contain general advice or recommendations which, while believed to be accurate at the time of publication, are not appropriate for all persons or accounts.

Read our full disclaimer here >

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >