Sydney Airport (SYD) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 23/08/18 | SYD | A$7.37 | A$7.80 | BUY |

| Date of Report 23/08/18 | ASX SYD |

| Price A$7.37 | Price Target A$7.80 |

| Analyst Recommendation BUY | |

| Sector : Industrial | 52-Week Range: A$6.31 – 7.62 |

| Industry: Transport Support Services | Market Cap: A$16,621.0m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate SYD as a Buy for the following reasons:

- Attractive asset with long-dated lease – Sydney International Airport.

- Strong growth in international tourism and domestic travel

- Solid and growing dividend stream – 5-year CAGR of +10.4%.

- New development projects (expand capacity & improve passenger experience).

- Leveraged to a falling dollar (cheaper to visit Australia).

- Diversification into hotels.

We see the following key risks to our investment thesis:

- Bond rates (seen as a bond proxy and rising bonds yields will have a negative impact on SYD’s valuation)

- Downturn in Australian tourism.

- Global calamity leading to reduced international travel.

- Distribution growth or lack of it disappoints.

- Cost pressures / operational disruptions

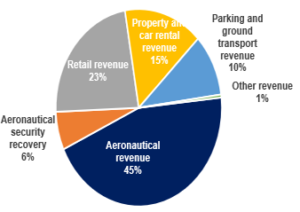

Figure 1: SYD Revenue by Segment

Source: Company

ANALYST’S NOTE

Sydney Airport (SYD) 1H18 results were largely in line with expectations, posting solid headline numbers with growth being realised across all segments.

SYD saw continually strong growth (+3.3%) in passenger levels, with international passengers increasing +5.5%, and consequently experienced top line growth of +8.1% to $623.4m. Other key points compared to the previous corresponding period (pcp) include:

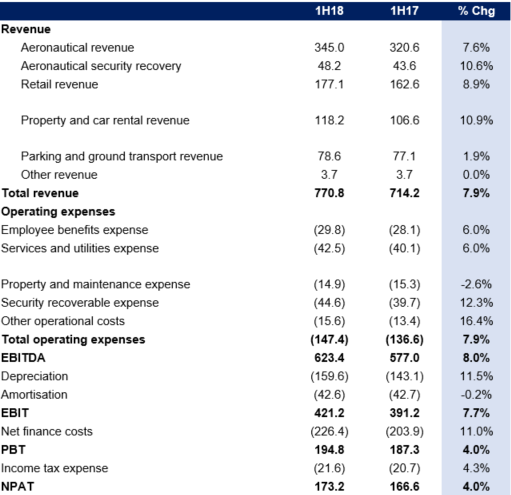

1. Revenue was up +7.9% to $770.8m (from $714.2m), supported by growth across all businesses

2. EBITDA rose +8.1% to $623.4m.

3. FY18 DPS reaffirmed at 37.5 (reflecting an +8.7% increase on 2017).

In terms of guidance figures, FY18 capital expenditure has been reaffirmed at a range between $380 – 420m.

We maintain Buy recommendation as the stock offers an attractive and growing dividend stream and international passenger numbers remain solid.

- Key 1H18 headline numbers. Compared to the previous corresponding period (pcp):

1. Revenue was up +7.9% to $770.8m and EBITDA rose +8.1% to $623.4m.

2. Net Operating Receipts were up +7.5% to $411.3m.

3. FY18 distributions per stapled security reaffirmed at 37.5 (reflecting an +8.7% increase on 2017).

4. Significant balance sheet flexibility with $1.4bn in undrawn facilities as at 30 Jun-18 and cashflow cover ratio increase to 3.1x (from 2.9x at 1H17).

5. Both S&P and Moody’s upgraded the airport’s credit rating to BBB+/Baa1. Net debt to EBITDA ratio reduced to 6.7x from 6.8x at 1H17. - On the segments: Over the pcp –

1. Aeronautical Services (45% group revenue) posted +7.6% in revenue growth, owing to strong international passenger growth and agreements for increased international charge which will be used to support continued “capital investment in aeronautical facilities”.

2. Retail (23% group revenue) also delivered solid results, seeing a +8.7% growth rate “following the completion of lease renewals on superior terms for our travel essentials contract and a number of T3 leases”. Positively, all three terminals are fully leased driven by consistent retailer demand, Duty-free continues to trade well, with 85% of T2 pier B currently under construction already leased, with the first staged opening scheduled for December 2018 Christmas period.

3. Property, hotels and car rental (15% group revenue) led revenue growth, which was up +10.9% following the completion of lease renewals, investment in hotels (continued strong performance from Iris Budget and Mantra) and supported by stable 98.6% occupancy rates. Newer, and upcoming developments will likely see this strong growth continue, with car rentals delivering solid performance from new desks leased to Avis Budget Group and newly signed agreements for the opening of lounge operators in Terminal 1.

4. Parking and ground transport (11% group revenue) grew +2.1%, driven by improved performance in online bookings, solid results in both domestic and international priority pickup products, and the opening of new roads and ground transport infrastructure focused on congestion reduction. - Capital expenditure. 1H18 CapEx totalled $179.6m, and was dedicated to increasing: aeronautical capacity, terminal works, airport access and business expansion. Management has reaffirmed CAPEX guidance of a rage between $1.3 – 1.5bn over the 2018 – 2021 period, with approximately $380-$420m expected to be invested for FY18.

1H18 Results Summary…

Figure 2: Summary of Results and Segments

Source: Company; BTIG

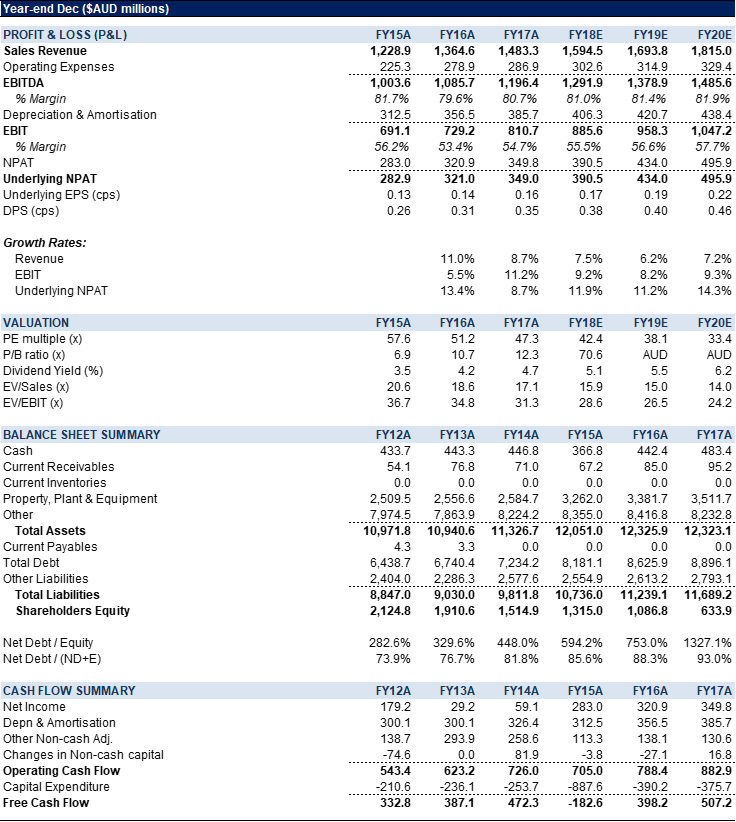

Figure 3: SYD Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Sydney Airport (SYD) operates the Sydney International Airport (Kingsford Smith). The company develops and maintains the airport infrastructure and leases terminal space to airlines and retailers. The ASX listed stock consists of Sydney Airport Limited (SAL) and Sydney Airport Trust (SAT1). Shares and units in the Group are stapled.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >