Treasury Wines (TWE) – NEUTRAL

TWE reported a strong FY18 result, with group operating earnings (EBITS) up +16.5%, driven by ANZ (up +22.5%) and Asia (up +36.7%).

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 20/08/18 | TWE | A$19.02 | A$18.60 | NEUTRAL |

| Date of Report 20/08/18 | ASX TWE |

| Price A$19.02 | Price Target A$18.60 |

| Analyst Recommendation NEUTRAL | |

| Sector : Consumer Staples | 52-Week Range: A$12.91 – 20.20 |

| Industry: Beverages | Market Cap: A$13,699m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate TWE as a Neutral for the following reasons:

- Significant opportunity to grow its Asian business, driven by the demand in China for premium international wine.

- Group margin expansion opportunity from premiumisation and good cost control.

- The turnaround in Americas business could lead to significantly higher margins in that business from current levels.

- Ability to gain market share on competitors.

- Favourable currency movements (leveraged to a falling AUD/USD).

- Further capital management initiatives.

We see the following key risks to our investment thesis:

- Slowdown in wine consumption in key market.

- Slowdown in key growth markets could see the stock de-rate from current high PE-multiple levels.

- Adverse movement in global wine supply and demand.

- Increase competition in key markets.

- Unfavourable currency movements (negative translation effect).

- Policy and / or demand changes in China leading to an impact on volume growth.

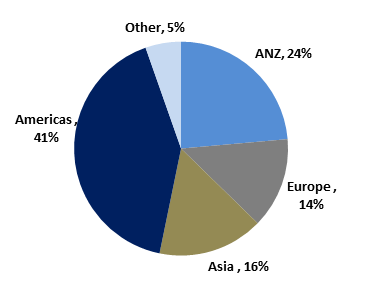

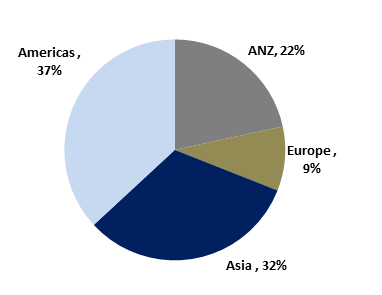

Figure 1: TWE revenue by region

Source: Company

Source: Company

ANALYST’S NOTE

TWE reported a strong FY18 result, with group operating earnings (EBITS) up +16.5%, driven by ANZ (up +22.5%) and Asia (up +36.7%).

U.S. underperformance was driven by the exit from lower margin Commercial volumes and reduced shipment to the U.S. due to change in U.S. route-to-market strategy. TWE expects FY19 EBITS growth of 25% on the back of higher availability of high-end wine.

Management also reiterated their aspiration of achieving 25% EBITS margin (versus current 21.8%). We maintain our Neutral recommendation given the stock is trading on a PE-multiple of 30x, which suggests little downside is being attributable to execution risk.

- Australia & NZ (NSR up +1.3%; EBITS up +22.5%). Volumes were up +1.3%, with growth outpacing the Australian wine category according to management (believed to be growing at 0-1%). Net sales revenue (NSR) per case was -0.5% below the previous corresponding period (pcp), however adjusting for the route-to-market transition underlying NSR per case was up +4%.

- Asia (NSR up +38.9%; EBITS up +36.7%). Solid volumes growth, up +23%, with North Asia up +41% while South East Asia, Middle East & Africa was down -6%. The strong volume growth was led by Australian (+27%) and French (+296%) brand portfolios. The Company noted that the fundamentals of Asia wine market remain attractive with growth in imported wine category coming at the expense of domestic peers.

- Americas (NSR down -9.4%; EBITS up +2.1%). Segment volumes were down 11.6% on pcp, driven by the exit from lower margin Commercial volumes and reduced shipment to the U.S. due to change in US route-to-market. Operating earnings (EBITS) rose +2.1% on the back of underlying premiumisation offset by a $25m impact from the route-to-market transition in 4Q18.

- Europe (NSR down -9.4%; EBITS up +3.1%). Segment volumes were down 10.4%, reflecting exit from lower margin Blossom Hill Commercial volumes as well as the exit from under-bond wholesale market in the UK. Growth in operating earnings (EBITS) of +20.7% was driven by favourable costs of goods sold (COGS) and overheads largely stable year on year.

- Group cash conversion was disappointing. TWE net operating cash flow fell -10% on pcp. TWE’s headline cash conversion fell to 68%, however management called out a number of one-offs which meant underlying cash conversion was approximately 83%. Whilst we agree a number of these are one-offs, we will be closely monitoring this in the coming periods.

- U.S. still represents execution risk. Management noted that the impact from the change in distribution strategy detracted from EBITS by approximately $25m. However, this impact isn’t likely to automatically reverse in FY19 and is more likely to flow through over a long-term timeframe as new distribution partnerships start to take shape.

FY18 RESULTS SUMMARY …

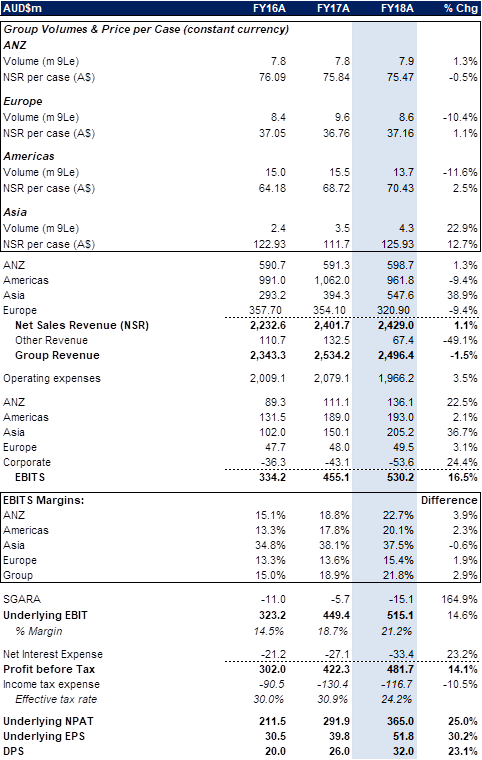

Figure 3: TWE FY18 group headline numbers versus pcp

Source: BTIG, Company

Group headline numbers. Compared to the previous corresponding period (pcp):

1. Group revenue was slightly up +1.1% (or up +1.7% in constant currency terms) driven by solid growth in net sale revenue per case (+6.5%) on the back of portfolio premiumisation and price realization. Volumes were down -2.7% driven by planned exit from lower margin Commercial volume and route-to-market transition in the U.S.

2. Operating earnings (EBITS) (before SGARA) was up +16.5%, with margin expanding 280bps.

3. TWE FY18 dividend of 32cps was up +23% on pcp.

4. $300m on-market buyback completed at an average price of $15.41.

5. Outlook – TWE reiterates guidance for expected FY19 EBITS growth of approximately 25%; committed to EBITS margin target of 25%.

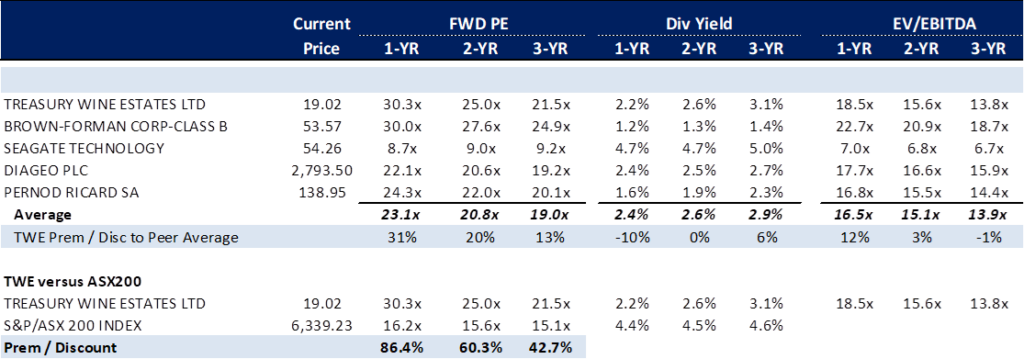

TWE RELATIVE VALUATION …

On consensus estimates, TWE trades on a significant premium to global peers, reflecting its near-term strong EPS growth trajectory.

Figure 4: TWE peer group valuations – consensus

Source: BTIG, Bloomberg

Our valuation.We value TWE using three methods: DCF (A$17.20), EV/EBITDA (A$20.62) and PE-relative (A$18.01). Our 5-year forecasts assume on a CAGR basis: revenue growth of +10.9% p.a., operating earnings growth of +21.1% p.a. (we assume TWE achieving 25% EBITS margin target by FY20) and WACC of 8.2%. For our relative valuations, we use global peers (including Diageo, Pernod Ricard) and apply a 15% premium to the multiple to reflect TWE’s above average earnings growth profile. We arrive at an equal weighted valuation of A$18.61 and our price target of A$18.60 is rounded to the nearest ten cents.

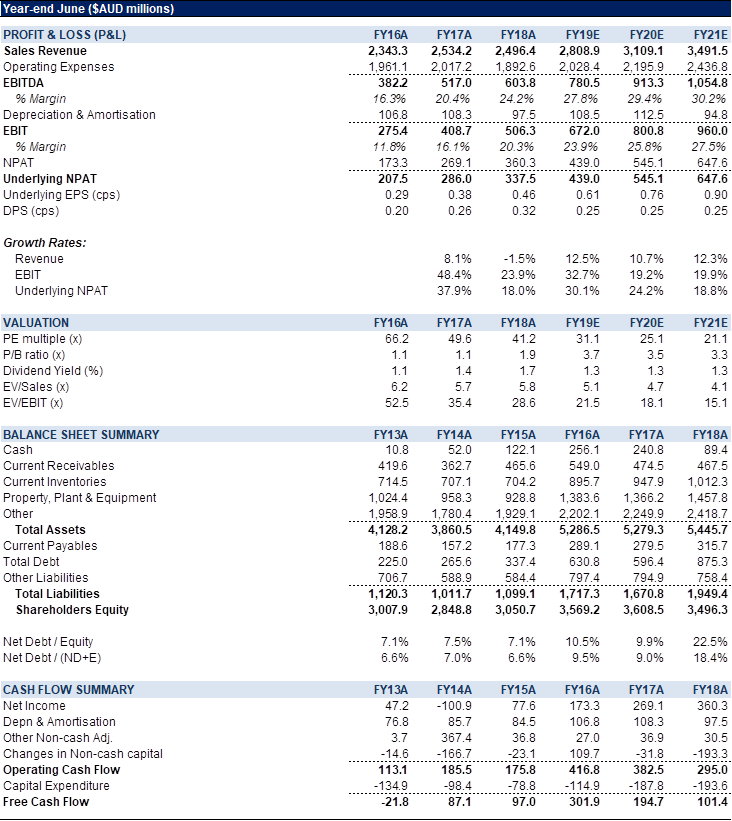

Figure 5: TWE Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Treasury Wine Estates (TWE) is one of the world’s largest wine companies listed on the ASX. As a vertically integrated business, TWE is focused on three key activities: grape growing and sourcing, winemaking and brand-led marketing. Grape Growing & Sourcing – TWE access quality grapes from a range of sources including company-owned and leased vineyards, grower vineyards and the bulk wine market. Winemaking – in Australia, TWE’s winemaking and packaging facilities are primarily located in South Australia, NSW and Victoria. The Company also has facilities in NZ and the US. Brand-led Marketing – TWE builds their brands through marketing and distributes its products across the world.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >