Thematic Investing: Uranium – deep value or trap?

The uranium spot price is down 70% (since Jan 2011), with the bear market now in its 7th year. Uranium equities have been decimated over the same period. The number of miners has declined from 500 to 40. Fukushima – Japan Nuclear disaster – in March 2011 was the catalyst for the start of this bear market. One thing is for sure, at some point, companies willing to sell product for US$22/lb which costs US$40/lb to produce will cease – no company or industry can make a loss into perpetuity. In our view, the exact turning point for the industry is difficult to predict, but we are of the view there is still a future for nuclear energy. In this report, we explore what signs may be appearing on horizon which may indicate that the market may be nearing its bear market. These include contract renewals coming up, secondary supply should be pulling back and significant supply required to meet future demand needs investment today – however no company is incentivised at current low prices to make the investment.

- Start of the bear market – quick recap in case you missed it.

The uranium industry entered its current bear market, now 7 years into it, after Fukushima in March 2011 (Japan Nuclear disaster). The spot price for uranium has declined from US$72.50/lb in (31 Jan-11) to current spot price US$21.65/lb – representing a decline of approximately 70%. Uranium related companies and equities were decimated over this period, with the number of miners declining from around 500 to 40.

- Demand-side dynamics.

According to World Nuclear Association, as at Feb-18 there are 448 operable civil nuclear reactors globally, with around another 57 under construction, 158 planned and 351 proposed. Most of the new capacity is being driven by emerging countries such as China and India. In China, there are currently 38 reactors in operation, with 20 under construction, 39 planned and 143 proposed. Depending on your time horizon, this equates to six to eight reactors being approved each year.

- Supply-side dynamics.

Past experience tells us that there are two main catalysts which could see an industry come out of a bear market:

1. demand improves and/or

2. supply (specifically uneconomical) is removed from the market (excess capacity diminishes)

As we have noted above, given the number of nuclear reactors under construction and planned, demand outlook remains healthy. Further, structural issues with nuclear energy appear to be overdone at this juncture. This then leads us to the other critical part of the equation – supply side dynamics. Some signs that supply may be correcting:

1. secondary supply also feeling the pinch of lower prices;

2. uncontracted supply to meet future demand is rising; and

3. limited new mine investment and curtailments to existing supply as contracts roll-off.

- Uranium production

The uranium production landscape has significantly changed since 2007, with Kazakhstan emerging as the global leader in uranium production. The Russian-friendly region mines close to 40% of the world’s uranium, with its major. Kazatomprom is the lowest cost producer in the world and is also the largest uranium producer. Along with a potential IPO in 2018, the Company plans to build a trading arm in order to sway market prices, much like OPEC in the oil industry. This concentration of supply has implications for the uranium industry and prices).

Key question – Will uranium prices trend up?

It would be wrong to try to predict the exact time uranium markets could or will turn from their current bear market lows (assuming one still believes that uranium has a future). Instead, we put forward a case as to what could potentially trigger a recovery in the sector sooner rather than later. Clearly, selling uranium (or anything for that fact!) for a price of ~$22/lb when it costs you ~$40/lb to produce it, is just not sustainable. Here we look to develop the case why this was more sustainable (selling at a loss) in the past 6 years but unlikely to be going forward.

Start of the bear market – quick recap in case you missed it. The uranium industry entered its current bear market, now 7 years into it, after Fukushima in March 2011 (Japan Nuclear disaster). A 9.0 magnitude earthquake triggered a 10-metre high tsunami that crashed into the Fukushima Daiichi nuclear power station in 2011, causing multiple meltdowns. As a consequence, 54 reactors which provided approximately 30% of Japan’s electricity production were shut down. With 12 of these reactors permanently closed, 5 have restarted to date, and a further 21 reactors are in the process of achieving approval.

As a result, the spot price for uranium has declined from US$72.50/lb in Jan 2011 to the current spot price of US$21.65/lb – representing a decline of approximately 70%. Uranium related companies and equities were decimated over this period, with the number of miners declining from around 500 to 40.

Policy response by global governments post Fukushima. The overwhelming response by most governments was to significantly increase regulatory and safety guidelines with respect to operating a nuclear power station. From our understanding, European countries (particularly France, Germany), but also the US and Japan, have been more willing or have plans to reduce the reliance on nuclear energy. While others remain in favour of nuclear energy playing some part in the future. Further, despite US’ stance, U.S President Donald Trump is in fact very much in favour of nuclear energy. Further, public sentiment, apart from a few developed countries (particularly Germany), towards nuclear is still balanced as a source of energy in the future.

Despite the negative sentiment towards the sector as a consequence of these countries potentially pulling back on nuclear energy, it is worth highlighting that they contribute little to new capacity being built (under construction or planned).

Switching away from nuclear not that simple. The global population is growing and reliable energy demand is significantly rising, especially in developing economies. Switching away from nuclear leaves governments with two options:

1. fossil fuels (e.g. coal); or

2. renewable energy (e.g. wind and solar).

In our view, the reliability and consistency is presently not available through renewable energy for it to step up in the medium term as base load supply. Further, fossil fuels carry the issue of higher emissions. Despite being one of the developed nations looking to pull back on nuclear energy, forward looking plans suggest demand out of the US will remain healthy. As at Feb 2018, the US has 99 operating reactors, 2 under construction, 14 planned and 21 proposed. It is estimated that 20% of the US’ electrical energy comes from nuclear power (that is, 1 in every 5 homes = 23 million homes), with 62% of the nation’s carbon-free electricity. Therefore, switching is no easy task.

Demand-side dynamics…

In our view, it does not appear that the nuclear energy industry is disappearing over the long-term. According to World Nuclear Association, as at Feb-18 there are 448 operable civil nuclear reactors globally, with around another 57 under construction, 158 planned and 351 proposed. Most of the new capacity is being driven by emerging countries such as China and India. In China, there are currently 38 reactors in operation, with 20 under construction, 39 planned and 143 proposed. Depending on your time horizon, this equates to six to eight reactors being approved each year. Nuclear energy is clean, it is dependable for base load, carbon-free and cost effective.

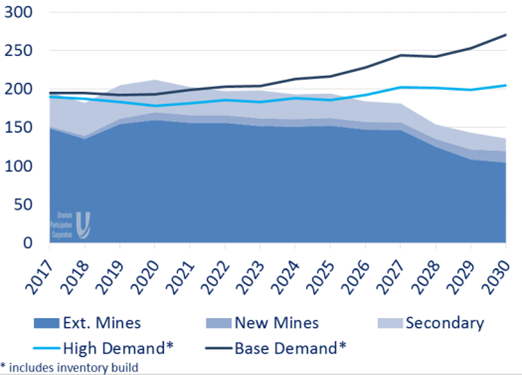

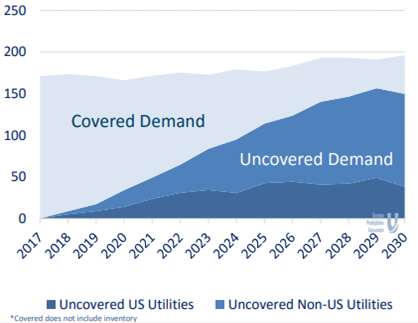

UxC and UPS provided the chart below, which shows two demand scenarios over the medium to long-term. On their estimates, demand will exceed supply, unless no supply is incentivised (via higher prices) to come online.

Figure 1: Uranium market demand forecasts (million pounds U3O8)

Source: UxC uranium market outlook Q4 2017, UPC

Supply-side dynamics…

Past experience tells us that there are two main catalysts which could see an industry come out of a bear market:

1. demand improves and/or

2. supply (specifically uneconomical) is removed from the market (excess capacity diminishes). As we have noted above, given the number of nuclear reactors under construction and planned, demand outlook is healthy. Further, structural issues with nuclear energy appear to be overdone, at this juncture. This then leads us to the other critical part of the equation – supply side dynamics. In recent years, the key drivers of excess supply:

- Japanese selling excess inventory.

One of the drivers of a lower uranium price has been the slow pace with which the Japanese reactors, which were shut down post Fukushima, have come back online. As noted above, 54 reactors in Japan were shut down, with 12 permanently closed. However, to date only 5 have restarted and a further 21 reactors are in the process of achieving approval. This has meant that Japanese reactors have continued to receive inventory as a result of contractual terms, however were selling in the secondary market to recover costs.

- Underfeeding (within secondary supply).

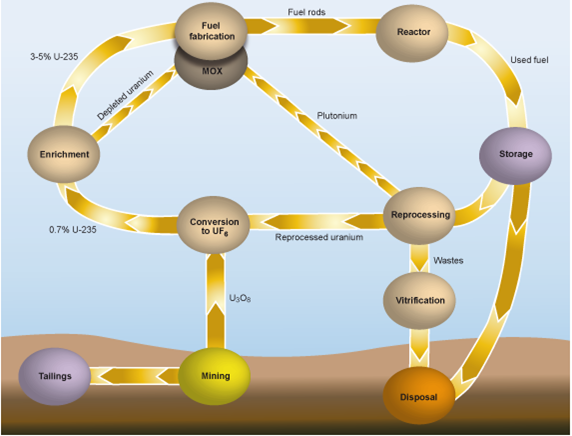

As many in the industry will note, this has been a significant source of pricing pressure in uranium markets. Most global commercial nuclear power reactors use uranium enriched in the U-235 isotope as their fuel. The Nuclear fuel cycle is provided in the figure below – as a rule of thumb it can take between 18 – 24 months from mining to utility.

Figure 2: Nuclear fuel cycle

Source: World Nuclear Org

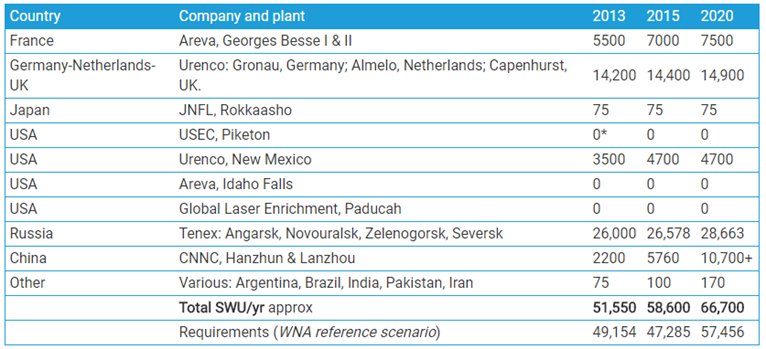

Natural uranium contains 0.7% U-235 and 99.3% U-238. In order to separate these, and enrich the percentage of U-235, the commercial process entails gaseous uranium in centrifuges. There are large commercial enrichment plants around the world and capacity of these plants is measured in terms of ‘separate work units’ (SWU). As the flow chart above indicates, utilities will buy uranium from the mines which will then be contracted to these plants to derive a fixed quantity of enriched uranium for fuel for their reactors. However, the enricher plants could be left with surplus natural uranium if the operational tails assay is lower than the contracted assay. In this case they sell the excess enrichment supply as alternative revenue source. This is referred to as underfeeding. What is important to understand here is that the enricher is motivated by plant economics and are low cost – that is the need to keep running centrifuges all year long even as demand for uranium came off. And so, lower demand resulted in these enrichers increasing their underfeeding to drive revenue and this significantly added to the secondary supply market. As the table below indicates, there is currently an oversupply of enrichment capacity – 58.6m units supply versus 47.3m units demand.

Figure 3: Global enrichment capacity – operational and planned (000 SWU/yr)

Source: World Nuclear Org

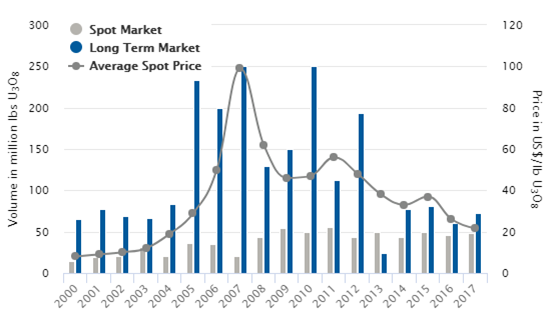

- Changing contracting cycle.

Customers (e.g. large utilities companies) in the past have signed on long-term contracts to shore up supply, as fuel is critical to running the plant. As the chart in the figure below highlights, there was a clear trend towards long-term contracts in the market from 2005 to 2012. It is generally noted that these contracts are around 7 years in tenure, which would suggest contracts signed in 2010-11 are coming off contract now. This means producers which had to supply uranium to meet contractual terms can now potentially take uneconomical production offline or pull back on future investments, until such time its economically viable.

Figure 4: Uranium contracting volumes and price history

Source: Ux estimates, Cameco

The key drivers which could help balance the supply / demand equation and could see uranium prices trend higher:

- Limited new mines and curtailments.

Given the state of the industry, there has been curtailments and under investment in the sector. We note recently Cameco announced the suspension of production at the world’s largest mine McArthur River. As we noted above, with long-term contracts now expiring, producers (no longer bound by contractual arrangements) lack incentive to produce at current prices. Also, in late 2017, Kazakhstan (the world’s largest uranium producer), cut its output forecast by 20% for the next three years. As a rule of thumb, it typically takes 7-10 years from beginning the application process to beginning mining.

- Uncontracted demand with shortening contract cycle.

With demand expected to increase and long lead time to bring supply online, uncontracted demand (with reactors required to shore up fuel normally a couple of years ahead), excess supply may quickly diminish in the spot market and prices could rise. According to UxC and UPS, there is approximately 21% of uncovered demand in 2020 and 65% in 2025. Whilst they have been taking advantage of the low spot prices, the shift in the demand/supply equation could see a sharp price re-rating as long-term contracts roll-off.

Figure 5: Utility uranium requirements

Source: World Nuclear Org

- Underfeeding slowing down.

This major source of pricing pressure could ease going forward, in our view. As indicated above, the global enrichment capacity is in oversupply. However existing contracts were based on much more attractive headline prices in previous years, the expiration and renegotiation of these contracts will be considered under the current low UX SWU spot price of US$37.00 (from levels of around US$90 per unit). Further, with demand for uranium being on a decline, new product going through these enrichment plants will also have reduced and therefore excess supply inventory should be diminishing. We note one of the largest global enrichment companies Urenco in their 2016 results spoke about the excess capacity in the industry, which drove headline prices lower. As a result, Urenco is undertaking a €300m cash savings program to combat lower prices. This indicates lower prices are starting to pinch secondary supply as well.

- Japanese selling inventory should reduce going forward.

As noted above, there are 21 reactors in the process of achieving approval to come back online, with 5 already back. We suspect with these 21 reactors slowly making their way back online, inventory selling should reduce as these reactors will need to hold onto inventory for future use.

- A different perspective on current inventory levels.

Most inventories are held with the utilities. Global inventories hold an estimated 770 million pounds versus annual demand of approximately 183 million pounds. This equates to 4.4 years of demand, however China is estimated to be holding approximately 40% of this given the significant amount of growth estimated in the sector by 2030. Excluding China, the rest of the nuclear world is holding approximately 2.9 years of supply. Historically utilities hold 2 to 3 years in inventory, with the fuel cycle estimated at around 2 years.

Production dynamics…

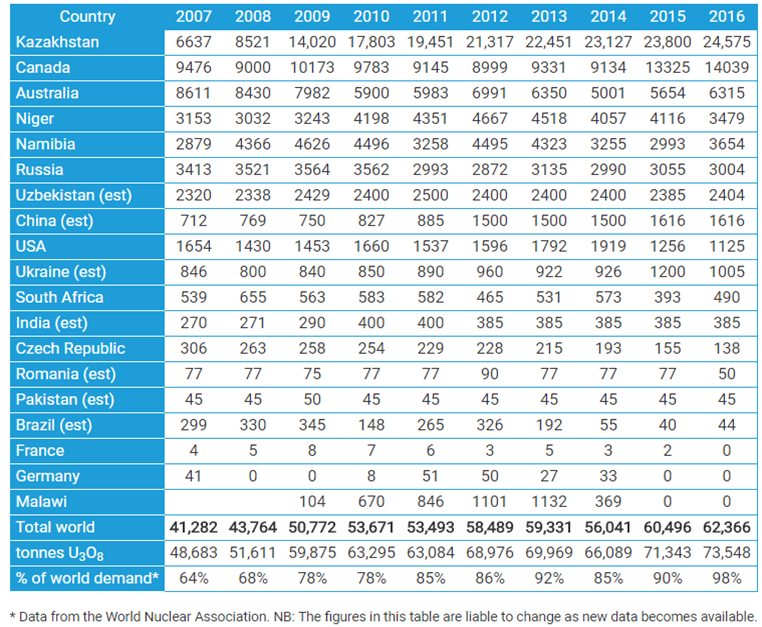

The uranium production landscape has significantly changed since 2007, with Kazakhstan emerging as the global leader in uranium production. The Russian friendly region mines close to 40% of the world’s uranium (see figure below).

Figure 6: Uranium production figures (as at July 2017)

Source: World Nuclear Org

This concentration of supply has implications for the uranium industry and prices. Key points for consideration:

- Russia controls ~50% of supply.

Another perspective on the global production numbers is that Russia (or Russia friendly regions) effectively control approximately 50% of global uranium production (Kazakhstan, Russia, Uzbekistan and Ukraine). In which case relations with Russia could drive price in the short term.

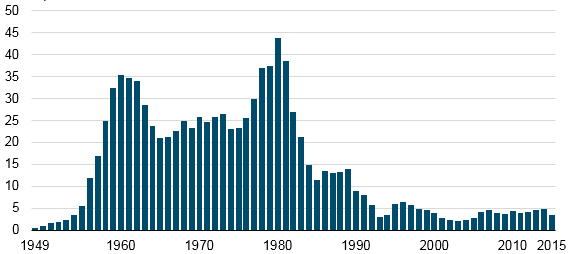

- Geo-political risks could drive prices higher.

We have seen global tensions against Russia rise in recent times – US elections meddling, Syria war, Crimea and the recent attempted murder of an ex Russian spy in the UK. Also recently, we have seen a number of global governments expel Russian diplomats including the US, UK and Australia. Given US’ reducing production profile (figure below), most of the uranium loaded in US reactors is now imported (predominantly Canada 17million lb & Kazakhstan 11million lb). Should tensions rise and sanctions are put in place, the US could be required to go to the spot market or other producers. Depending on contractual arrangements, meeting US demand could be difficult.

Figure 7: U.S. uranium concentrate production (million pounds U3O8)

Source: IEA, DOE

- Kazakh uranium producer is looking to IPO.

Having captured a large part of the global uranium production during a period in which most were leaving the industry, Kazatomprom is now looking to play a key role in uranium market prices. Kazatomprom is the lowest cost producer in the world and is also the largest uranium producer. It’s ability to dictate prices was already evident when the Company announced a cut in production which sent uranium prices spiking higher. In a news story in Bloomberg, a Company board member noted the following: (1) The Company plans to build a trading arm in order to sway market prices, much like OPEC in the oil industry. Given this will increase the price transparency of the firm, the company will want to seek higher prices on the market via this marketing set up. Therefore, given it controls the largest production and now has an interest in achieving higher prices, this bodes well for the overall market. (2) The Company is due to decide on an IPO of its shares in the first half of 2018 calendar year. We would suspect, higher prices could only be positive for achieving a higher IPO valuation/price.

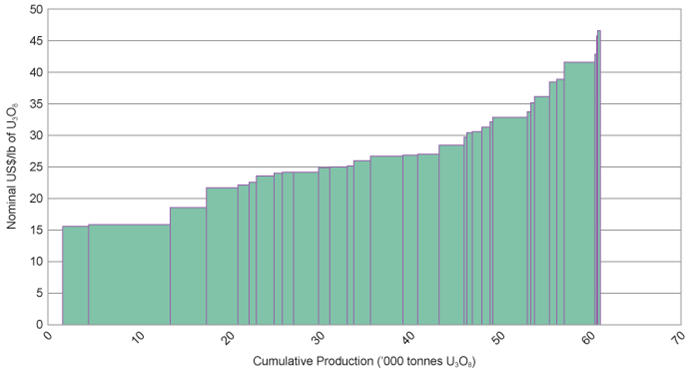

Cost of supply. In the past, companies typically achieve a premium of $10/lb above the spot price to supply uranium. In the figure below, we have provided the cost curve for global uranium miners in 2010, produced by CRU strategies. The curve indicates for 53,500t uranium p.a. production from mines in that year and for 56,200t uranium production in 2014, US$40/lb is marginal. Whilst the chart is a little dated, we believe the numbers are largely still relevant. We note at a conference in Abu Dhabi in April 2016, a representative from leading uranium pricing company Ux Consulting noted that the cost to produce uranium was approximately around US$39/lb.

Figure 8: Uranium mine production cost curve 2010

Source: CRU Strategies, World Nuclear Association

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >