Telstra Corp

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 22/06/18 | TLS | A$2.66 | A$2.73 | NEUTRAL |

| Date of Report 22/06/18 | ASX TLS |

| Price A$2.66 | Price Target A$2.73 |

| Analyst Recommendation BUY | |

| Sector : Telecommunications Services | 52-Week Range: A$2.65 – 4.37 |

| Industry: Communications | Market Cap: A$31,576.7m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate TLS as a Neutral for the following reasons:

1. Additional cost measures announced to support earnings.

2. InfraCo provides optionality in the long-term.

3. Despite intense competition, subscriber growth numbers remain solid.

4. Company looking to monetize $2.0bn of assets.

5. In the long-term, the introduction of 5G provides potential growth.

6. TLS still commands a strong market position and has the ability to invest in growth technologies and areas (e.g. Telstra Ventures) which could provide room for growth.

We see the following key risks to our investment thesis:

1. Further cuts to dividends

2. Any increase in churn, particularly in its Mobile segment – worse than expected decrease in average revenue per users (or any price war with competitors).

3. Any network disruptions/outages.

4. More competition in its Mobile segment.

5. Quicker than expected deterioration in margins for its Fixed segment.

6. Risk of cost blowout in upgrade network and infrastructure to 5G.

ANALYST’S NOTE

TLS annual strategy day had a number of new details which warrant some attention. The overarching view is that the short to medium term outlook for the Company (and in fact for the industry) is challenging. TLS’ legacy businesses are holding the Company back in an environment where, frankly, the change and pace of change has surprised the management team.

Nonetheless, we do believe management is doing their best to navigate this change. In their effort, the management team announced a number of new initiatives: (1) increased cost out target by $1.0bn to $2.5bn by FY22 (8,000 jobs to be cut over 3 years); (2) establishment of InfraCo which will house TLS’ infrastructure assets (excluding mobile network) almost like a separate company (potential demerger down the track); (3) up to $2.0bn in gross asset sales over the next couple of years to strengthen the balance sheet; and (4) a significant simplification of product offering from 1,800 consumer & small business plans/products to 20 core plans.

Whilst the Company reaffirmed its FY18 dividend guidance of 22cps, management refused to provide guidance for FY19. Further, TLS’ operating earnings (EBITDA) guidance of $8.7 – 9.4bn for FY19 is well below pre announcement consensus guidance of $10.5bn and highlighted an acceleration in the earnings decline. We downgrade our recommendation to Neutral following the strategy update and whilst we believe the measures announced will see TLS’ position improve over the long-term, execution risk remains (cutting jobs + product offering is no ease/smooth task) and any benefits to flow are some years away (with the risk of increased costs and additional charges in the interim).

In our view, the current share price by and large reflects many of the downside risks to the Company but we believe there are limited upside catalysts in the short to medium term. The current share price is likely implying a further dividend cut (the probability of which has increased) but we still believe the share price is likely to come under pressure if and when it materializes.

- Key announcement #1 – more cost outs announced but expected. TLS now expects to achieve a further $1.0bn in underlying cost savings by FY22.

- Key announcement #2 – simplifying product portfolio and increase digitization. To enable the Company to significantly reduce its cost base, management will radically simplify its product offering from more than 1,800 to 20 core plans.

- Key announcement #3 – monetizing assets of up to $2.0bn gross but little detail. Management do expect to monetize up to $2.0bn in assets over the next two years in order to strengthen its balance sheet.

- Key announcement #4 – creation of InfraCo. TLS has announced that from 1 July it will establish a standalone infrastructure business unit called Telstra InfraCo which will include data centres, non-mobile related domestic fibre, copper, HFC & international subsea cables.

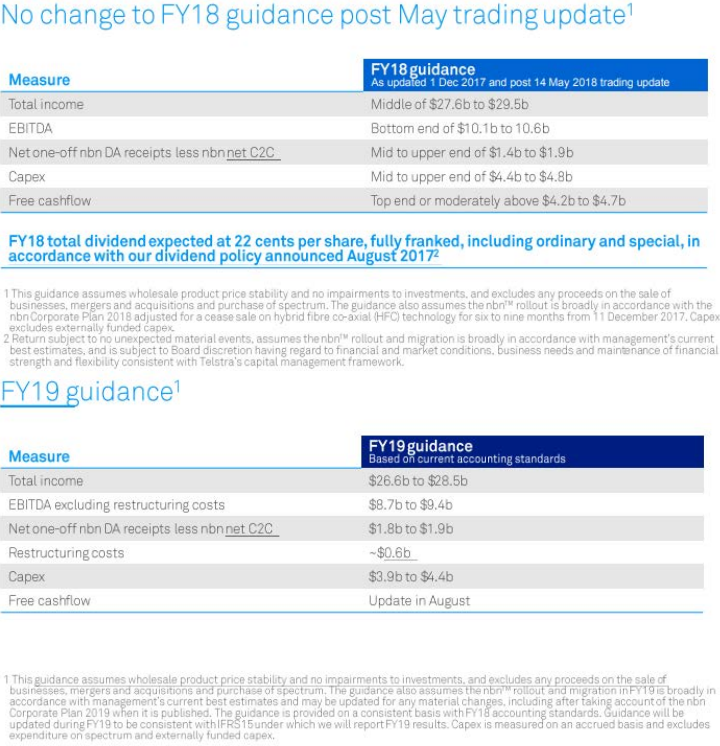

- FY19 guidance implies ongoing pressure in the core business. Whilst there were no changes to the FY18 guidance, TLS provided in its May trading update, the Company’s FY19 guidance suggested ongoing deterioration in its core business.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

STRATEGY DAY – KEY SLIDES…

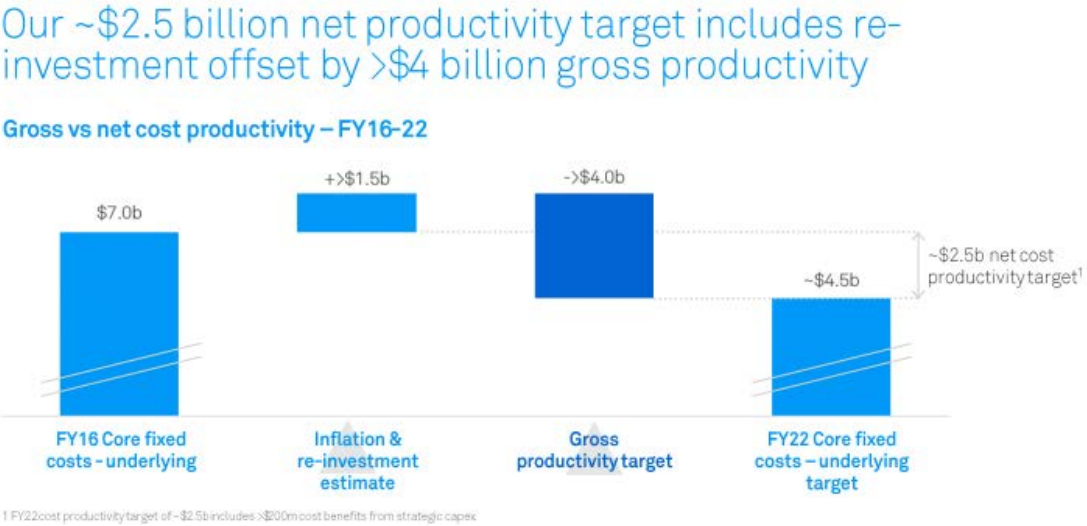

More cost outs announced but expected. In our view, the market was expecting (maybe even coerced) management to lift their cost out targets given the industry and competitive pressures. TLS now expects to achieve a further $1.0bn in underlying core fixed costs by $2.5bn by FY22. Further, the Company has guided base costs to remain flat or slightly reduce over this period, even when accounting for inflation and NBN migration. Put another way, TLS needs to find $4.0bn in gross productivity gains by FY22 to achieve this target. There is a risk of this cost out target not being achieved and/or that the Company incurs additional costs (expect a number of restructuring charges to start dominating financials) to get there.

Figure 1: TLS cost out target lifted by $1.0bn

Source: Company

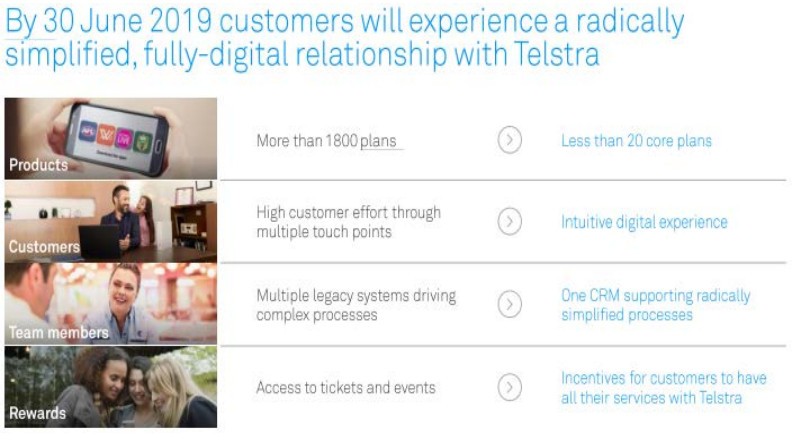

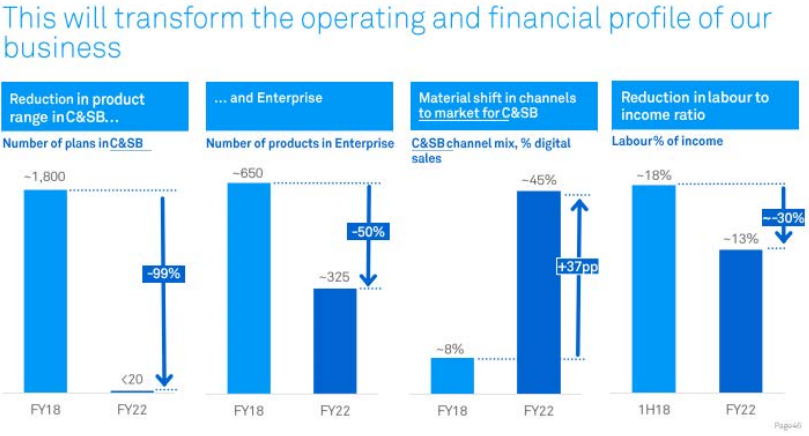

Simplifying product portfolio and digitizing customer relationship. To enable the Company to significantly reduce its cost base, management will radically simplify its product offering from more than 1,800 to 20 core plans. The streamlining of this will require less labour costs and further enhance the digital experience (which will also help reduce customer calls/contact and therefore reducing costs). Whilst we are positive on this strategy and it makes absolute sense to do this, we caution that the execution risk high and could see further pressure on revenue and APRU during this transition.

Figure 2: TLS to reduce product complexity

Source: Company

Figure 3: Reduced products will lead drive costs lower

Source: Company

Monetizing assets of up to $2.0bn gross. Whilst the details on this front was little vague or not forthcoming due to commercial confidentiality reasons, management do expect to monetize up to $2.0bn in assets over the next two years in order to strengthen its balance sheet. We are reluctant to account for this in our estimates given the scant details.

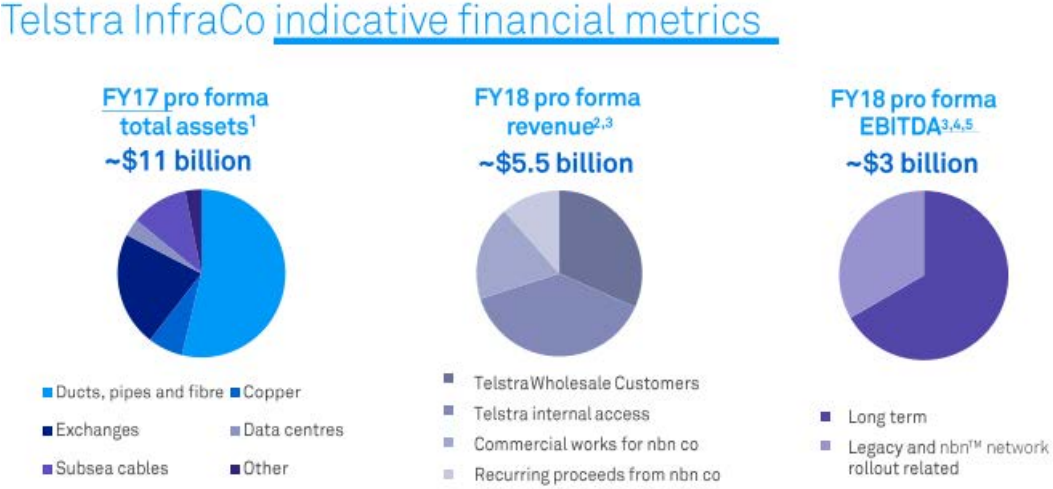

Establishment of Infrastructure Company (InfraCo). TLS has announced that from 1 July it will establish a standalone infrastructure business unit called Telstra InfraCo which will be made up of its data centres, non-mobile related domestic fibre, copper, HFC, international subsea cables, exchanges, poles, ducts and pipes. It will have three main customer segments – Telstra, wholesale customers and nbn company. On a pro forma basis, the InfraCo will have annual revenues of $5.5bn and EBITDA of $3.0bn. InfraCo will have its own CEO who will report to the CEO/MD of TLS Andrew Penn and will give TLS optionality in the future for a potential demerger or sale to a strategic investor once the nbn rollout concludes. However, we note this optionality will not become available until FY22.

Figure 4: InfraCo pro-forma numbers

Source: Company

FY18 and FY19 guidance. Whilst there were no changes to the FY18 guidance TLS provided in its May trading update, the Company’s FY19 guidance suggested ongoing deterioration in its core business. Specifically, the Company noted:

1. Ongoing intense competition and expects overall FY19 market mobile and fixed revenue to be down 2-3%.

2. Expected decline in mobile EBITDA given ARPU trends and potential impact from new competition (TPG).

3. Impact of Telstra2022 initiatives on mobile legacy profits.

4. Additional impact from the rollout of the nbn. Using the bottom end of TLS’guidance, relative to previous corresponding period (pcp), TLS’ EBITDA will decline by – 5.4% in FY18 and -13.9% in FY19.

Figure 5: TLS FY18 and FY19 guidance

Source: Company

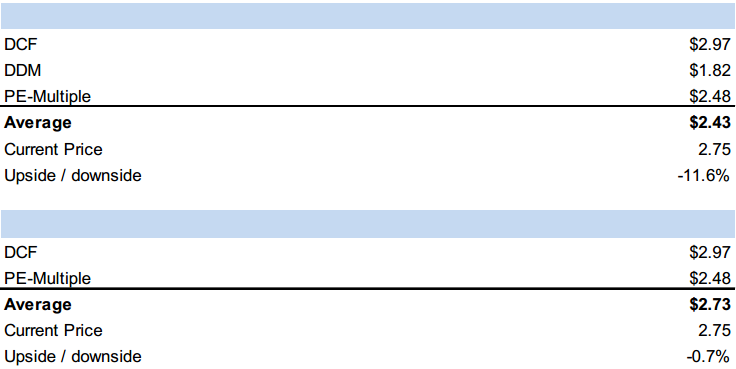

VALUATION SUMMARY

We use three main valuation methodologies to value TLS shares – DCF, Dividend Discount Model and PE-relative. In the figure below, we provide our three valuations, updated for our revised earnings and market multiples. However, to arrive at our price target we use the average of our DCF and PE-relative valuation, rounded to the nearest ten cents.

PE-relative valuation. For our PE-multiple valuation we have used the peer group

average PE-multiple and applied a 30% discount to this multiple. We believe this discount

to the market should adequately account for the negative sentiments towards the cut in

TLS’ dividend yield, which arguably has also supported its share price in the past.

Figure 6: TLS valuation summary

Source: BTIG estimates

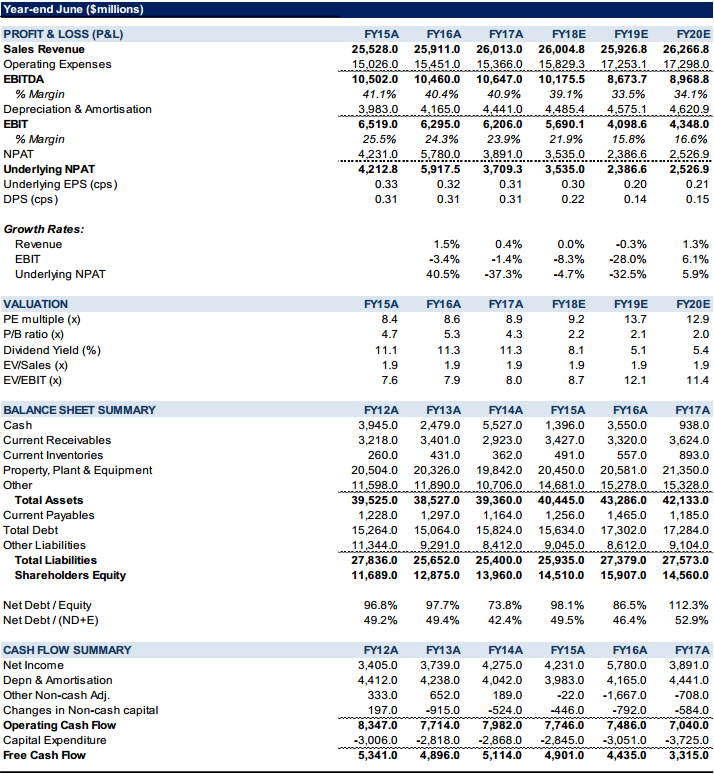

Figure 7: TLS Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

Telstra Corporation (TLS) provides telecommunications and information products and services. The company’s key services are the provision of telephone lines, national local and long distance, and international telephone calls, mobile telecommunications, data, internet and on-line and pay TV. Its key segments are Mobile, Fixed, Data & IP, Foxtel, Network applications and services and Media.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >