Suncorp Group Ltd (SUN) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 13/08/18 | SUN | A$15.63 | A$15.50 | NEUTRAL |

| Date of Report 13/08/18 | ASX SUN |

| Price A$15.63 | Price Target A$15.50 |

| Analyst Recommendation NEUTRAL | |

| Sector: Financials | 52-Week Range: A$12.43 – 15.96 |

| Industry: Insurance | Market Cap: A$19,464.6m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate SUN as a Neutral for the following reasons:

- SUN currently trades at a reasonable 15.3x FY19 PE-multiple and 5.2% yield.

- APRA allows advanced accreditation for SUN’s Bank resulting in capital relief.

- Favorable point in premium cycle for its Australian and NZ insurance segment.

- Continual strong credit quality for its Bank and Wealth segment whilst maintaining net interest margins.

- We believe management can maintain an underlying insurance trading ratio of 12% consistently going forward and sustainable ROE of at least 10%.

- Potential sale of Life business.

We see the following key risks to our investment thesis:

- Greater than expected competition in lines of insurance affecting pricing, unit growth, and risk management.

- Missing company guidance on key targets for FY19.

- Weaker than expected investment yields.

- Increased levels of catastrophes which use up SUN’s reinsurance and impacts earnings.

- Lower net interest margins or higher provisions than expected.

- Increased levels of claims.

ANALYST’S NOTE

SUN’s FY18 cash profit for the full year came in ahead of consensus estimates, with management announcing a special dividend of 8cps along with the final dividend of 40cps.

Key points:

1. cash profit $1.1bn was ahead of estimates of $1.05bn;

2. SUN agreed to sell its life insurance business to Japan’s Dai-Ichi Life Holdings for $725m; and

3. FY18 cash ROE 8.0%, with second half ROE 9.2%

The sale of the life insurance business is in line with other major banks such as CBA and NAB, with declining margins and increasing offshore competition. The sale will provide additioanl $600m in proceeds to deploy towards capital management (independent of the 8cps special dividend paid). SUN maintains a strong capital position with all businesses holding CET1 in excess of targets.

We downgrade to Neutral with the stock re-rating approximately +15% since our last note in March. Whilst the trading environment remains supportive (increasing general insurance rates) and ongoing focus on capital management, we see limited upside from here, all else being equal.

- Key FY18 numbers.

1. Insurance (Australia) NPAT up +2.2% to $739m with gross written premium (GWP) up +0.3% to $8.1bn;

2. Banking & Wealth NPAT declined by -2.8% to $389m, with net interest margin (NIM) improving to 1.84% (from 1.83% in pcp) and cost to income ratio increased to 54.7% (from 52.7% in pcp); and

3. New Zealand saw NPAT jump +64.1% to A$135m.

- Life insurance. SUN has agreed to sell its life insurance business to Japan’s Dai-Ichi Life Holdings for $725m and this removes one overhang from the stock. The purchase price will result in a non-cash write-down of $880m, with proceeds of approximately $600m to be returned to shareholders in FY19. As part of the deal SUN has negotiated a 20 year distribution arrangement. The sale of the life insurance business is in line with other major banks such as CBA and NAB, given declining margins and increasing offshore competition. Management noted they expect the sales to be completed by end of this year.

- BIP. The Business Improvement Program (BIP) exceeded management net benefit target of $30m, delivering $40m in the first year of BIP. Further, management noted that for FY19 $187m of gross benefits on an annualised basis were already locked in, which means the Company is on target to exceed its $274, target for FY19.

- Operating expenses. Operating expenses (excluding FSL) increased by +5% to $2.7bn, driven by regulatory expense and investment in technology.

- Capital management. With a strong balance sheet, management was able to declare a special dividend of 8cps in addition to the $0.73 per share full year dividend. The Company remains committed to returning excess capital to shareholders.

- Outlook – FY19 targets.

1. Expenses base to $2.7bn.

2. Underlying ITR (insurance trading result = underlying insurance margins) expected to return to at least 12%.

3. Bank cost to income (CTI) ratio around 50%.

4. Net interest margin at the low end of 1.80 – 1.90% range.

5. Cash ROE of 10%.

6. Sustainable dividend payout ratio range of 60-80% of cash earnings and returning surplus capital to shareholders.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

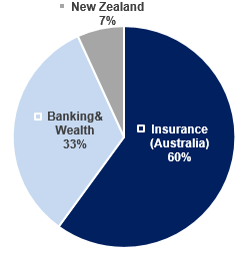

Figure 1: : SUN’s NPAT split by Segment

Source: Company

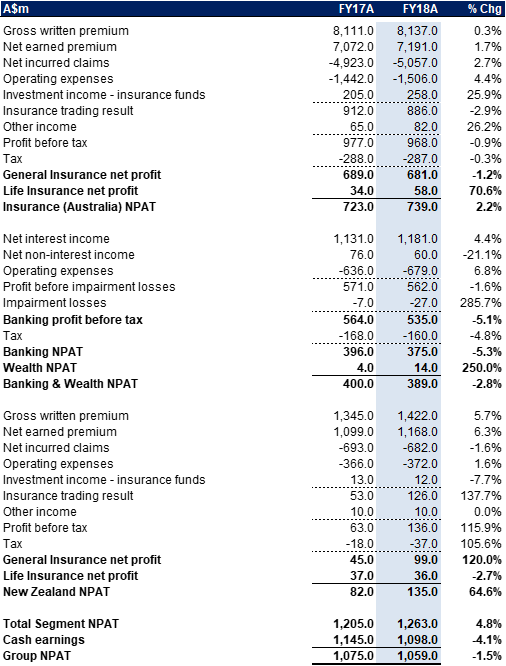

FY18 NPAT Summary…

In the figure below, we present SUN’s FY18 NPAT by key segments.

Figure 2: SUN FY18 NPAT summary

Source: BTIG, Company

Insurance (Australia) (59% of FY18 Segment NPAT). Second half profit increased +79.9% on first half due to lower natural hazard costs and the claims benefits from BIP initiatives. GWP increased +0.3%, however excluding CTP, GWP increased by +4.0% over the year. Home and Motor reported GWP growth of +4.7% driven by average written premium increases of +3.8% and volume growth of +0.9%. While operating expenses rose +4.4% over the year, they improved +5.2% in the second half of the year. Life underlying profit increased +43.4%, driven by higher profit margins and repricing benefits.

Banking & Wealth Management (31%% of FY18 Segment NPAT). Home lending increased by +6.2%, which was 1.2x system. Bank Home Lending growth was +6.2% above last year or 1.2x system for the year. Management noted that strong growth in the first half moderated in the second half as competitive pressures increased (aggressive pricing) and system growth slowed. Business lending was up +7.0% year on year, 1.4x system growth. Impairments over the year were just 5bps, which is well below the long-term operating range of 10-20bps. Net interest margin (NIM) was mostly flat year on year driven by positive shift in the funding mix and portfolio repricing being offset by increased funding costs (elevated BBSW) and increased competitive pressures in the second half.

New Zealand (11% of FY18 Segment NPAT). New Zealand grew GWP by +8.2% over the period, however when adjusted for the sale of Autosure, it grew by +10.2%. The strong performance in the general insurance business year on year (NPAT up +120%) was driven by premium increases, volume growth, claims management and solid expense control. Further, the previous year was impacted by the Kaikoura earthquake.

SUN comps table…

Figure 3: SUN peer group table

Source: Bloomberg

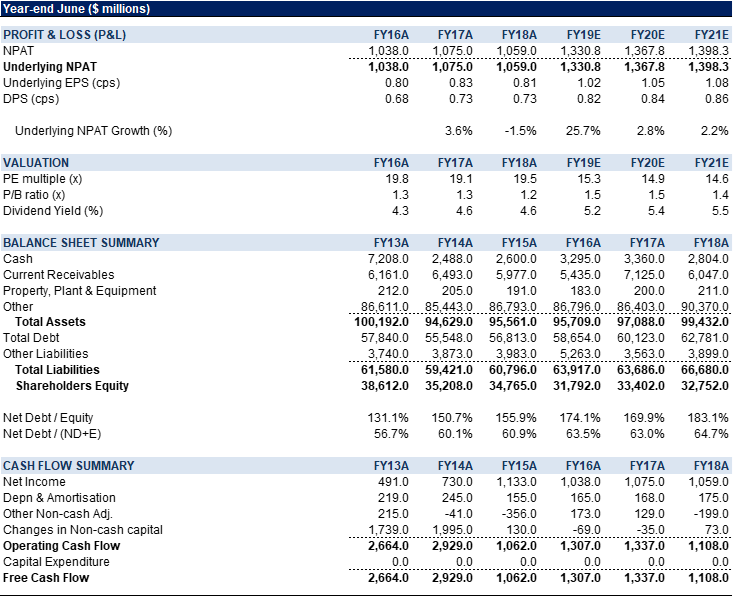

Figure 4: SUN Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Suncorp Group Ltd (SUN) provides general insurance, banking, life insurance, and superannuation products and related services to the retail, corporate, and commercial sectors in Australia and New Zealand. The company operates through Personal Insurance, Commercial Insurance, General Insurance New Zealand, Banking, and Life segments.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >