Virtus Health Ltd (VRT) – Buy

Virtus Health Ltd (VRT) reported FY18 results missed analyst expectations, with net income of $30.7m -2.8% below consensus at $31.6m

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 27/08/18 | VRT | A$5.70 | A$6.27 | BUY |

| Date of Report 27/08/18 | ASX VRT |

| Price A$5.70 | Price Target A$6.27 |

| Analyst Recommendation BUY | |

| Sector: Healthcare | 52-Week Range: A$4.97 – 5.93 |

| Industry: Healthcare Services | Market Cap: A$461.4m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate VRT as a Buy for the following reasons:

- Ageing Australian population and increased age of mothers (especially with the trend of more females choosing career over family until their early thirties) will provide favourable demographic tailwinds.

- Potential accretive acquisitions domestically and internationally. Domestic acquisition of other laboratories will consolidate VRT geographic expansion strategy along the eastern seaboard of Australia.

- Earnings increasingly becoming diversified as international segments expected to become a larger contributor.

- Solid balance sheet with flexibility to execute expansion strategies.

- New management for Victorian business to turn results around.

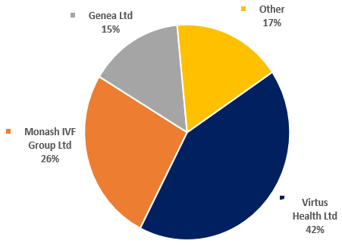

- Market-leading position with ~40% of domestic market share.

We see the following key risks to our investment thesis:

- Regulatory risk as changes in government funding may increase patient’s out-of-pocket expenses and thereby decrease volume demand.

- Fluctuations in the availability and size of Medicare rebates may negatively influence the number of IVF cycles administered and overall industry revenue

- Weakening cycle activity continues to adversely impact revenues.

- Increased competition from low-cost providers.

- Weakening economic activity resulting in increased unemployment leading to less disposable income to be spent in IVF treatment.

- Execution of international forays goes poorly.

- Population of males and females with fertility problems decline.

Figure 1: Industry Market Share

Source: Company

ANALYST’S NOTE

Virtus Health Ltd (VRT) reported FY18 results missed analyst expectations, with net income of $30.7m -2.8% below consensus at $31.6m.

Key highlights include:

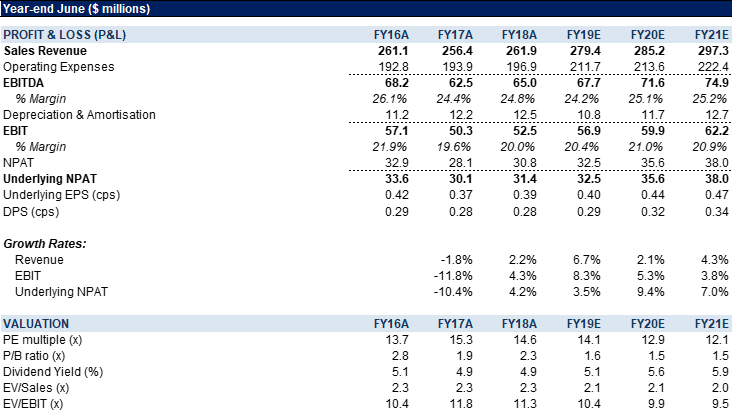

1. Revenue up +2.2% to $262.1m on prior corresponding period (pcp) but disappointingly group EBITDA was flat at $65.0m.

2. Australian segment EBITDA up 1.6% to $66.8m.

3. Significant improvements to operations completed in FY18 saw VRT’s Diagnostics segment EBITDA growth of +9.1%.

4. International segment saw earnings and cycle growth with EBITDA up +29.5% to $9.2m.

5. NPAT was up +9.4% to $30.8m over the pcp.

6. Final dividend 12cps fully franked.

7. Annualized leverage ratio is 2.4x adjusted Group EBITDA.

Our Buy recommendation is based on a long-term investment thesis:

1. The Company controls ~40% of the domestic market share;

2. Medicare data shows that long-term demographic drivers for IVF remains strong with short term volatility often equating to pent-up demand.

VRT trades on undemanding valuations of 12.9x PE20, 5.1% dividend yield.

- Australian Segment – saw weak conditions. VRT achieved consistent Australian ARS performance despite a softening of the domestic market in 2H18, with Australian eastern state markets in which VRT operates declining 0.7%. Cycle volume in VRT’s Australian clinics decreased -3.4% due to low cost competition in Queensland’s economically challenged market and new competition in a contracting Tasmanian market. Virtus’ IVF Australia, Melbourne IVF and “The Fertility Centre” (“TFC”) clinics in NSW and Victoria achieved cycle volume and market share growth.

- Diagnostics – was the highlight in our view. Revenue increased +3.6% in FY18, translating to +9.1% EBITDA growth over the pcp driven by “increase in the internal utilisation of genetic testing and screening in ARS, an expanding pathology testing platform and collection centre footprint and significant operational improvements”.

- Day Hospitals – poor performer. Despite increased IVF activity of 6.6% from strong IVF first half volumes and higher frozen embryo transfers, VRT’s Day Hospitals saw a quieter year largely attributable to weaker non-IVF revenue (decline -5.3%) in VRT’s Queensland day hospitals.

- International Segment; management remains in search for potential acquisitions. The segment reported revenue growth of +17.6% to $44m. Complete Fertility (UK) and Trianglen (Denmark) was added to VRT in FY18 with management expecting both to be EPS accretive in FY19. VRT also increased its ownership in the Sims Group in Ireland to 85%, during FY18. VRT’s Singapore operation delivered positive EBITDA of SG$350,000 (A$321,000) compared to a prior year EBITDA loss of SG$144,000 (A$120,000). According to management, “International revenue now sits at 17% of Virtus’ total revenue… [with] ambition is for this to reach 30% through organic growth in our international clinics and our continued targeted strategy of international acquisitions in the UK and Europe”.

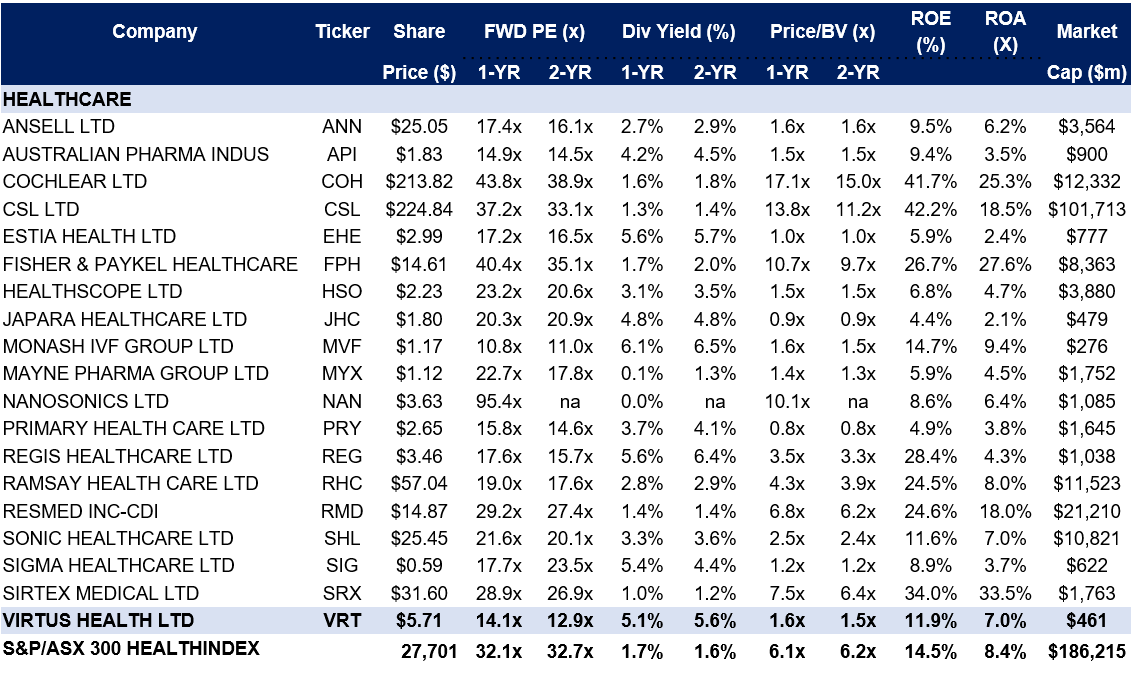

Figure 2: Peer group comparables – consensus

Source: Company, BTIG, Bloomberg

Figure 3: VRT Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

Virtus Health Ltd (ASX: VRT) is a global provider of assisted reproductive services. The group’s main activity is providing patients with Assisted Reproductive Services such as specialized diagnostics, fertility clinics and day hospital services. It has 116 fertility specialists who are supported by over 1100 professional staff and is the largest network and provider of fertility services in Australia and Ireland, with a growing presence in Singapore. Virtus is one of three major players which collectively control more than 80% of market share and was the first infertility treatment company in the world to float on the stock market.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >