TabCorp Holdings (TAH) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 09/08/18 | TAH | A$4.75 | A$4.80 | NEUTRAL |

| Date of Report 09/08/18 | ASX TAH |

| Price A$4.75 | Price Target A$4.80 |

| Analyst Recommendation NEUTRAL | |

| Sector : Consumer Discretionary | 52-Week Range: A$3.905 – 5.74 |

| Industry: Casinos & Gaming | Market Cap: A$9,058.4 |

Source: Bloomberg

INVESTMENT SUMMARY

We rate TAH as a Neutral for the following reasons:

- The combination of Tabcorp Holdings and Tatts Group will create a group with market leading positions and attractive assets adding $130m of EBITDA synergies and benefits.

- Intecq business fully integrated and providing strong growth opportunities in Gaming Services.

- Move out of UK business – Sun Bets has ceased trading – removing earnings drag on the group.

- Subdued outlook for wagering business and cost pressures likely to keep a lid on margin expansion in the near term.

- Lotteries delivering earnings double digit earnings growth provide some offset to pressures in wagering.

- Positive regulatory changes – such as the introduction of a point of consumption tax – could drive our smaller uneconomical corporate bookmakers.

- Potential capital management initiatives.

- Value is emerging in the stock after recent de-rating.

We see the following key risks to our investment thesis:

- Competitive pressures within the core Wagering business.

- Loss of market share.

- Lack of product development.

- Cost blowouts with failed investment in Sun Bets business in the UK.

- Adverse outcome from any regulatory change.

- Failing to fully realize synergies from the Tatts merger.

ANALYST’S NOTE

Tabcorp’s FY18 results were largely in line with our estimates. In our view, its core Wagering business continues to be impacted by structural trends (shift to online wagering), competitive pressures in retail and cost pressures.

Wagering & Media segment (significant driver of group EBITDA) delivered +0.6% revenue growth and +0.1% EBITDA growth, whilst EBIT declined by -1.7%. Lotteries & Keno delivered strong results, whilst the company is on target to deliver EBITDA synergies from integration of the Tatts transaction, delivering initial synergies of $8m in FY18 and remains on track to deliver $50 of EBITDA synergies in FY19 and at least $130 p.a. of EBITDA synergies and business improvement benefits in FY21.

Management confirmed that the recent regulatory changes – such as the introduction of point of consumption tax (POCT) in NSW & VIC – will be a positive for TAH. On a positive note, TAH ended the agreement with News Corp UK and ceased Sun Bets trading which should remove the earnings drag on the group.

Management expects to increase marketing spend on wagering and media and is working to take lottery distribution wider. TAH retains strong cash flows (good cash conversion) and strong EBITDA and we see the WA Tab privatization as a potential opportunity for the company. The stock trades in-line with our valuation – Maintain Neutral.

- FY18 results up on previous period (before significant items). Revenue was up +71.7% to $3,828.7m on pcp, with significant items of $217.5m adversely impacting NPAT and EPS. Operating earnings (EBITDA) before significant items was up +46.1%. Statutory NPAT was $28.7m (before significant items NPAT of $246.2m), whilst EPS was 1.9 cents (before significant items EPS of 16.6 cents). On a pro-forma basis revenue was up +2.5% to $5,109.3m, EBITDA was $989.2m (up +2.8%) and EBIT was up +2% to $695.6m.

- TAH integration with TTS on track. Since combination of Tabcorp and Tatts was completed in December 2017, management has prioritized the integration of the two businesses. The management is on track to deliver $50m of EBITDA synergies in FY19 and reaffirmed its target to deliver at least $130m p.a. of EBITDA synergies and business improvement benefits in FY21.

- Wagering & Media (~45% of EBITDA) – flattish results at the top-line and earnings (EBITDA) line. Whilst revenue was up +0.6% to $2,461.8m pcp, operating earnings (EBIT) fell – 1.7% to $307m. TAB delivered +2.5% turnover in revenue growth with +16.3% growth in Digital turnover, offsetting a decline of -3.3% in retail. Fixed Odds products were a major contributor to revenue growth, with +12.7% growth in racing and +14.4% growth in sports (driven by the FIFA World Cup).

- Lotteries & Keno (~40% of EBITDA) – key highlight of the results. TAH refinanced $1.8bn bridge loan into long dated maturities in US market. Management is targeting FY19 dividend payout ratio of 100%. Further, the Company will target gross debt / EBITDA ratio of 3-3.5x, with gross debt / EBITDA at June-18 at 3.4x

- Capital management the focus. Tabcorp exited its agreement with News Corp UK to operate Sun Bets, making a payment of approx. $71m to exit the agreement. Significant items expense of $90.5m (after tax) has been recorded in FY18 which includes the exit fee and asset impairment charges. Closure costs of ~$10m are expected to flow through FY19.

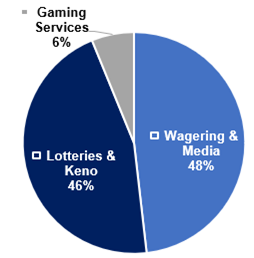

Figure 1: TAH Revenue Breakdown by segments

Source: Bloomberg

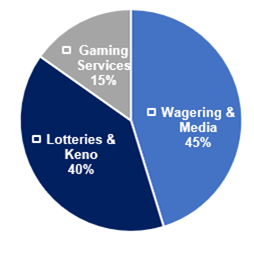

Figure 2: TAH Earnings (EBITDA) Breakdown by segments

Source: Bloomberg

ASK THE ANALYST

Our analysts are ready to answer any questions you have

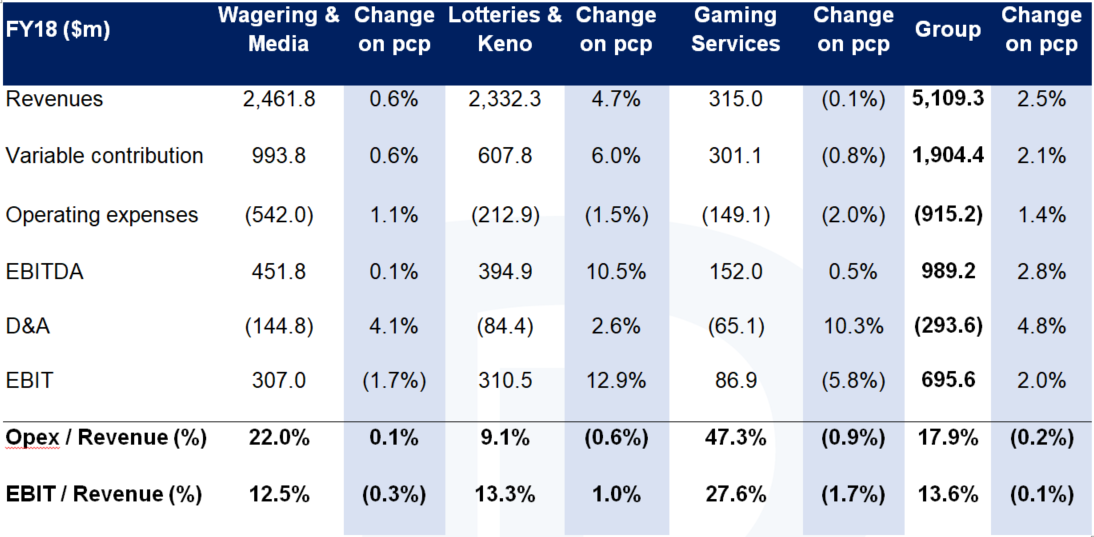

FY18 key results summary…

Figure 3: TAH results summary – by segments

Source: Bloomberg

Key operational highlights:

- Group Results. Excluding the impact of significant items, EBITDA was up +46.1% and NPAT up +37.6%. Significant items (after tax) of $217.5m comprised:

1. Tatts Group combination related costs $114.6m;

2. Sun Bets exit cost of $90.5m;

3. Luxbet closure costs $12.4m. On a pro-forma basis Revenues were up +2.5% to $5,109.3m, EBITDA was $989.2m (up +2.8%) and EBIT was up +2% to $695.6m.

- Wagering & Media (~45% of EBITDA) – flattish results at the top-line and earnings (EBITDA) line. Whilst revenue was up +0.6% to $2,461.8m pcp, operating earnings (EBIT) fell -1.7% to $307m. TAB delivered +2.5% turnover in revenue growth with +16.3% growth in Digital turnover, offsetting a decline of -3.3% in retail. Fixed Odds products were a major contributor to revenue growth, with +12.7% growth in racing and +14.4% growth in sports (driven by the FIFA World Cup).

- Lotteries & Keno (~40% of EBITDA) – key highlight of the results. Revenue was up +4.7% (pcp) to $2,332.3m and EBITDA was $394.9m (up +10.5%) driven by VC margin expansion due to digital growth, cost control and early stage benefits (synergies from the acquisition).

- Sun Bets ceased trading. Tabcorp exited its agreement with News UK to operate Sun Bets, making a payment of approx. $71m to exit the agreement. Significant items expense of $90.5m (after tax) has been recorded in FY18 which includes the exit fee and asset impairment charges. Closure costs of ~$10m are expected to flow through to FY19.

- Gaming Services (~15% of EBITDA) – saw steady but flat results performance. On a pro-forma basis, Gaming Services revenues were steady at $315m. Whilst EBITDA of $152.0m, was up +0.5%, EBIT declined -5.8% to $86.9m. Revenues declined -2.1% in 2H18, partly impacted by the expiry of Tabcorp Gaming Solutions (TGS) venue contracts in Victoria. eBet’s performance was adversely impacted by uncertainty associated with the merger, competitive pressures, and the divestment of Odyssey.

- Capital Management. Management announced a fully franked final dividend of 10cps taking the full year dividend to 21cps and reaffirmed its target to deliver a dividend of 100% of NPAT before significant items, amortization of the Victorian Wagering and Betting License and purchase price accounting in FY19.

- Regulatory update.

1. Federal legislation passed banning synthetic lottery products;

2. Wagering point of consumption tax regimes announced;

3. advertising restrictions and stronger consumer protections introduced.

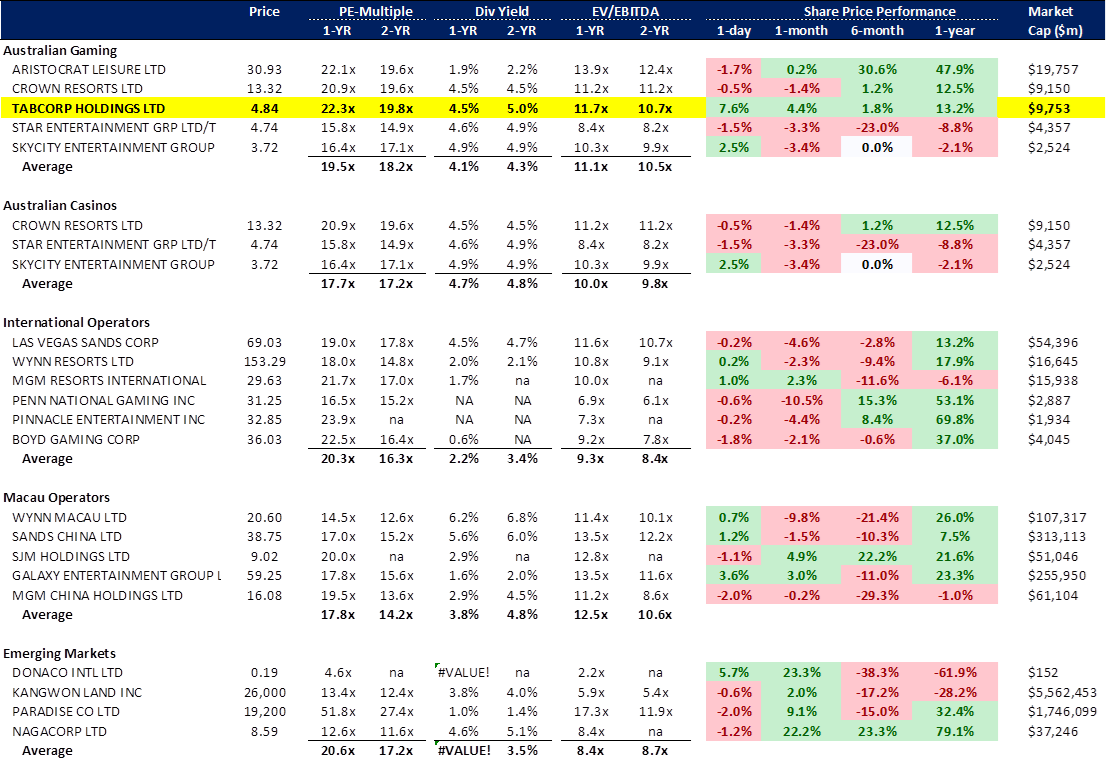

TAH Global Comps…

Figure 4: TAH relative valuation – consensus gaming and casinos valuations

Source: Bloomberg

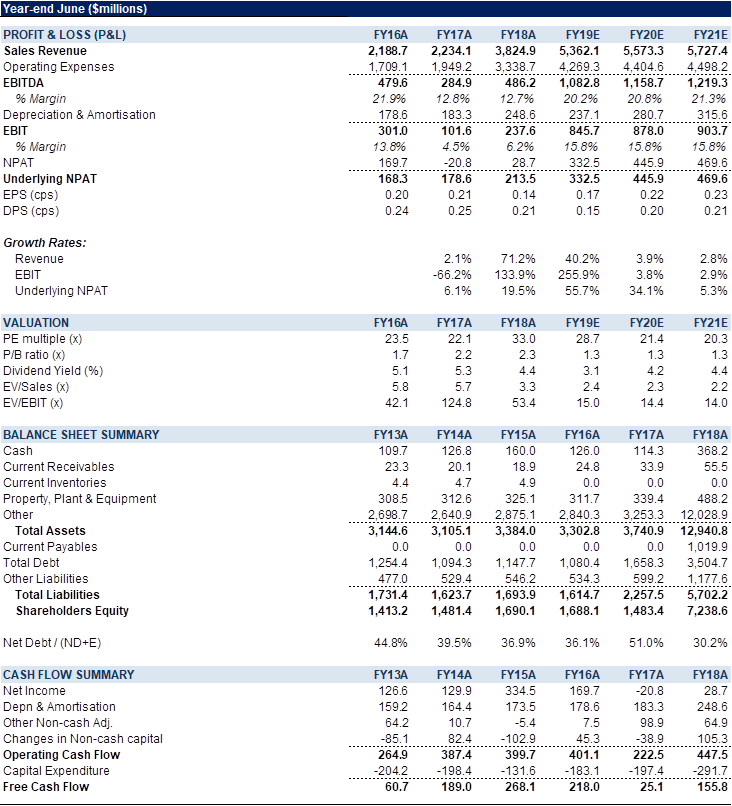

Figure 5: TAH Financial Summary

Source: Bloomberg

COMPANY DESCRIPTION

Tabcorp Holdings Ltd (TAH) is an integrated gambling and entertainment company listed in Australia, with operations overseas. The business operates three key segments – Wagering & Media, Keno and Gaming Services. These services are delivered to customers through TAH’s retail, digital and Sky media platforms.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >