Woodside Petroleum (WPL) – BUY

Woodside Petroleum (WPL) first half FY18 (1H18) result was largely in line with expectations, with underlying NPAT of $566m up +11% on pcp and sales revenue up +27% to $2.25bn.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 20/08/18 | WPL | A$36.75 | A$40.00 | BUY |

| Date of Report 20/08/18 | ASX WPL |

| Price A$36.75 | Price Target A$40.00 |

| Analyst Recommendation BUY | |

| Sector : Energy | 52-Week Range: A$27.85 – 36.83 |

| Industry: Oil & Gas Exploration and Production | Market Cap: A$34,404m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate WPL as a Buy for the following reasons:

- Quality assets (NWS, Pluto, Australia Oil, Browse, Wheatstone) with superior free cash flow breakeven price of $34 per barrel of brent (relative to peer group). 1H17 portfolio unit production costs were $4.90/boe, low cost operations underpinning gross margins of 48% and cash margins of 78%.

- On-going focus on cost reduction and positioning of the business for lower oil price environment.

- Increasing LNG demand, with WPL well positioned to fulfill this.

- Strong and conservative balance sheet position.

- Strong free cash flow generation.

- Potential exploration success in Myanmar, Senegal, Gabon. However, we have not factored any success into our forecasts + valuation.

- Quality management team with solid long term strategy in place (“Horizons I, II and III”).

We see the following key risks to our investment thesis:

- Supply and demand imbalance in global oil/gas markets.

- Lower oil / LNG prices.

- Not meeting cost-out targets (e.g. reducing breakeven oil cash price).

- Production disruptions.

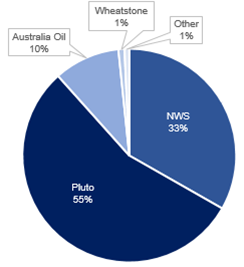

Figure 1: WPL Revenue by Segment

Source: Company

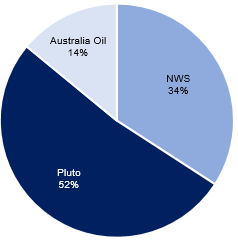

Source: Company

ANALYST’S NOTE

Woodside Petroleum (WPL) first half FY18 (1H18) result was largely in line with expectations, with underlying NPAT of $566m up +11% on pcp and sales revenue up +27% to $2.25bn.

WPL continues to progress on its key growth assets (getting them towards FID), whilst its base business continues to operate in line with expectations. Management have slightly upgraded their 2018 production guidance from 85-90 million barrels of oil to 87-91 million barrels of oil equivalent (boe), lowered their unit production cost to US$5.5 – 5.8/boe. Management again reiterated their target of approximately 100 mmboe (million barrels of oil equivalent) annual production in 2020 (versus 84.4 in 2017).

We maintain our Buy recommendation as we believe the Company provides an attractive balance of growth assets (albeit slightly long-dated) with quality underlying base business providing solid shareholder returns.

The current question most investors are grappling with is whether to place any value on these longer-dated growth options (we believe the market is currently placing very little value on these) and whether WPL comes back to the market for a capital raising for Browse should the FID come in earlier than expected.

- Key updates.

1. A 5% higher production of 44.3 MMboe compared to that of in 1H17;

2. Reliability at Pluto LNGL exceeding 99%;

3. An increased Pluto LNG capacity increased by 14% on original design capacity to 4.9 Mtpa;

4. Steady production above nameplate capacity from Wheatstone Train 1 and commencement of Wheatstone Train 2 production earlier than expected;

5. Entering of a non-binding MOU for the supply of approximately 125TJ/d of domestic gas over 20-25 years (underpinned by proposed Scarborough development);

6. The long-term agreement with Pertamina approved with an expected 1.1m tonnes per annum from 2019. - Dividend payout exceeds management target on higher prices. A clear positive from the half year results was the +20% increase in the interim dividend, which represented a payout ratio above company’s stated guidance of 80%, driven by higher commodity prices. We are likely to see this payout ratio revert back to 80% level. Given the projects in the pipeline in the medium term, we believe WPL’s board will likely consider the merits of a high dividend payout ratio. We are not entirely against such a proposition (as long as the required return on investment is achieved) but the Company has pitched itself as a yield play and any change to this view will see the share price come under pressure.

- Strong LNG global demand outlook. The outlook for LNG remains very robust. In short, data indicates the gap between supply and demand is opening earlier than expected and the investment required (but not in play) to meet this supply gap is lacking – given that it typically takes 5 years from FID (final investment decision) to supply to market. Demand from other Asia markets also is robust, which includes countries such India, Indonesia, Malaysia, Myanmar, Pakistan, Philippines, Singapore, Sri Lanka, Thailand and Vietnam. According to IHS Markit, these countries will drive a much stronger lift in LNG demand from 2020 – 2035 versus China and other developed economies in Asia.

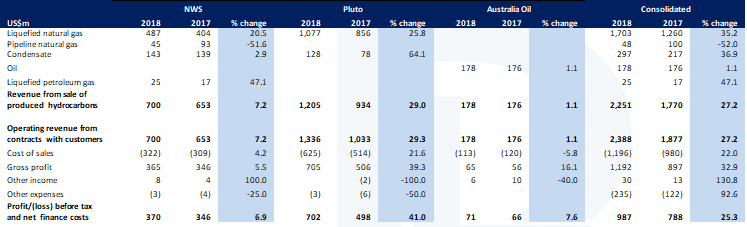

1H18 RESULTS SUMMARY…

Key headline numbers for 1H18 compared to 1H17 by segments are presented below.

Figure 3: 1H18 key headline numbers

Source: Company. Note: Table above is a summary; as such line items, may not add up.

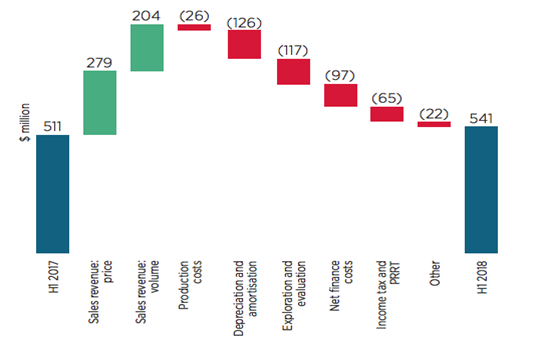

Figure 4: WPL 1H18 NPAT waterfall

Source: Company

Key financial headlines figures. NPAT increased to $541m over the half, with underlying NPAT of $556m (+11% over the pcp) and declared a fully-franked interim dividend of US$0.53 cents per share (cps), up +20% over the pcp. This increase in NPAT can be attributed to the timing of exploration activities, depreciation and financing costs, with a significant exploration project completed in the first half (exploration spend is likely to decrease in the second half). Group earnings (NPAT) was driven by:

1. average realised price was up +19% to US$51/boe. Specifically, a +37% jump in average brent price to $71/boe.

2. Higher sales volumes during the period contributed $204m to NPAT.

3. A reduction in production costs by $26m.

4. A reduction in depreciation by $126m, attributed to the Wheatstone start up, Pluto year-end 2017 reserves revisions and overall higher production.

5. A decline in exploration and evaluation expense contributed $117m to NPAT.

6. Net financing costs declining by $97m due to lower borrowing costs following start-up of Wheatstone LNG Train 1 in conjunction with early redemption of unsecured bonds.

Full year guidance revised. Management slightly revised higher their production guidance for 2018 to 87 – 91 mmboe (from 85 – 90 mmboe), owing to increased LNG contribution from Wheatstone and increased capacity (up +14%) at Pluto LNG. This revision can also be attributed to strengthening LNG prices from (1) strong early production for Wheatstone increasing the proportion of spot sales; (2) spot price seasonal peaks during the Asian winter and; (3) improved delivery basis and customer mix. These increases are likely to continue given the increased lagging CC and spot LNG prices. Further, FY18 investment expenditure remains unchanged at a range of $2.0 – 2.05bn, with “Wheatstone LNG spend significantly reduced following start-up of Train 1”.

Gearing at 15%…which is within management’s target range of 10 – 30%. To date, WPL’s average term to majority for debt has been extended from 4.5 to 4.7 years, with the portfolio cost of debt remains at a competitive 3.6%.

Development pipeline accelerated. Management again reiterated its target of approximately 100 mmboe (million barrels of oil equivalent) annual production in 2020 (versus 84.4 in 2017). Driving this production increase is Wheatstone Train exceeding nameplate capacity, Train 2 ramped up faster than planned, Greater Enfield and Greater Western Flank Phase 2, all forecasted to start up and targeting first oil in FY19.

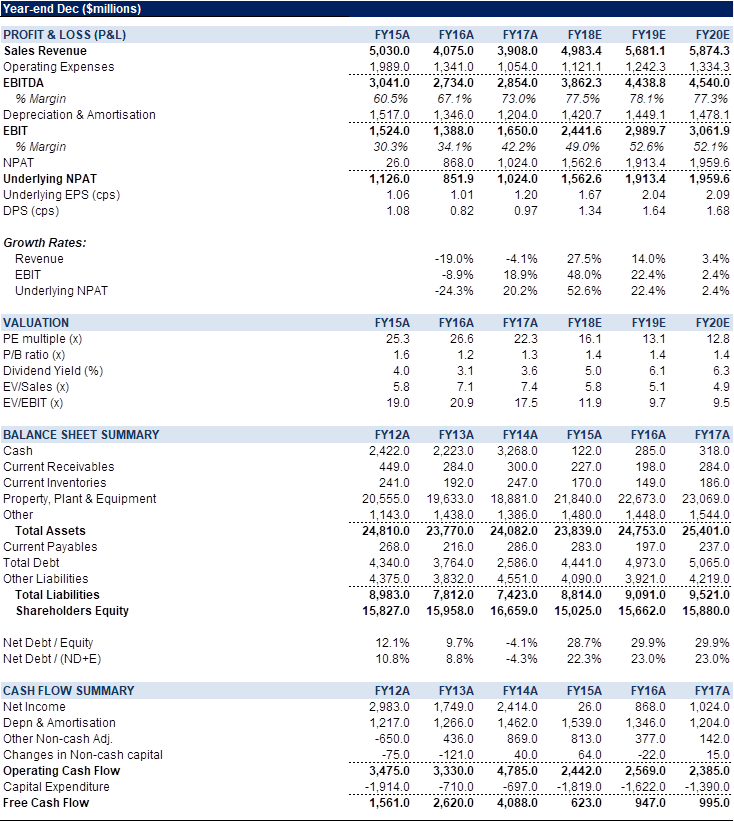

Figure 5: WPL Financial Summaryl

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Woodside Petroleum Ltd (WPL) explores for and produces natural gas, liquefied natural gas, crude oil, condensate, naptha and liquid petroleum gas. WPL owns producing assets in the North-West Shelf (NWS) project, Pluto LNG and Australian Oil. WPL is currently developing Browse, Sunrise, Wheatstone, Grassy Point and Kitimat LNG. WPL is currently undertaking exploration activities in Myanmar, Senegal, Morocco, Gabon, Ireland, NZ and Peru.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >