Woolworths Ltd (WOW) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 21/08/18 | WOW | A$29.41 | A$31.40 | NEUTRAL |

| Date of Report 20/08/18 | ASX WOW |

| Price A$29.41 | Price Target A$31.40 |

| Analyst Recommendation NEUTRAL | |

| Sector: Consumer Staples | 52-Week Range: A$2.45 – 31.48 |

| Industry: Food & Staples Retail | Market Cap: A$38,624.9m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate WOW as a Neutral for the following reasons:

- Leading market positions with key sites in higher population growth areas.

- Positively leveraged to the growth in population over time

- Increasing digitisation to remove more costs and increase the efficiency of the supply chain.

- Key leading indicators (such as basket size / items per basket) are improving for the core Australian Food segment.

- Transaction growth and customer metrics are showing improving trends.

- Food deflation to continue.

- BIG W losses to moderate.

- New management teams will likely bring in fresh eyes on strategy

- Uncertainty over the future of the petrol business.

We see the following key risks to our investment thesis:

- Further margin pressure in the Food & Petrol business.

- Increasing competition in retail and changing consumer preference and consumption trends

- Deterioration in balance sheet metrics due to earnings decline.

- Adverse movements in AUD/USD (international sourcing).

ANALYST’S NOTE

The share price of WOW was a little weaker post the FY18 results, with the group results coming in slightly below market expectations but bang in line with our NPAT / EPS estimates.

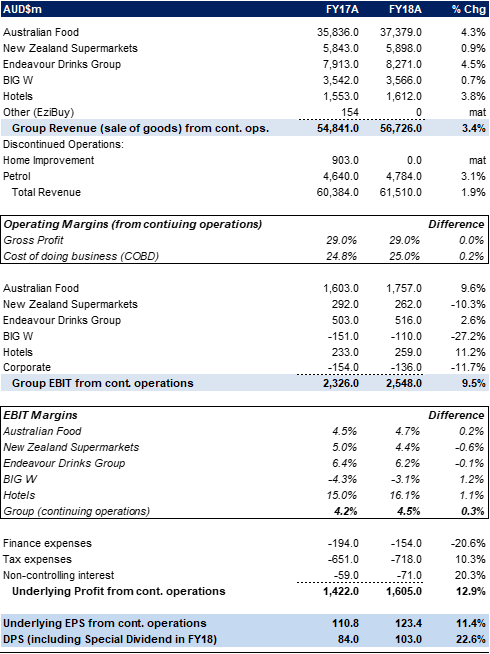

FY18 NPAT from continuing operations came in at $1.61bn, which was +12.9% above previous corresponding period (pcp) but slightly below (-0.9%) estimates of $1.62bn. Group sales of $56.7bn (vs. estimates of $58.1bn) and operating earnings (EBIT) of $2.55bn (vs. estimates $2.57bn) also missed market expectations.

On a positive note, the Company declared a special dividend of 10cps. Management also provided a disappointing trading update, with Food sales in the first seven weeks of 1Q19 slowing, driven by customers adjusting to the removal of single-use plastic bags, the impact from competitor activity, meat/fruit/vegetable deflation and the cycling of “Earn and Learn” in the prior periods.

We maintain our Neutral recommendation. Moderating sales growth in WOW’s Food business got a bit of attention on the analysts’ conference call, however we hold no major concerns here as the main competitor (Coles) is active ahead of the demerger and we expect WOW to reinvest in its value proposition.

Further, whilst cost of doing business pressures is likely to persist into FY19, the investment is necessary.

- Key business segments.

1. Food. Food experienced solid operating leverage with +4.3% sales growth delivering +9.6% in EBIT on the back of sales growth and higher gross profit (GP).

2. Endeavour Drinks. EBIT up +2.8% over the year, however excluding the gain on sale accounted for in the prior year, EBIT was actually up +4.7% year on year. In the second half of the year, the Company experienced a more competitive environment and higher supply chain costs.

3. BIG W. BIG W reported a loss of $110m for the year, which was within management’s guidance range of $80-120m. Management expects losses to moderate further in FY19 but provided no quantitative guidance.

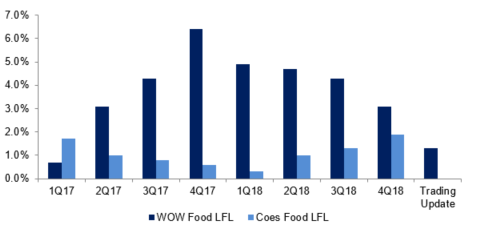

4. Hotels. The segment reported +11.2% EBIT growth, driven by higher sales and some mix improvement and good cost control. - Key issue #1 – WOW Food like-for-like (LF) sales moderating. There was much discussion on the moderating growth rate in WOW’s Food LFL sales over the recent period compared to its competitor Coles, which has seen acceleration. From 1Q17, WOW had opened up a significant gap between its growth rate relative to Coles (in 4Q17 WOW reported +6.4% versus Coles +0.6%). However, over the recent quarters Coles has closed this gap. It appears WOW’s LFL sales growth has moderated again in 1Q19, with management noting LFL sales are up +1.3% (versus 4Q18 +3.1%). We remain comfortable that WOW can win back some of the lost ground has management gears up value proposition around key dates.

- Key issue #2 – Cost of doing business pressures to persist into FY19. We expect cost growth to remain a feature on the near-term as WOW works through EBA (Enterprise Bargaining Agreements), new distribution centres (DC) and various digital projects. This will clearly have earnings implications in the short-term, however we believe the company will reap benefits over the long-term. We saw the potential of operating leverage in FY18 Food results – revenue growth of +4.3% delivering +9.6% in EBIT growth (2.2x leverage).

FY18 results summary…

Key profit and loss numbers are presented in the table below.

Figure 1: FY18 key P&L results

Source: Company

Woolworths Food vs. Coles Food – LFL sales…

Figure 2: Like-for-like (LFL) sales comparison

Source: Woolworths, Wesfarmers (Coles)

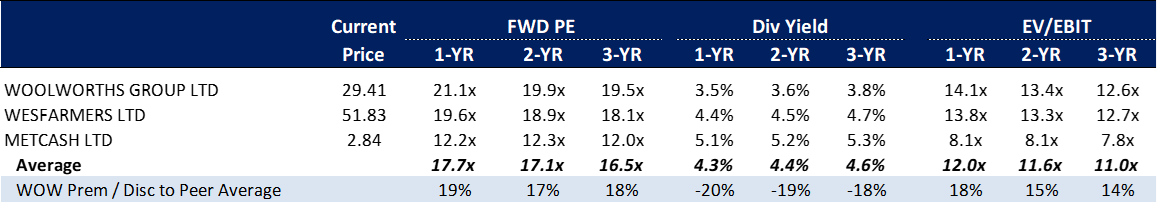

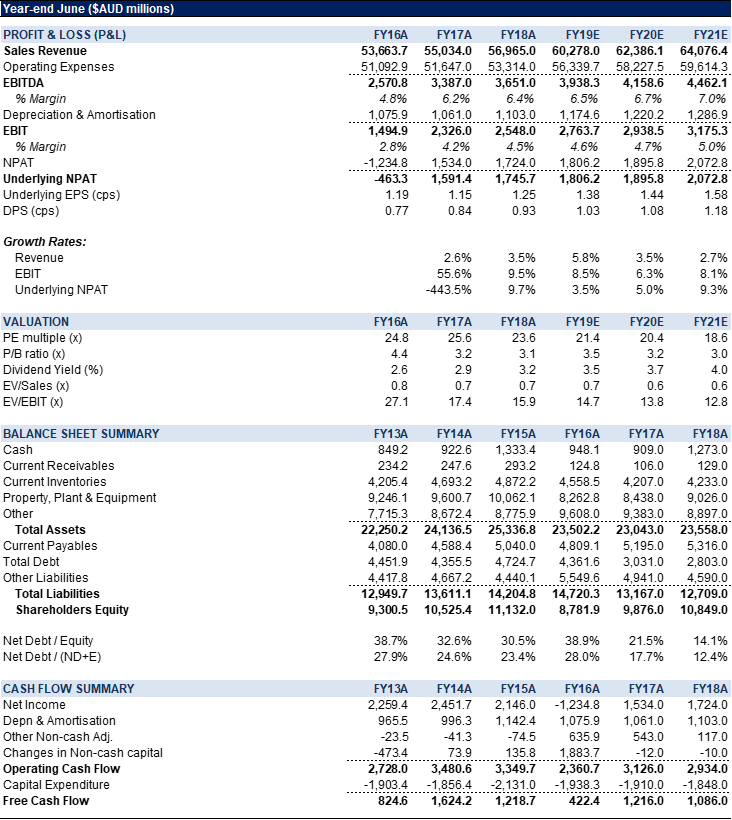

Woolworths comps table and trading multiples…

Figure 3: Peer group comparables – consensus

Source: Bloomberg

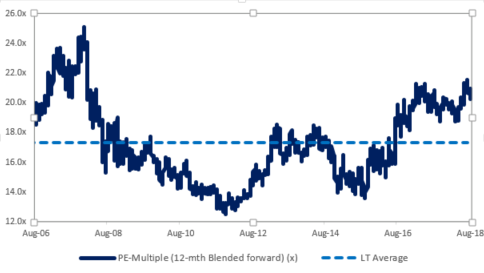

Figure 4: WOW PE-multiples vs. long-term average

Source: Bloomberg, BTIG

Figure 5: WOW Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

Woolworths Limited (WOW) operates supermarkets, specialty and discount department stores, liquor and electronics stores throughout Australia. Woolworths also manufactures processed foods, exports and wholesales foods and offers petrol retailing. The company also operates hotels which includes pubs, food, accommodation, and gaming operations.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >