Sonic Healthcare (SHL) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 20/08/18 | SHL | A$25.29 | A$25.74 | NEUTRAL |

| Date of Report 20/08/18 | ASX SHL |

| Price A$25.29 | Price Target A$25.74 |

| Analyst Recommendation NEUTRAL | |

| Sector : Healthcare | 52-Week Range: A$20.61 – 27.00 |

| Industry: Healthcare Services | Market Cap: A$10,879.1m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate SHL as a Neutral for the following reasons:

- Ageing population requiring more diagnostic tests, especially as Medicine focuses on preventative medicine.

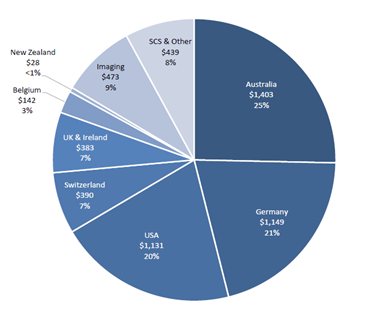

- Market leading positions in pathology (number one in Australia, Germany, Switzerland, and UK number three in the US). Second leading player in Imaging in Australia.

- High barriers to entry in establishing global channels.

- Ongoing bolt-on acquisitions to supplement organic growth and potentially improve margin from cost synergies.

- Leveraged to a falling dollar.

- Globally diversified.

We see the following key risks to our investment thesis:

- Disruptive technology leading to reduced diagnostics costs.

- Competitive threats leading market share loss.

- Deregulation resulting in new pathology collection centres.

- Adverse regulatory changes (fee cuts).

- Disappointing growth.

- Adverse currency movements (AUD, EUR, USD).

Figure 1: SHL Revenue by Segment

Source: Company

ANALYST’S NOTE

Sonic Healthcare (SHL) FY18 results were largely in line with management guidance, with earnings (EBITDA) up +6.4% on a constant currency basis over the previous corresponding period (pcp), albeit at the lower end of the 6-8% guided.

Net profit was up +11.2% on statutory basis and up +6.5% on underlying basis. FY19 EBITDA growth guidance however missed analyst estimates, impacted by known fee reductions in Germany and the U.S. which saw the stock fall by -2.7%.

FY18 results were affected by one-off factors including fewer workings days in several regions, U.S and Germany fee cuts and a US tax benefit of $20m. SHL’s management noted the negative effect of fee cuts to be around 2% of EBITDA growth and if these effects are excluded, EBITDA growth was ~7.5% which in our view, is solid operational performance given industry-wide cost pressures.

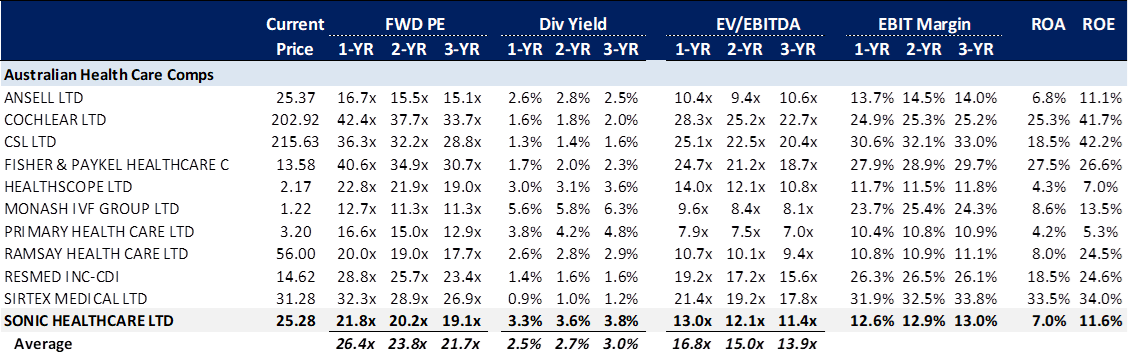

SHL’s Laboratory segment performed well showing a margin accretion of 30-40bps, driven by organic revenue growth of 6%. Management noted that SHL’s growth momentum is well established and set to continue in FY19, expecting +3-5% EBITDA growth (constant currency basis). SHL is trading on a ~19.9x PE multiple and yield of 3.3%, which is fair value in our view.

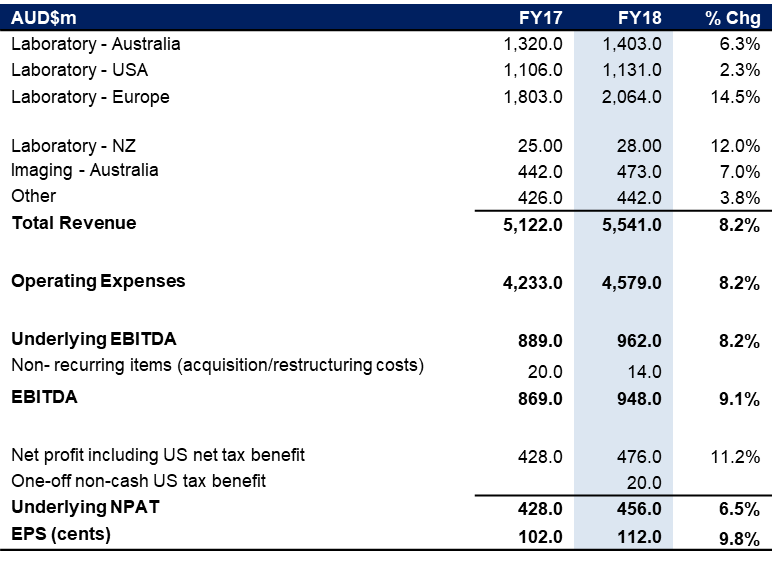

- FY18 key results. FY18 results were in line with management guidance and management noted that SHL’s performance in FY18 was strong both financially and operationally. Key figures from the results were:

1. Underlying EBITDA on actual currency basis was up +8.3% to $962m over the pcp (+6.4% growth on constant currency basis).

2. Revenue grew by +8.2% to $5.5bn driven by Laboratory (Europe) which was up +14.5%.

3. Net profit was $476m (up +11.2%) and Earnings per share (EPS) grew +9.9% to $1.12 per share.

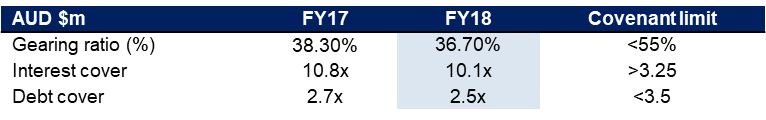

4. The board declared a final dividend of 49cps (up +6.5% pcp), bringing the total FY18 dividend to 81cps, growth of +5.2% pcp. Management suspended the DRP for the FY18 final as the debt cover ratio is now in line with the preferred long term average ratio and SHL has headroom of ~$650m to fund its future expansions and acquisitions.

- FY19 guidance. Management provided solid FY19 guidance, in our view, with key figures being:

1. Expectations of EBITDA growth +3-5% (constant currency basis) and +5-7% on current exchange rates.

2. Interest expense to grow by ~4% assuming constant currency.

3. Tax rate at ~25%.

4. Incorporates known fee reductions in Germany and USA equivalent to ~2% EBITDA.

5. Management expects continued strong organic growth and continuation of progressive dividend policy. No regulatory changes are expected in FY19 except the ongoing fee changes which have been already factored in the guidance.

6. Management noted that SHL has a rich pipeline of acquisitions, JVs and contract opportunities for FY19.

7.Pathology Trier acquisition in Germany is to be EPS accretive in FY19. - Capital management.

1. Total debt saw an increase of $48m in FY18 to A$2,483m, largely due to exchange rate changes and partially offset by net cash generated.

2. In October, SHL refinance EUR160m of debt with 7 and 15-year tenors at 2% fixed rates, bringing the total weighted pretax average cost of debt to ~2.6%.

3. Net cash available is at ~A$650m, after the FY18 final dividend is paid out.

4. Debt cover ratio decreased from 2.7x to 2.5x in FY18 and is in line with SHL’s preferred long term position.

SHL FY18 RESULTS SUMMARY

Figure 2: SHL revenue results summary

Source: BTIG, Bloomberg

Figure 3: SHL Debt Metrics Summary

Source: BTIG, Bloomberg

Figure 4: Australian Healthcare Comps

Source: BTIG, Bloomberg

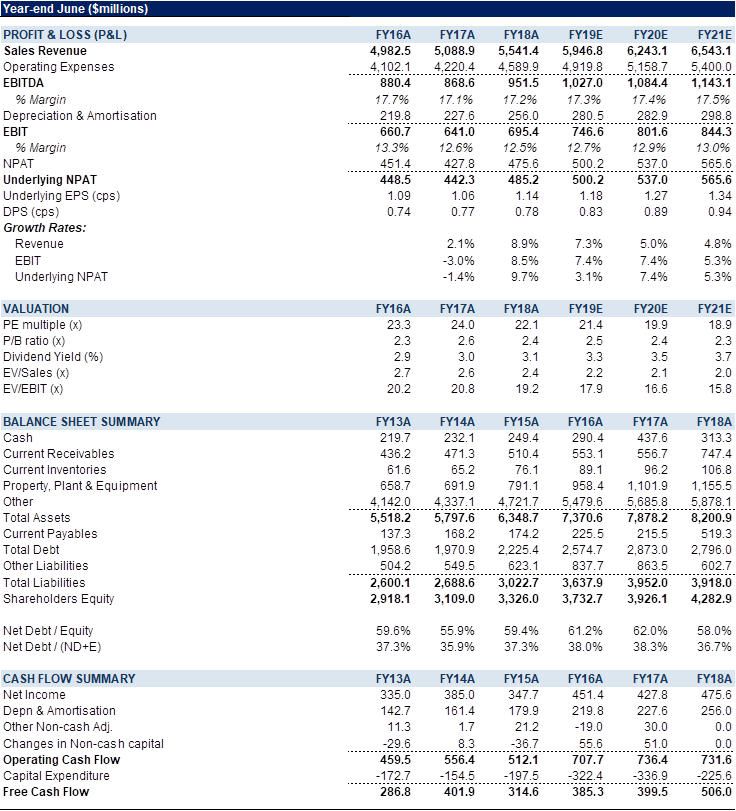

Figure 5: SHL Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Sonic Healthcare (SHL) is a medical diagnostics company with operations in Australia, New Zealand, and Europe. The company provides a comprehensive range of pathology and diagnostic imaging services to medical practitioners, hospitals and their patients along with providing administrative services and facilities to medical practitioners. SHL has three main segments: (1) Pathology/clinical laboratory services based in Australia, NZ, UK, US, Germany, Switzerland, Belgium and Ireland. (2) Diagnostic imaging services in Australia; and (3) Other which includes medical centre operations (IPN), occupational health services (Sonic HealthPlus) and laboratory automation development (GLP Systems).

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >